Jamna Auto Industries (JAI), a provider of suspension products to all major commercial vehicle (CV) manufacturers, has posted a strong set of numbers for Q4 FY18. It posted significant growth in both topline and bottomline driven by strong industry tailwinds.

Market leadership, marquee clientele, operating leverage, reduced debt and strong financial performance should support earnings going forward. The business remains unaffected by the electric vehicle disruption and trades at reasonable valuations which beckons investor attention.

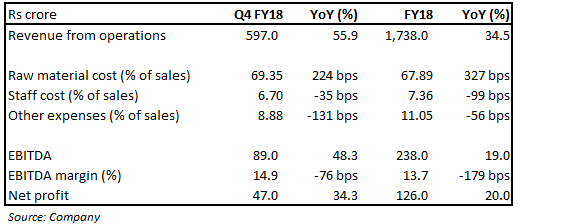

Quarterly snapshot

In the quarter gone by, net revenue from operations grew 55.9 percent year-on-year (YoY) on the back of strong growth in CV sales. On the profitability front, the company posted a 76 basis points YoY contraction in earnings before interest, tax, depreciation and amortisation (EBITDA) margin and 48.3 percent YoY growth in EBITDA. Margin contraction was driven by significant rise in raw material prices, which was partially offset by a reduction in staff and other operating costs. Profit after tax (PAT) grew 34.3 percent YoY.

On a full-year basis, the company posted a 34.5 percent increase in net revenue. EBITDA grew 19 percent, with a 179 bps margin contraction. PAT grew 20 percent.

Key growth driversStrong clienteleThe company is a leader in this space with 72 percent original equipment manufacturer (OEM) market share. The company boasts of marquee clients in its kitty.

Focus on R&DThe management has been focusing on research and development and built a centre in Pune. The latter has been approved by the Department of Scientific and Industrial Research. JAI is also boosting its information technology infrastructure which is being implemented across the organisation. It also has a technical association with US-based Ridwell Corporation, a global leader in design and manufacturer of air suspensions and lift axles.

Industry tailwinds, unaffected by move towards EVThe CV industry had a bumpy ride in FY17 as demonetisation and Bharat Stage (BS) IV implementation impacted sales followed by Goods & Service Tax led de-stocking. However, things are limping back to normalcy. This augurs well for JAI as it is the largest provider of suspensions for CVs.

We see positive demand going forward on expectations of a normal monsoon, improved rural sentiment and investment in infrastructure. Moreover, the company is likely to remain unaffected by the EV disruption as the products find use in this space too.

JAI has a strong aftermarket presence as well with 15-18 percent market share. Post-implementation of GST, it witnessed strong demand from this space as well. The management is targeting 30-35 percent market share in the next couple of years. Going forward, we see it benefiting from a shift from unorganised to organised players.

Adoption of parabolic leaf springsThere is increasing adoption of parabolic leaf springs by major OEMs given the need for lighter products ahead of BS-VI adoption in FY20. This augurs well for JAI as it has greater dominance there with over 90 percent market share.

Capacity in placeAt present, the company has a capacity of 240,000 units spread across 9 manufacturing units: the second-largest capacity globally. The management had commissioned a new plant in Hosur in Q4 FY17, which is now operational and would cater mainly to the export market. It plans to open two more plants to service the additional demand.

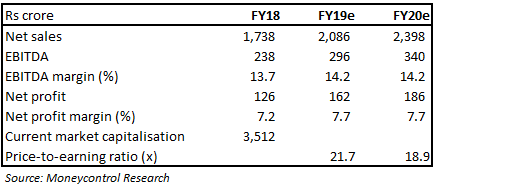

ValuationThe stock has risen 46 percent since our initiation on October 26 last year. The company is currently trading at 21.7 and 18.9 times FY19 and FY20 projected earnings. We advise investors to accumulate the stock for the long term.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.