Dear Reader,

Indian markets were focused on the interim budget during the week, moving in a narrow range. Volatility was high during the week due to the FOMC meeting and the interim budget.

Despite the budget's minimal impact and the Federal Reserve's maintenance of the status quo, global cues spurred a market surge on Friday.

While benchmark indices achieved a new record high, a correction towards the close led to a 2.34 percent gain for the week, marking the most substantial weekly increase in two months. This positive closure came after two consecutive weeks of negative performance.

Structural Weakness Continues

However, structural weaknesses persist in the market. The Nifty formed an engulfing bear candlestick pattern the preceding week, signalling weakness on weekly charts. Although there was a recovery in the Nifty this week, it failed to close above the previous two weeks' highs, maintaining the pattern's significance.

The weekly chart indicates an inverted hammer at the end of the week, revealing that despite an intraday recovery, the market faced selling pressure at higher levels. Confirmation of this weakness would be indicated by a close below 21805 on daily charts and below 21137 on weekly charts in the upcoming week.

Caution is advised, as various sentiment indicators are reversing from record levels. It is not a time for complacency, especially considering the possibility of a correction back to the 20-week average, approximately 20500.

Analyzing the chart below, it is evident that Foreign Institutional Investors (FIIs) are unwinding their long positions. While this was initially a reason for caution, the situation has escalated as they now hold short positions. Despite the potential for short covering to drive short-term market gains, the overarching stance of FIIs remains directional. Their current position is not at the extreme levels historically associated with market bottoms. The possibility of further additions to short positions suggests anticipating another downturn or adopting a hedged position. In either scenario, caution is warranted. Notably, FIIs continue to sell in the cash market, with sales amounting to Rs 35,977.87 crore in January 2024 and Rs 2,008.68 crore in the previous week.

Source: web.strike.money

Source: web.strike.money

This week, we shall look at the sector that has been the reason behind the strong market move. The Nifty PSE index is the best-performing sector index. The one-sided move was on record volumes and very high relative strength readings. The daily Relative Strength Index (RSI) level was 91, and the weekly RSI was 93.

These are dangerous levels and carry the risk of falling on their own weight. When something overextends itself to this degree, the reversal can happen quickly. Correction in the sector is far overdue and can impact the benchmark index negatively when it happens, given their weights in the index.

Source: web.strike.money

Source: web.strike.money

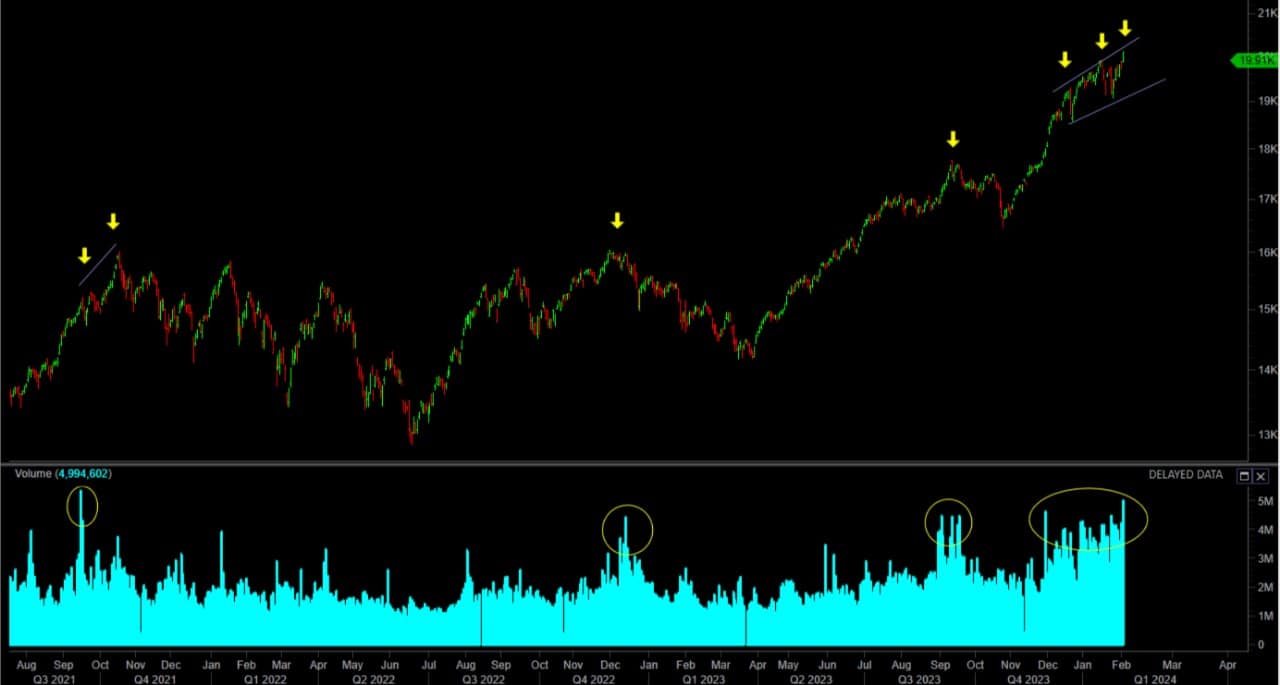

Another cause for concern is the volume pattern in Nifty 500 stocks, as seen in the chart below. The volume pattern shows extreme bullish sentiment as volumes and prices are directly proportional. Rising prices produce rising volume activity, and the peak is generally made with the highest volumes.

Recently, the Nifty 500 has shown not only peak volume but a prolonged period of such volumes. This could be a sign of distribution as the broad market gets euphoric and money shifts from one set of stocks to the other. Such volume activity has in the past occurred near turning points in the market.

Source: web.strike.money

Source: web.strike.money

Indices and Market Breadth

Last week's performance can be summed up by the strong performance on Friday, which helped Nifty touch a new high but witnessed profit booking towards the end.

Nifty touched a fresh record high of 22,126.80 while BSE Sensex inched closer to its all-time high of 73,427.59 but closed the week at 72,085.63.

Multiple sectors saw strength during the week, with the Nifty PSU Bank index gaining 11.5 percent, the Nifty Oil & Gas index rising 9 percent, the Nifty Energy index rising 8 percent, and the Nifty Metal, Auto, and Realty indices each increasing 4 percent.

During the week, the BSE Small-cap index gained 3.3 percent and touched a new high of 46,169.7. NBCC, with a 47.46 percent gain, Shakti Pumps, with a 41.63 percent gain, and Punjab & Sind Bank, with a 40.03 percent jump, were among the top gainers.

Global Market

As in the case of India, US stocks also ended sharply higher on Friday, and the S&P 500 closed at an all-time high. S&P 500 gained 1.38 percent, Nasdaq was up 1.12 percent while Dow Jones closed 1.43 percent up. All three US stock indexes recorded their fourth consecutive weekly gains.

The MSCI World index reflected the optimism in the US and Indian markets and closed the week nearly one percent higher.

Chinese markets closed 6.19 percent lower, while the Hang Seng was down 2.62 percent after a court in Hong Kong ordered the liquidation of China's biggest real estate player, Evengrande.

Stocks to watch

Among the frontline stocks showing strong upside momentum are IDBI, LIC Housing Finance, Chennai Petro, Bajaj Auto, Subex, L&T Finance, Gujarat Gas.

Tata Communications, Tata Chemicals, SBI Cards, Bajaj Finance, Asian Paints, and AU Bank are stocks showing weakness.

Cheers,

Shishir Asthana

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.