Madhuchanda Dey Moneycontrol Research

A leading business daily has reported that the promoters of Mindtree are considering selling their stake in the company to Japan's NEC Corp and a large global private equity fund. We think the deal, if concluded, will be positive for minority shareholders in the long term. In the short term, the stock price could be influenced by the price at which the deal happens.

The existing promoters have done a good job of turnaround the company, and a strong techno savvy promoter of global repute can help it grow to the next level. If the regulator directs the new promoter to make an open offer, that could be an additional trigger for the stock.

Mindtree's solid financials

Mindtree has been an early investor in digital technologies. While this hurt profit margins in the past, the investment phase is drawing to a close and the results are evident from the rise in deal wins, in revenue and the improvement in margins.

In FY18, the company's dollar revenues grew 8.6 percent. However, digital revenue grew much faster at 18.9 percent and constituted 45 percent of the company's total revenues – one of the highest in the industry.

For Mindtree, both deal wins as well as the pipeline of deals remains strong. At the end of FY18, the pipeline of deals overall was 32 percent higher than previous fiscal with the pipeline of digital much higher at around 66 percent. The company expects a better win ratio in deals and the high customer satisfaction ratings too points to a better future.

What can NEC bring to the table?

NEC Corporation, listed on Tokyo Stock Exchange, is into the integration of information technology (IT) and network technologies worldwide. The company provides systems integration services, maintenance and support services; outsourcing/cloud services; and system equipment. It also provides network infrastructure products.

It is by now accepted that the wave of digital-led changes is much more significant than any industrial revolution that we have so far experienced, and it is progressing at unprecedented speed. NEC is supporting the business transformation of customers through digital.

NEC aims to digitize events in the real world, incorporate them into the cyber world, and connect people, things, and contexts at deeper levels to create value.

A partner who has traversed the learning curve in digital will significantly enhance Mindtree’s digital capabilities and help in its journey of being a future-ready business.

What's the rumoured deal?

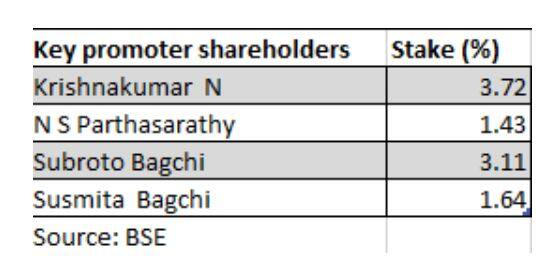

According to the report, the promoters of Mindtree plan to sell their entire 13.37 percent stake in the company. Based on the current market capitalisation this amounts to a deal value of Rs 2,083 crore.

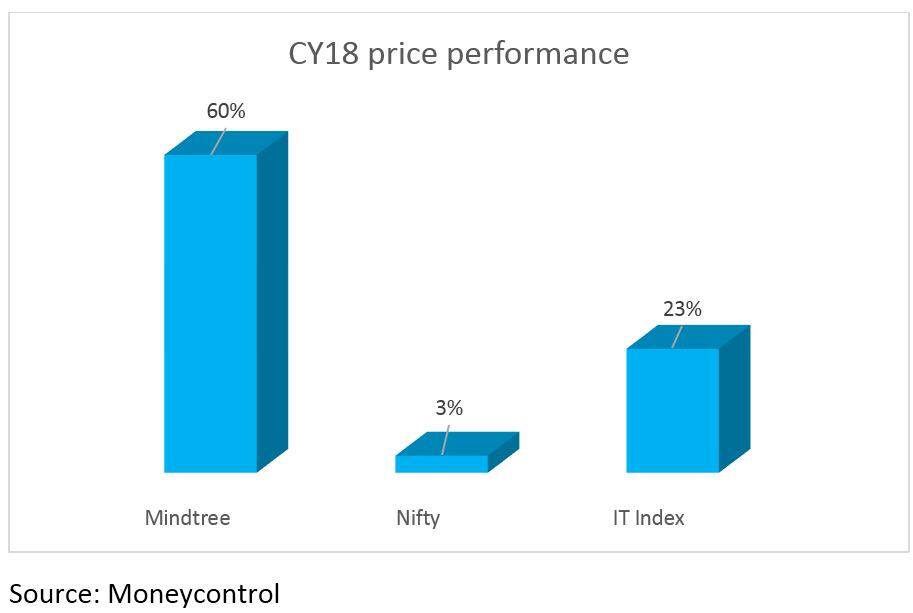

In calendar 2018, Mindtree has been a big outperformer vis-à-vis the Nifty as well as the IT Index.

Consequently, the valuation at 23.5 times estimated FY19 earnings prima facie captures the near-term positive. However, a change in ownership with an international major of repute can help sustain the premium, although the near-term stock movement might get impacted by the deal valuation.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.