Microfinance industry officials have welcomed the steps announced by the Reserve Bank of India (RBI) to support smaller microlenders hit severely by the second wave of the pandemic. However, industry was expecting more measures including postponement of payments by borrowers at least for few months considering the difficult operating environment.

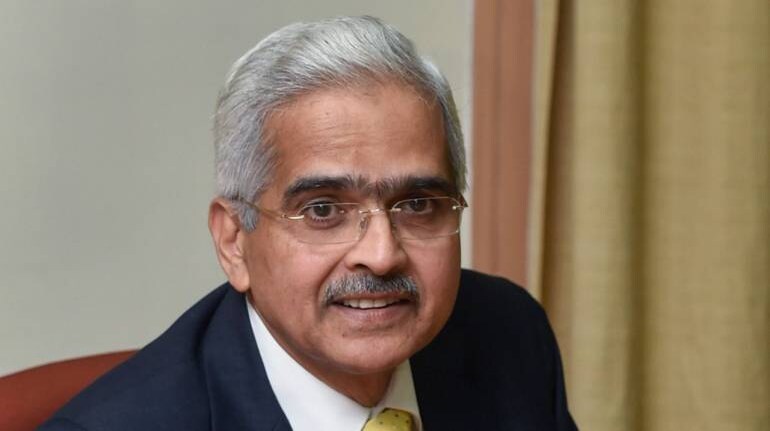

Announcing the measures today, the RBI Governor Shaktikanta Das said small finance banks (SFBs) can classify loans to MFIs under the priority sector lending (PSL) category. PSL refers to mandatory lending by banks to economically weaker sections. Banks need to lend 40 per cent of their loans to this category.

At present, lending by SFBs to MFIs for on-lending is not reckoned for PSL classification. "In view of the fresh challenges brought on by the pandemic and to address the emergent liquidity position of smaller MFIs, SFBs are now being permitted to reckon fresh lending to smaller MFIs (with asset size of up to Rs500 crore) for on-lending to individual borrowers as priority sector lending," the RBI Governor said. This facility will be available up to March 31, 2022, the RBI said, the governor said.

MFIN (Microfinance Institutions Network), the representative microfinance Industry association and RBI recognized self-regulatory organization, welcomed RBI Governor’s initiative. As SFBs understand the market well, it should lead to tangible liquidity flow and by allowing lenders the flexibility to restructure microfinance loans on a case-to-case basis is also welcome as it will provide relief to stressed clients, MFIN said.

“We will keep engaging with the RBI on creating a systemic support for allocating a specific subtotal out of the overall liquidity support for the smaller NBFC MFIs,"MFIN's CEO, Alok Misra, said adding “we also anticipate that the pricing issue would also hopefully be resolved soon.”

P Satish, executive director at Sa-Dhan, said he expect more measures from the central bank in the next few days or weeks. “The permission to SFBs to classify fresh lending to smaller MFIs under the PSL tag is a good move. But, MFIs were hoping for moratorium for all loans two to three months for their borrowers. This hasn’t come. We expect the RBI to come with further announcements in future,” Satish said.

MFIs are institutions that give small-ticket loans and mostly source funds from banks to do business. On May 3, MFI representatives had met the RBI top brass seeking assistance.

MFIs representatives said though the sector recovered from the severe impact of the lockdown in April-June, 2020 and was returning to normal, the second coronavirus wave and intermittently increasing local lockdowns were creating problems for the sector. They said a larger number of MFI staff were being affected by the second wave, leaving the employees worried.

Also, a large number of borrowers and their families were also ill, even in rural areas, when compared to last year's outbreak. Many MFIs reported normal collection levels in the early part of April but it was slowing down as livelihoods of borrowers were getting hit and they were conserving cash, the industry officials told the RBI.

RBI steps inAnnouncing the measures today, the RBI also said it will conduct special three-year long-term repo operations (SLTRO) of Rs10,000 crore at repo rate for the SFBs, to be deployed for fresh lending of up to Rs10 lakh per borrower. This facility will be available till October 31, 2021.

This helped banks to escape a huge spike in their non-performing assets (NPAs). A loan becomes an NPA if there is no repayment of interest or principal for 90 days. Once a loan becomes an NPA, banks need to set aside money to cover the potential losses from such accounts. High provisions hurt banks’ profitability.

This time, the central bank has not announced a blanket moratorium scheme. It said those who availed the restructuring under the covid resolution framework 1.0 can seek moratorium of loans up to two years. For other borrowers, the RBI has announced a separate loan restructuring scheme (resolution framework 2.0) under which individuals and small businesses and MSMEs having aggregate exposure of upto Rs25 crore, can go for recast.

Restructuring under the proposed framework may be invoked up to September 30, 2021 and shall have to be implemented within 90 days after invocation, the RBI said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.