India Inc.'s optimism about the economy is soaring ahead of the first budget presented by a coalition government led by Prime Minister Narendra Modi.

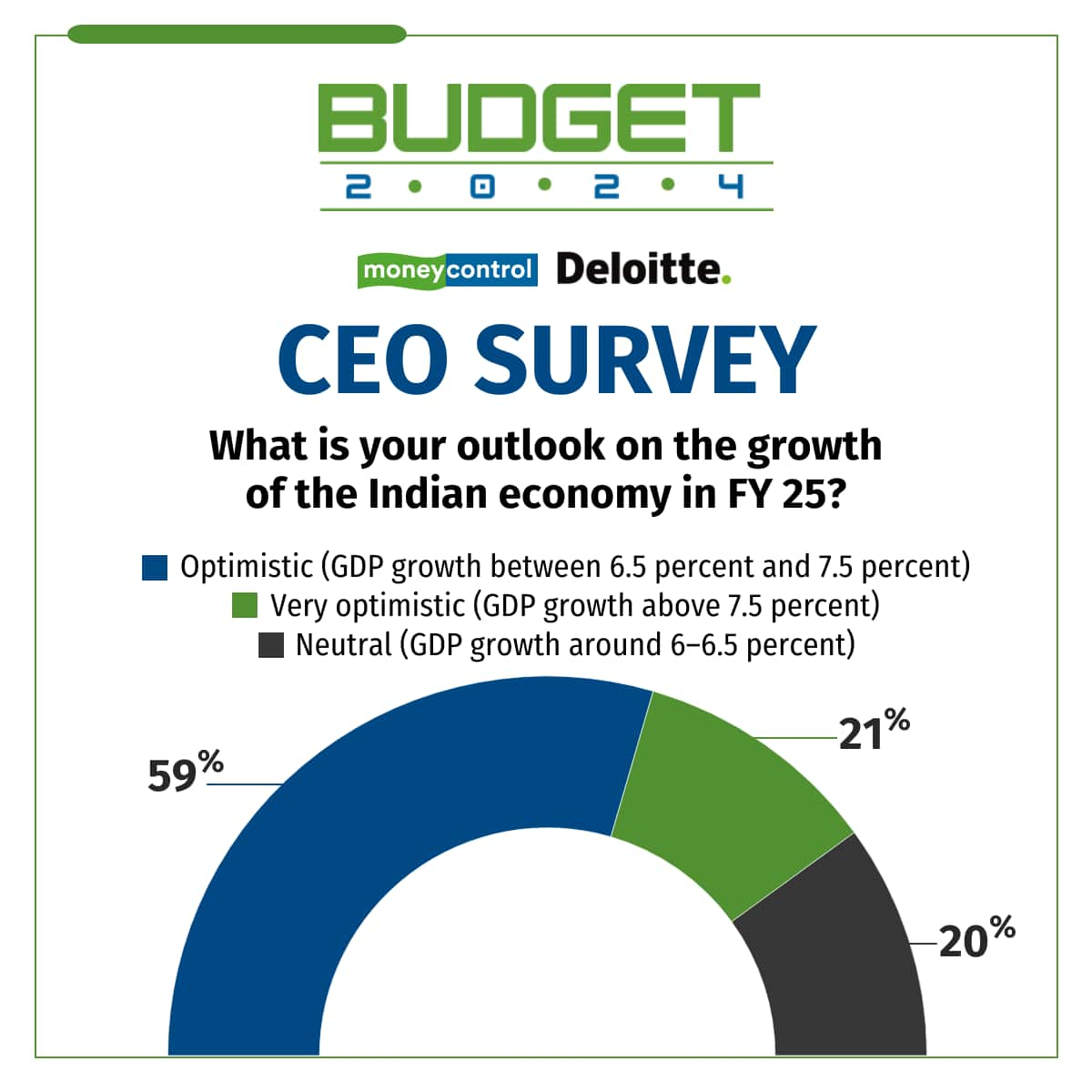

An exclusive Deloitte survey for Moneycontrol of 78 CEOs and CXOs across financial services, consumer goods, technology, and energy sectors showed that nearly 80 percent of the respondents are optimistic or very optimistic about India's economic growth. About 59 percent of respondents were optimistic about GDP growth between 6.5 percent and 7.5 percent, while 21 percent were "very optimistic" about growth exceeding 7.5 percent.

The July 23 budget follows Modi becoming the Prime minister for the third time, despite his Bharatiya Janata Party failing to secure a majority. However, the survey shows that the political complexities have not dampened India Inc.'s optimism.

As many as 73 percent of the top executives identified physical and digital infrastructure as a key growth driver, while 72 percent said that a young, skilled workforce and a large consumer base would drive the growth story. About 51 percent viewed bold reforms as crucial for boosting manufacturing and job opportunities.

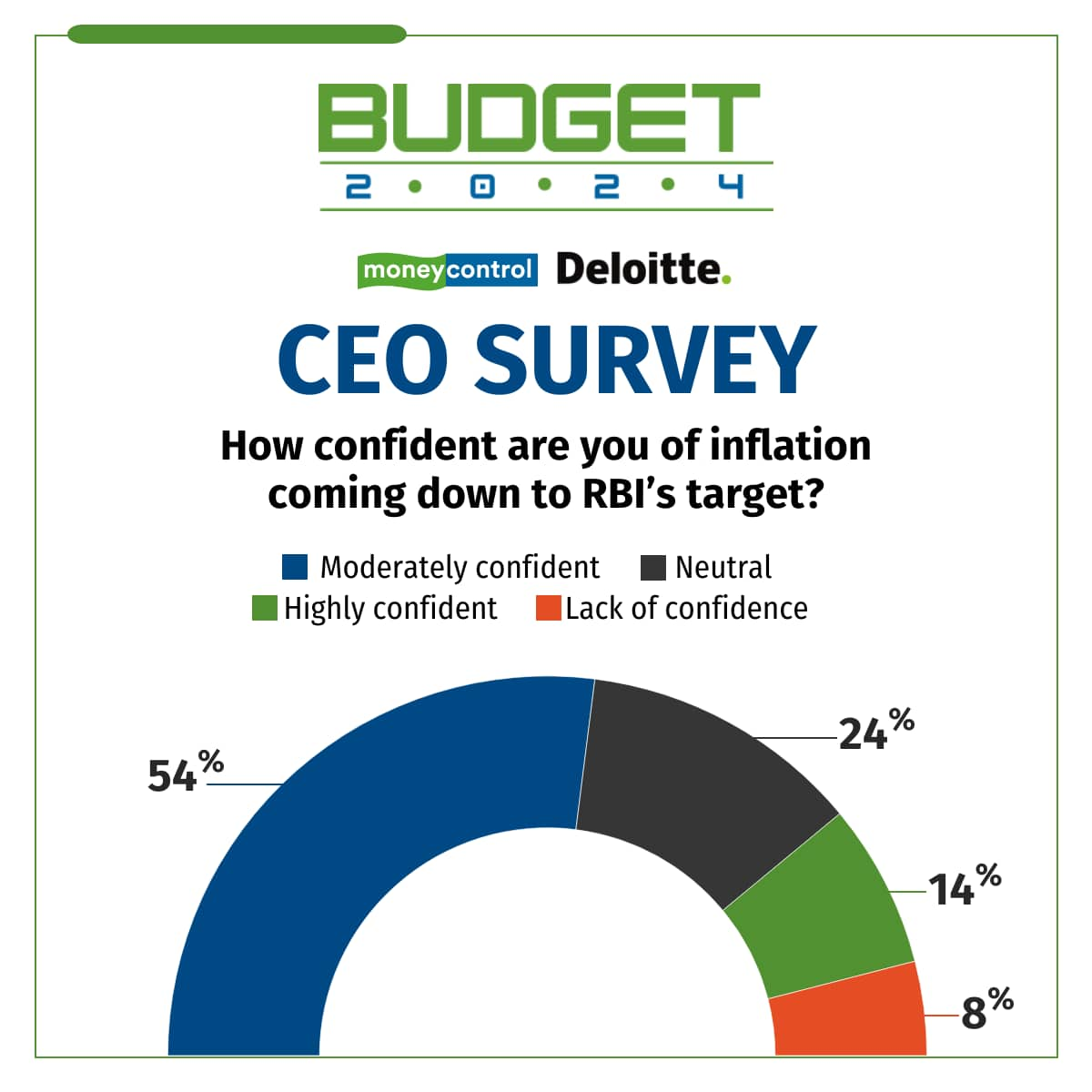

Regarding the central bank achieving its FY25 inflation target of 4.5 percent, a majority of respondents said that they were moderately confident, while 14 percent were highly confident. Fifty-four percent expect no change in The Reserve Bank of India's policy rates over the next six months, while 27 percent expect a decrease of 25-50 basis points.

On ease of doing business, India Inc's top wish is a simpler tax regime and compliance, with 87 percent of the respondents advocating for the same. Additionally, 55 percent of the respondents identified digital, online single-window systems for clearances, and 29 percent sought fast disposal of commercial disputes.

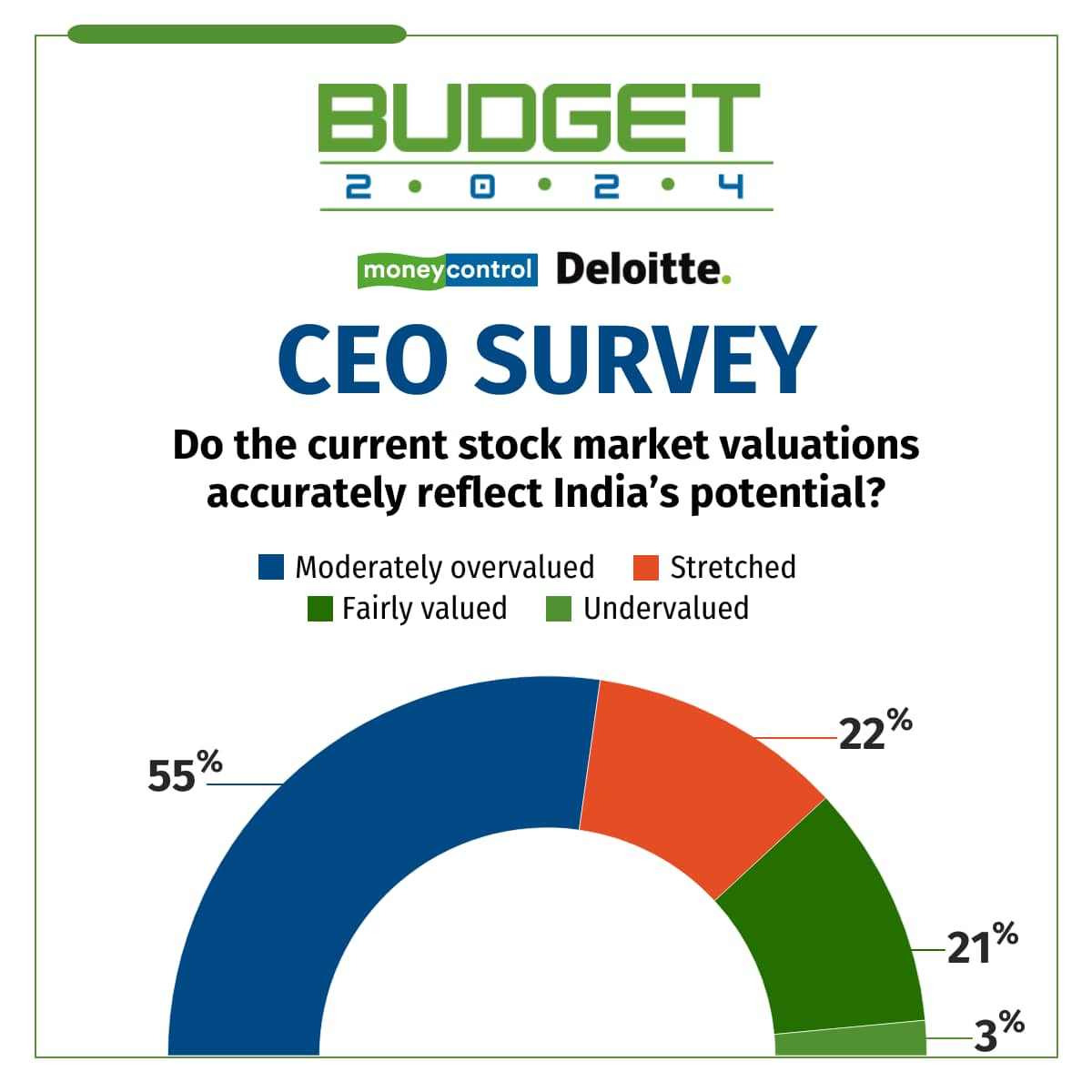

With equity markets touching new highs, 55 percent of the respondents said that current stock market valuations were "moderately overvalued" and 22 percent said they were undervalued. Geopolitical risks with volatility in commodity prices emerged as the key global risk to Indian businesses, with 26 percent identifying a global economic slowdown with modest growth in China and the US as the next big global threat.

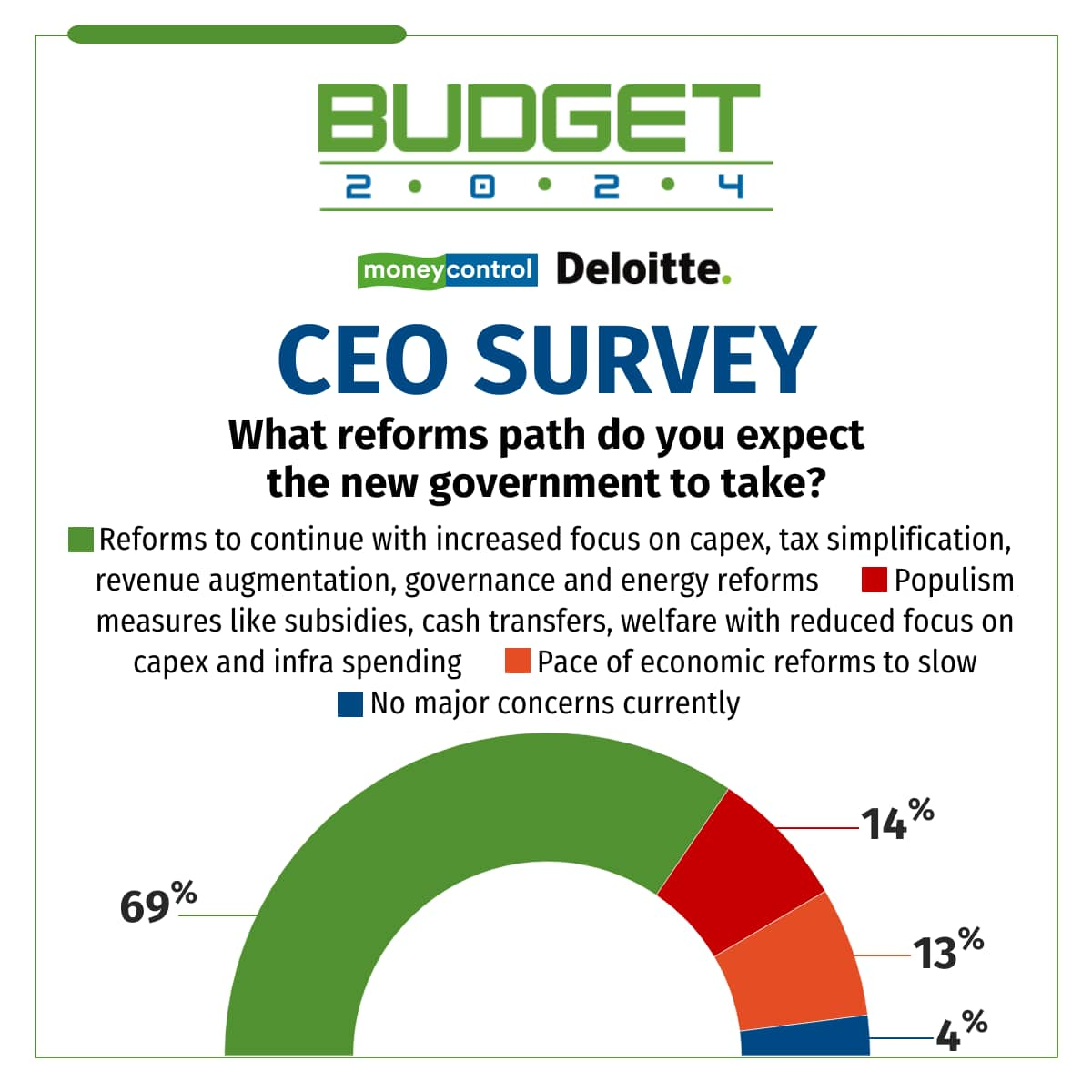

On the reforms agenda, 69 percent of the CEOs surveyed are betting the government will continue reforms with a focus on capital expenditure, tax simplification, revenue augmentation, governance and energy reforms. Just 14 percent expect populist measures such as subsidies and cash transfers with a reduced focus on capital spending and infrastructure.

India Inc.'s top reform agenda includes accelerating investments and trade reforms to boost exports and attract foreign investments by simplifying the tax regime.

India has stated a target of 4.5 percent fiscal deficit by 2025-26.

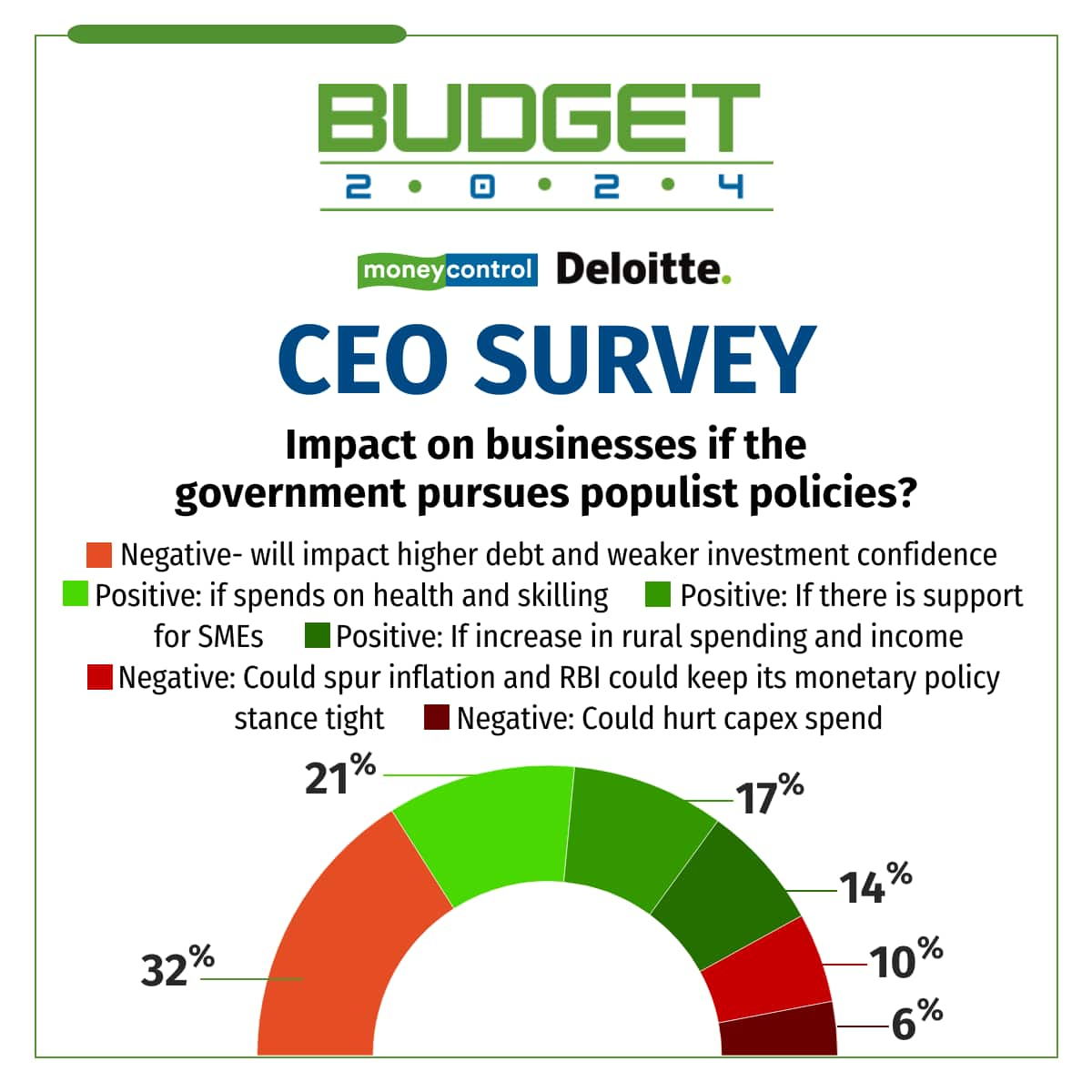

Interestingly, 38 percent of respondents view government initiatives targeting health, skilling, and SMEs as positive if they incorporate populist policies.

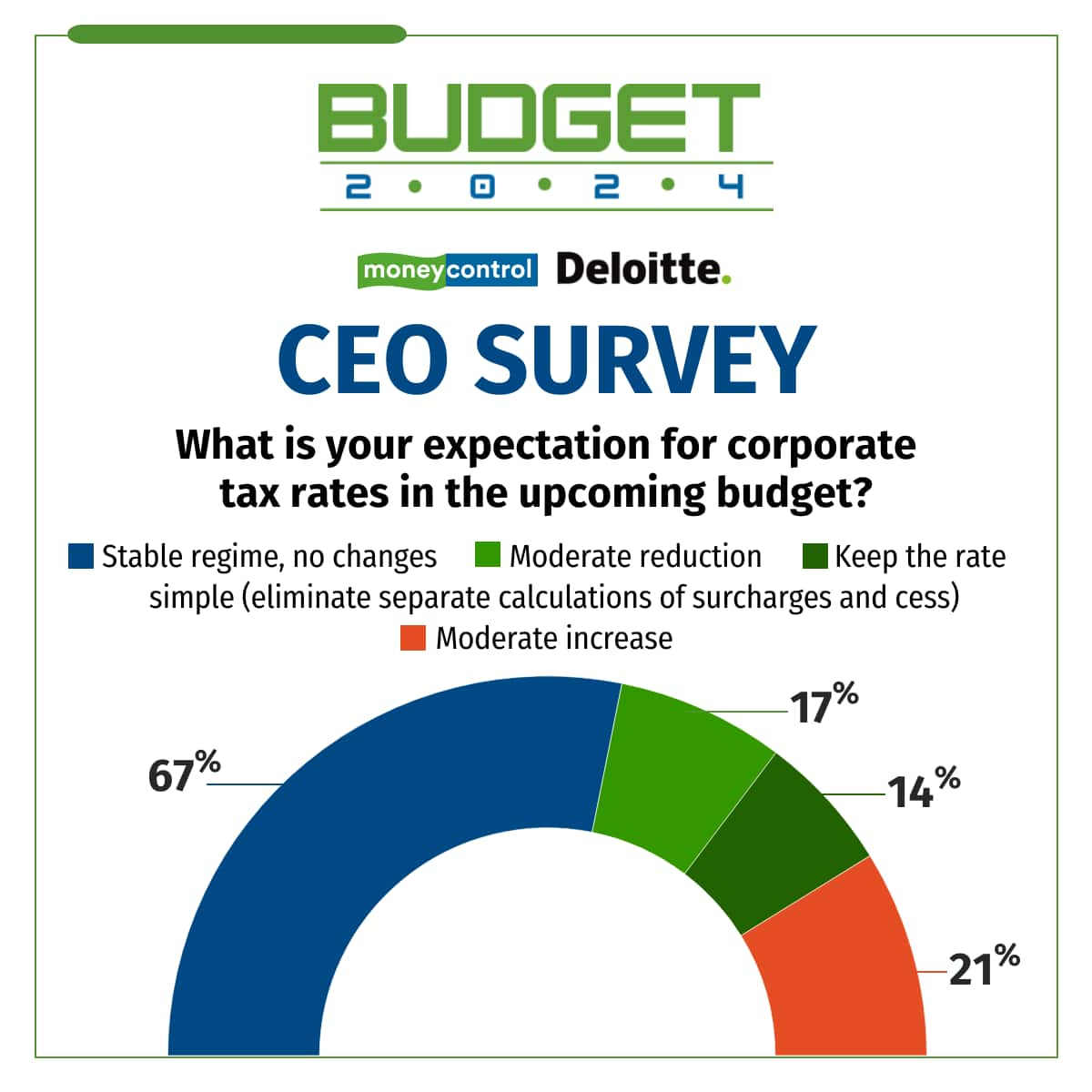

About 32 percent of the respondents believe that pursuing populist policies could undermine investment confidence. On corporate tax rates, 67 percent expect a stable regime with no reduction, while 17 percent expect a moderate reduction.

In recent decades, India's corporate tax rates have nearly halved, with a significant cut announced in the 2019 budget resulting in a 10 percentage point decrease for corporates."

Currently, Indian companies with revenue of Rs 400 crore pay a 25 percent tax, which rises to 30 percent for larger companies. In 2019, a lower 22 percent rate was offered to companies opting out of exemptions.

Making India a semiconductor hub also tops India Inc.'s agenda, with 58 percent of the CEOs emphasizing the government's role in promoting research and development.

Overall, the MC-Deloitte survey shows India Inc.'s confidence in the country's growth story despite the pulls and pressures of coalition politics and calls on the government to simplify compliances and boost ease of doing business.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.