Indian benchmark indices added more than 1 percent in the week ended December 13 amid weak domestic data but positive global cues pushed the indices near the all-time highs.

The market remained range-bound during the week amid domestic and global cues including IIP, CPI data, the UK election and the US-China trade deal ahead of the December 15 deadline.

On the domestic front, rising food prices pushed up retail inflation in November to an over three-year high of 5.54 percent. The industrial sector output contracted by 3.8 percent in October, for the third month in a row, against a 4.3 percent contraction in September.

On the global front, UK Prime Minister Boris Johnson registered a big win that would deliver a swift Brexit.

Earlier in the week, the US Federal Reserve, held interest rates steady in the range of 1.5 percent to 1.7 percent. However, the United States and China announced an initial trade agreement, cooling trade tensions between the two big economies.

"Nifty as per weekly timeframe formed a long bull candle with lower shadow. This candle pattern was formed immediately after the formation of a bearish engulfing type pattern in the last week. This is a positive indication and one may expect further upside in the short term. A sustainable move above 12,158 levels could nullify the negative implication of bearish engulfing," said Nagaraj Shetti – Technical & Derivative Analyst, HDFC securities.

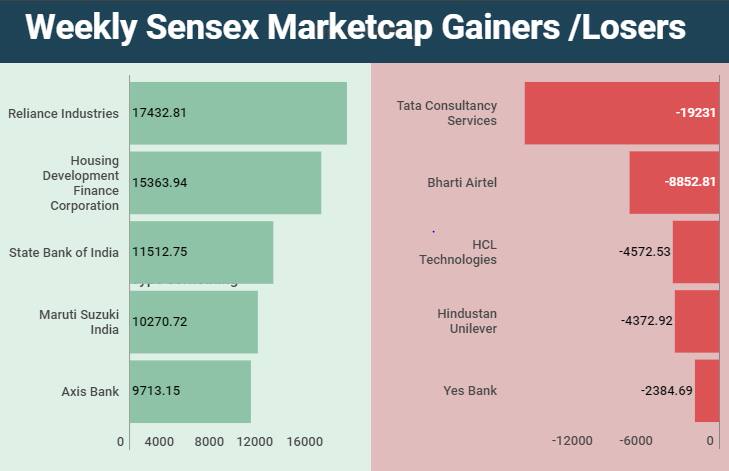

In the past week, the Sensex rose 564.56 points (1.39 percent) to end at 41,009.71, while the Nifty added 166.2 points (1.38 percent) to end at 12,086.7.

Foreign Institutional Investors (FIIs) remained net buyers the past week as they bought equities worth Rs 129.71 crore, while Domestic Institutional Investors (DIIs) bought equities worth of Rs 1,848.35 crore.

The Indian rupee continued its upward momentum as it ended higher by 39 paise at 70.81 on December 13 versus the December 6 closing of 71.20.

"The recent developments on the global front have subsided the fear of prolonged crisis and that cheered the participants across the world markets including ours. And, we feel the positive momentum to extend further in the coming week too," said Ajit Mishra, VP - Research, Religare Broking.

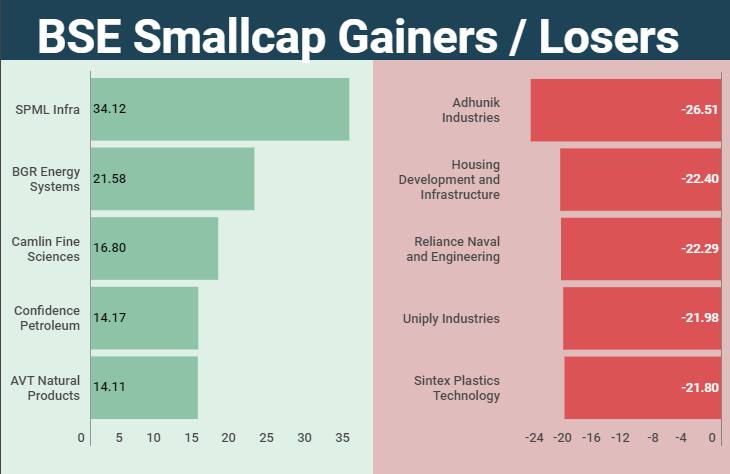

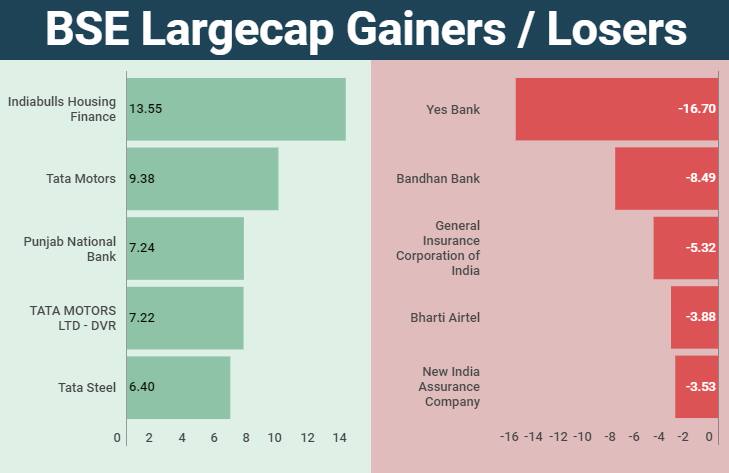

The BSE mid-cap index rose 1.11 percent, and the BSE large-cap index added 1.35 percent in the past week.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.