The market witnessed buying throughout the truncated week ended November 1 on the back of positive earnings from India Inc continued buying by foreign institutional investors (FIIs), hopes for further tax reforms from the government, mixed auto sale numbers for October 2019 and no major development on the global front.

In the last week, the Sensex touched a fresh all-time high of 40,392.22.

The benchmark indices rose for the six consecutive sessions on November 1, and the Sensex managed to hold above the 40,000 mark, while Nifty finished below the 11,900 mark.

The Indian markets were closed for trading on October 27, on account of Diwali Balipratipada.

Auto sales on year-on-year (YoY) basis for the month of October was mixed, while it has seen some improvement on the month-on-month (MoM) basis due to the festive season.

"Technically, Nifty formed a Bullish Candle on a weekly scale which indicates the major trend is positive while dips are being bought at an immediate basis. It has been forming higher highs-higher lows on the weekly scale and supports are gradually shifting higher," said Siddhartha Khemka, Head - Retail Research, Motilal Oswal Financial Services Private.

"Now it has to continue to hold above 11,820 levels to witness an up move towards 11,950 then 12,000-12,103 zones while on the downside major support is seen at 11,780 then 11,700 zones," Khemka added.

The US Federal Reserve cut its benchmark interest rate for the third straight time on October 30. The FOMC lowered the policy interest rate by 25 basis points to a target range of 1.5-1.75 percent.

FIIs remained net buyers last week as they bought equities worth Rs 10,473.30 crore, while Domestic Institutional Investors (DIIs) sold equities worth of Rs 828.4 crore.

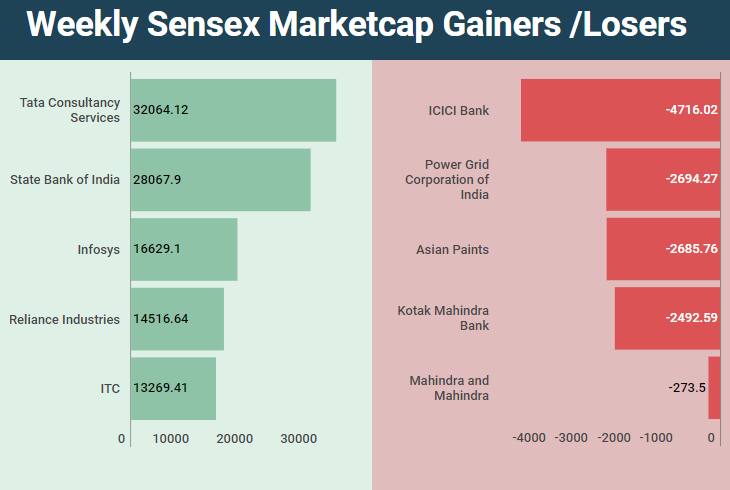

Last week, the Sensex rose 914.83 points (2.33 percent) to end at 40,165.03, while Nifty added 263.45 points (2.26 percent) ended at 11,890.6.

On a weekly basis, the rupee rose 7 paise at 70.81 on November 1 versus the October 25 closing of 70.88.

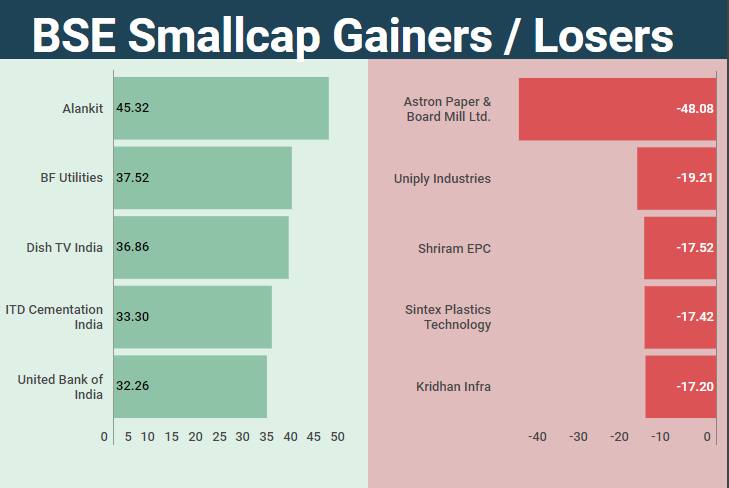

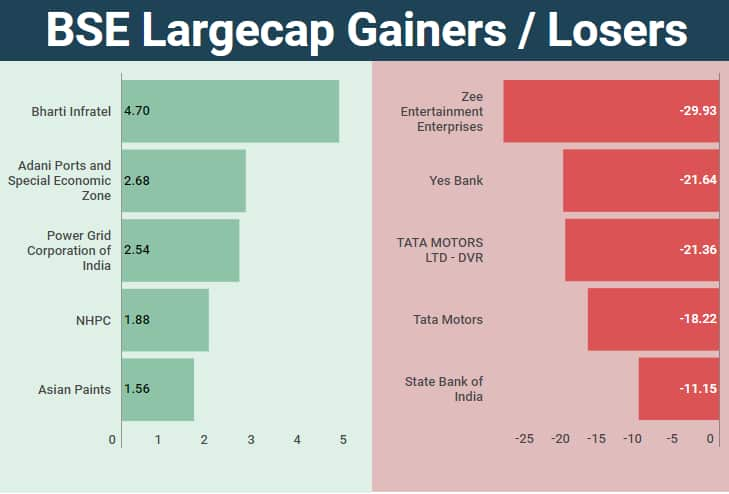

The BSE mid-cap index rose 3 percent, while large-cap and small-cap Indices were up 2 percent each in the past week.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.