Sacchitanand Uttekar, DVP Technical (Equity), Tradebulls Securities, is cautious when it comes to high-beta mid-cap names where traders can remain active. He says investors can look for booking some profits and wait for better entry points.

In an interview to Moneycontrol’s Kshitij Anand, Uttekar says active retail participation is one of the key reasons for broader markets outperforming the benchmarks. Falling coronavirus cases, easing of restrictions and hopes of pent-up demand, too, have worked in the favour of small and midcap stocks, he says. Edited excerpts:

It was a historic week for Indian markets with both the Sensex and the Nifty50 hitting a record high. What led to the price action?Both benchmark indices hit fresh record highs in the week gone by and we are among the top performers globally this year. India did step into the party late amid a rise in COVID cases but they have now shown a significant drop in infection rate, which is a positive sign.

Additionally, the rate of vaccination has been going up steadily without any delays or shortages. For the fourth straight day, cases were below 1 lakh.

Many states have started easing restrictions, which has boosted market sentiment. Indian market is also witnessing a strong influx of retail investors and vaccination drive has started picking pace as supply constraints are easing.

They were the key factors that played an important role in uplifting the sentiment that pushed benchmark indices to their record highs during the week.

Where do you see the Sensex and the Nifty this week? Which are the important levels to track?The Nifty50 closed in the green for the sixth consecutive week. The index closed above the five-week (EMA) which is now placed around 15,430.

This level would act as key pivotal support for the ongoing momentum during the week. The upside for the series is expected to remain capped at around 16,040.

The trend strength indicators are showing signs of exhaustion but there is no sign of any reversal in trend yet. India VIX is now trending within a new regime of 11-15, another supporting evidence complementing the ongoing upmove.

For this week, 15,430 remains a key level to track on the lower side as it also corresponds with its 20-day EMA zone. As long as Nifty50 is able to trade above this level, the up move towards 16040 remains likely.

Small & midcaps have also been participating in the rally. What is leading to the price action and what is the outlook?Broader markets have outperformed the benchmark significantly and active retail participation is one of the key factors for this outperformance.

Fear of missing out, or FOMO, pushed many retail and HNI investors to buy into many of these smallcaps and midcap stocks. Active cases that have come down and states are opening up have created a further conducive environment where demand is expected to get better and so investors are lapping up these stocks in anticipation of pent-up demand.

Macro data like Q4 GDP data, PMI data, and RBI’s MPC announcement have also contributed in boosting market sentiment for small and mid-cap stocks as most of these parameters reported at par expected numbers.

BSE utilities and power indices were the top sectoral gainers in the week gone by. Why?Utilities and power indices were top gainers due to Adani Power and Adani Green Energy posting strong performance this week. These two stocks were the primary reason why we saw strong gains in the power index.

Right now portfolio shuffling is taking place and money is getting rotated into those sectors, which has not seen strong inflows like power and realty.

With states opening up, there would be pent-up demand in realty and an increase in consumption of power and that is why we have seen BSE utilities and power indices being top gainers.

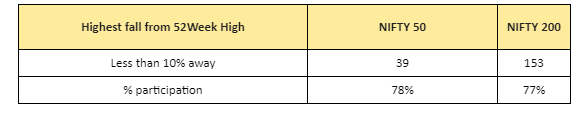

More than 400 stocks hit a fresh 52-week high on June 11. Should investors pick stocks with momentum, especially the ones that have hit 52-week highs?It’s a classic case of any bull run and a healthy sign of a broad-based rally. Below is the data pertaining to the stock’s current price performance wrt to their 52-week highs.

As we can see the rally has been broad-based as the percentage of the number of stocks close to their life highs has been significant. But, on the other hand, we have an ongoing diverging trend when we look at some of the trend strength indicators, especially on the Nifty 200 where despite the upmove, their relative strength value has been lower than its January 2021 reading.

The same is the case with Nifty 50 where its weekly RSI is about to hit the overbought zone. Hence, we remain cautious when it comes to high beta midcap names where traders can remain active, while investors can look for booking some profits and wait for better entry points.

We expect the immediate up move above 15,600 towards 16,040 to be challenging and hence the view remains cautiously optimistic where leverage on either side should also be avoided.

Top 3-5 trading ideas for the next three-four weeks?Here is a list of top trading ideas for the next three-four weeks:

Tech Mahindra: Buy| LTP: Rs 1073| Buy up to Rs 1060| Stop Loss: Rs 1030| Target: Rs 1130| Upside 5%

Price trending close to its January 2021 highs after 22 weeks of consolidation. Its weekly RSI has registered a breakout above its falling trend line level along with a crossover with its trigger line above the 50 zone.

We expect strong outperformance by Tech Mahindra in the coming weeks, as the stock is ready to scale towards fresh life highs during the week and maintain its secular uptrend until Rs 950 holds from hereon.

Escorts: Buy above 1230| LTP: Rs 1218| Stop Loss: Rs 1190| Target: Rs 1330| Upside 9%

Escorts has scaled above its 200-D (EMA), and holding itself well. Its daily ADX has confirmed a positive reading above 26, hence we may see a sustainable trend from here on towards the retracement/pullback zones of its previous declining wave, which are placed around 1,285-1,330.

UPL: Sell upto Rs 845| LTP: Rs 836| Stop Loss: Rs 860| Target: Rs 800| Downside 5%

Occurrence of a ‘Gravestone Doji’ on its weekly scale along with a fresh price breakdown below its 5-DEMA after maintaining itself above it since April 29, 2021.

We believe the stock has already kickstarted its corrective move and could fall back to its 5-week (EMA) zone around 800.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.