American historian Henry Brook Adams once said, ‘A teacher affects eternity’. Many success stories have an inspiring teacher that ignited a spark in a deserving student who then used it to achieve great heights.

Today we cover one such bright young software engineer. Vishvesh Chauhan was inspired and encouraged by his teacher Avijan Dutta, who was a fund manager before he took to teaching, to look at markets as a career. Chauhan has never looked back since then.

Son of a retired police officer from Daman, Chauhan credits his father for instilling discipline and hard-work -- the twin pillars he attributes to his trading success.

Chauhan’s excellent technical analysis skills, coupled with his knowledge of data science and computing skills, makes him a lethal trader -- one who you would not like to bet against in the market.

He, however, has had his shares of failures, but like every successful person he has used it as a stepping stone and learning experience to move forward.

In an interview with Moneycontrol's Shishir Asthana, Chauhan walks us through his journey as a trader, pausing at various hurdles he faced and finally taking us through his trading strategies.

Edited excerpts

Q: Take us through your journey in the market. A: I am a software engineer with an MBA in finance based out of Surat. Coming from Gujarat, the stock market was not an alien subject, but my introduction to the market was pragmatic.

During my MBA course, we had a professor -- Avijan Dutta, who was from IIM Ahmedabad and a fund manager in his previous avatar. It was he who gave us an inside tour of the market.

In one such assignment, I analysed a software company called i-Flex Solutions (now Oracle Financial Services Software), which was trading at around Rs 300 per share. I liked the stock because the company wrote software for banks to run their core operations. Given the computerisation of banks, I figured out that there would be no demand-side issues for the company. My price target for the company was Rs 1,200 over the next four years. However, we were in the midst of the biggest bull run (2004-08) and i-Flex hit my target in a matter of months.

I saw the magic unfold in front of my eyes and wanted to learn more about the market. I approached my professor and asked him how I could learn more about the market. He told me that fundamental analysis is only one small segment of the overall market and directed me towards technical analysis.

In the final year of two-year full-time MBA, I did a very detailed project on technical analysis putting my software knowledge to use. I downloaded the bhav copy from both stock exchanges and fed it into open-source software, which uses various technical indicators to throw up simple trading strategies. While my project was selected as the best, the stocks I had picked during this assignment doubled in a short span of time.

After the course, I decided I would like to be a technical analyst. What also tilted my decision was what my professor told me. He said that analysts are among the highest paid professionals.

Q: Take us through your job experience. A: My first job was with one of the biggest retail brokers in the country. After the initial learning process, thanks to hand-holding by my bosses, I picked up the art and science of technical analysis. Those days I was good at picking up short and medium-term trends.

All throughout, my focus was on price and volume. I was taught that irrespective of whether you are a promoter, analyst, trader, fund manager or insider you can do only two things when you come to the market: buy or sell stocks. Now, if you trade in large volumes, you will leave your signature on the market.

Reading price and volume data gives an insight into what the ‘smart money’ is doing. I have always looked to read the price and volume data to understand the force behind the price action.

Having said that, one needs to know that the market is nothing but a mass psychology reflector. There are three emotions – fear, greed and hope – prevalent in the market at all times. One can only take unbiased decisions in the market if he is detached from these emotions.

Now, markets have an inherent structure. The puzzle is to crack the structure. If you can do it, you can forecast overall behaviour to a large extent, though you may never always be right.

Trading techniques can be developed using these structures. However, there is a flaw in such technique. The flaw is the bias that comes with this strategy. In order to remove these biases, I decided to codify the system. But coding the system is a huge task, if one wishes to incorporate all parameters.

I started out by simplifying the process and came out with my own definition of trends. For instance, if the market does not break a three-day low, I would call it a short-term uptrend. If it crosses the 20-day high, I would call it a medium-term trend. I started introducing such codes into my system, which helped me my trading system evolve during my initial days.

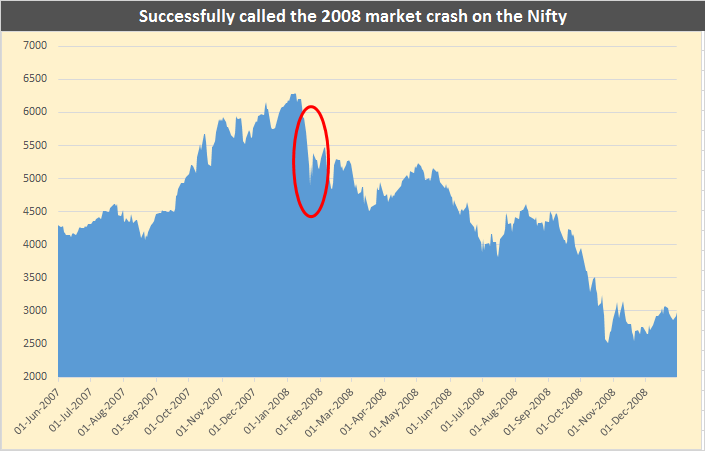

I know it may sound like I am boasting, but my accuracy rate was 85 percent in those days. I could give a buy or sell call with a Rs 3-5 points stop-loss on the indices. I initiated a sell call just days before the market hit the lower circuit during the 2008 crash.

While my calls were doing well, working with a retail broker had its limitation as retail clients are generally interested only in an Rs 10-15 points move.

I then changed jobs and moved to the institutional broking side of a multinational bank. Here the hope was that I would be facing bigger clients who may be interested in larger price moves. This was early 2009 and I was disseminating buy calls with a target of 20 percent and a stop-loss of three percent.

I still remember a Tata Steel call I recommended with an upside target of 20 percent. The head of fundamental research of this multinational bank said that the company will not have any earnings in future. Next day, the stock moved 20 percent in a single day.

With each passing day, I was getting confident of my skills and felt ready to manage larger sums of money. As luck would have, my previous boss called me to ask if I was keen on managing a technical PMS (portfolio management services) fund. The offer came with a 100 percent increase in salary.

Q: How was your stint as a fund manager? A: My entry into fund management coincided with the market trending sideways. All throughout my career as a technical analyst, I was able to predict the market very well as it was either trending up or down. I had never been through a sideways market.

I was buying breakouts and they were failing. I was shorting breakdowns and the market would trade in a range. I did not help that I was managing large sums of money. This impacted me emotionally as I come from a middle-class family and this was the first-time I was dealing with such huge sums of money.

Over the next one-and-a-half years the market trended sideways. At one time, my portfolio was down 20 percent but I closed the year with a loss of around five percent. I finally realised I was not that great. My boss called me and said that the returns were not acceptable.

Q: So, what happened after you moved on from there? A: During my stint as a fund manager, I completed a certificate course in Applied Mathematics from the Indian Institute of Quantitative Finance. This gave me a strong insight into the math behind the finance. It helped me learn volatility forecasting and modelling, swaps, option pricing, et al. Basically, it taught me that there is more to markets than trading directional moves.

My new found interest helped me secure a job in Reuters and I was based out of their Sydney office. The job required interaction with treasury heads globally, translate their technology requirements and then work with the coding team to provide solutions. The job tested a mix of my software and quantitative finance skills. But even as I was working, I tested my currency trading skills against some of the best in treasurers across the globe. The results made me do a rethink on whether I should give myself a second chance to become a trader.

Debt free and with decent savings, I decided to start my own trading firm, which could later be scaled to a hedge fund. However, life had other plans for me.

Around November 2013, my wife delivered twins 28 weeks into her pregnancy. Both boys were on a ventilator for the next three months and even after that there were multiple complications which kept us preoccupied for all of 2014. Though I was able to trade well, the medical bills were fast eroding my capital.

With my emotional risk capital shrinking, I had to accept destiny and decided to join Monarch Networth Capital as head of their trading desk in Mumbai.

Q: Can you take us through your trading strategy? A: Till this point, my transition has been from a technical analyst to a fund manager to a system developer and finally to a systems trader.

In my over three years at Monarch, I put to use all my learning and traded options consistently without a single losing month. Over the years, I learnt that my strength is in predicting directional moves and using my quantitative skill to predict volatility. For an options trader, the two essential tools are a view on the direction of the underlying and a view on volatility.

We regularly trade four-to-five systems, which help stabilised our monthly return around 2-3 percent.

There is a step-wise process by which we trade for each strategy. It starts with running a scanner based on quantitative models that have been developed by me. The output of this scanner is a list of stock that have a high probability of unidirectional moves.

The second step is to check the volatility range of each stocks. This can be based on either Implied Volatility Rank (IV Rank) or IV Percentile.

Recently, we initiated a trade in Yes Bank where the IV percentile was 90 and another in IndusInd Bank with an IV percentile of 15. Both had cleared the filter of prospective stocks for a big move, but had different IV percentiles, so they had to be treated differently.

We initiated the Yes Bank trade when the stock was trading around Rs 170 per share. Since the IV Percentile was high, it suggested a strong move. We sold a 1:2 ratio call spread of 220 and 240 strikes (bought one 220 call and sold two 240 calls). At the time of initiating the trade, the risk on the trade was Re 1, or Rs 1,750 per lot. We exited from the trade when the spread touched Rs 15. In the case of IndusInd Bank, which had a lower IV, we went long on the future contract and hedged it with a put contract.

Understanding volatility is very important for an options trader. It is said that volatility is mean-reverting. While it is true, volatility also seeks extremes. Since volatility moves in a range, it can be mean-reverting in a range. But when it moves out of that range, it enters a new range where the ‘mean’ also shifts.

Volatility is stickier on the lower side of the range. For instance, consider volatility of the Nifty, which generally moves between 10 and 24. However, it can spend months in the 10-11 range than at higher ranges.

Despite the precautions we take in picking up a stock, I have found that my trades can still go wrong.

This is where the third part of our process kicks in – adjustment and management of the trade. Every option structure has a different hedging mechanism. Each trade has to be handled on its own merit. The idea is to lock in the loss as soon as possible. The beauty of trading options is that you can hedge and protect your trades using a variety of methods.

Q: How do you trades the indexes? A: We also trade the index using a shorter term strategy, where our main concern is direction, intensity and volatility. There can be various combinations of these three variables. We can have a situation where the trade direction is short but volatility and intensity are high. There can be around 9-10 such combinations and we are ready with a strategy to deal with each.

On March 13, the Bank Nifty had a very high open interest at 28,500, but this was challenged and the market moved up to 28,600. The underlying was showing a lot of strength, but 28,700and 28,800 strikes were witnessing good amount of call writing. Volatility was high and we expected the 28,700 and 28,800 strikes to be challenged.

The best way to trade this situation was to create a call back spread, where you sell a call of a lower strike and buy two calls of higher strikes in a back spread. The key here is that one should not look at the expiry payoff, but at shorter timeframe of T+2 or T+3.

While trading indexes, I have an inter-index offsetting position. Though this does not give me large profits, it helps curb my losses.

Q: Do you trade any other strategies? A: On expiry day, we generally trade a risk-defined short Iron Butterfly – selling one at-the-money (ATM) call and put and buying one out-of-the-money (OTM) call and put. An ideal case would be a 200-point Iron Butterfly available at Rs 180, then the risk will be only 20 points. Since option prices decay faster on expiry day, we have found this structure to work well for us.

The most important thing to note in trading using this strategy on expiry day is ‘Pinning the Strike’ which is basically getting the strike price where the strategy will be initiated.

Like on May 31, 2018, the market suggested that FII holding limit in HDFC Bank would increase. The expectation was that Bank Nifty would open higher and it did. However, it soon started correcting and so did the HDFC Bank.

But data showed an increase in open interest in HDFC Bank call options, even as the price was going down. In Bank Nifty, the open interest increased from two lakh to 27 lakh contracts. Data suggested that Bank Nifty may shoot up, so we created a 200-point Iron Butterfly, which was 300 points away from where the market was, at a cost of Rs 180. Within an hour, the market moved higher and we covered the trade at 80 points, giving us a quick Rs 100 profit per lot.

But like all traders, even I am subjected to greed. I took another 200 points Iron Butterfly, 100 points away from the strike that I had created earlier. But the market kept on moving and this short Iron Butterfly, which was created at 160 points, was booked at 190 points. As this position was bigger than the earlier one, it took away a portion of the earlier loss. But without this structure, we would have incurred a bigger loss.

We do initiate a lot of intra-day trades, but these are all spreads which define our risks. Here too we look at the volatility before entering a trade.

For example, if the volatility is in the lower quartile of the last 52-week range, then we know that the market is not nervous. We look to sell at-the-money (ATM) straddles – selling an ATM call and put.

If on a five-minute chart, we get a sell trade, then we look to create a short strap position, wherein if the underlying is expected to go down, we sell two call options and one put option, which may be one strike apart. So, if the Nifty is at 11,200, we would sell one 11,200 put and two 11,300 calls.

In all our trades, we follow our four trading steps. The first is scanning our list of most liquid stocks. Two, look for where they are on the volatility spectrum. We then pick up an option structure through which we would initiate the trade. Finally, when we are in the trade, we look to actively manage to maximise profits.

Q: Now that you are successfully running a quant desk, what do you look for in a trader if one comes to you seeking a job? A: For me, a quant trader should have five important skills – strong mathematical knowledge, good in statistics and programming, have a wide understanding of option instruments and decent communication skills.

Since trading is all about maths, I am not talking about arithmetic skills, but about the ability to play around with numbers. So, if I were to reduce the number of days in a Black & Scholes model, then that person should know how it will impact option premium. So, inquisitiveness is necessary.

Statistics is about understanding the terms and their relationship with options. A person becomes very objective if his understanding of statistics is strong. If one were to ask what is the probability of the price covering a distance of three standard deviations, then that person should confidently say that with a 99 percent chance this can be achieved in only two percent of cases. Artificial intelligence or machine learning is all about statistics and about fitting the regression line, or in layman’s terms following the market’s price.

Programming is the most difficult but is an important skill that a quant trader should possess. If on a 15-minute candle there is a sell signal and if on the daily chart of the same underlying there is a certain behaviour, I should know how the market behaved during previous occasions.

My edge is the ability to process such information at a faster pace. In a single trading day, there are 375 minutes, so if you include all stocks and instruments associated with it across all expiries, we would have 3.75 lakh data points. In a span of 10 years, it would be 48 crore data points. A normal SQL (Structured Query Language) query cannot go through such data fast enough. I have spent over a month to learn a new language that can scan through the data fast enough to retrieve the information I need in a matter of 0.6 seconds.

Your ability to scan through the data will provide you an edge in the market. I will be at an advantage, if I knew beforehand how the Bank Nifty behaved when its open interest spiked by 20 percent in the at-the-money strike, which occurred with an implied volatility (IV) spike of two percent. The behaviour of the market in the past will give me an edge against those who are unaware of it.

The fourth skill is the ability to know which instrument class to trade under various situations. If you do not understand the nitty-gritty of option Greeks and its behaviour under various situations, you would be missing out on the opportunity to trade with the most optimal instrument. In our trading, we work on managing the second derivative Greeks like Volga and Vanna, which requires a robust knowledge of option structures.

Finally, if you are working in a business that requires client-servicing, you need strong communication skills, especially when it comes to a complex product like quant-based options trading.

Q: What are your plans going forward? A: Coming from a software background, I like coding various strategies. At present, my strategies are semi-automated. I would like to take a six-month sabbatical to fully automate them. The aim is to manage Rs 100 crore fund, which does not look too far away from where we are currently placed.

One thing that I learned in my journey is to take nothing for granted, both in life and in trading. Which is why I prefer trading options as it gives me the flexibility to emerge profitably even if I am wrong.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.