By demerging to six separate entities, Vedanta Ltd aims to attract global investors, particularly sovereign wealth funds, to invest in pure-play assets, said the management.

"We aim to reassign risk of each business within the respective entities and mitigate the potential risk associated with one business affecting others," said Arun Misra, executive director, Vedanta Ltd in an analyst concall held post the demerger announcement.

Billionaire Anil Agarwal-owned Vedanta Limited on September 29 announced its plan for six separate entities: Vedanta Aluminium, Vedanta Oil & Gas, Vedanta Power, Vedanta Steel and Ferrous Materials, Vedanta Base Metals and the residual Vedanta Limited.

The demerger is planned as a vertical split, for every one share of Vedanta Limited, the shareholders will additionally receive one share of each of the five newly listed companies.

"Independent entities will have their own growth strategies without being constrained by the overarching structure. They will have more nimble database, can innovate faster, make strategic decisions more decisively, and respond proactively to market disruption," Misra added.

This will also attract more foreign capital as institutional investors tend to focus on specific businesses, he said.

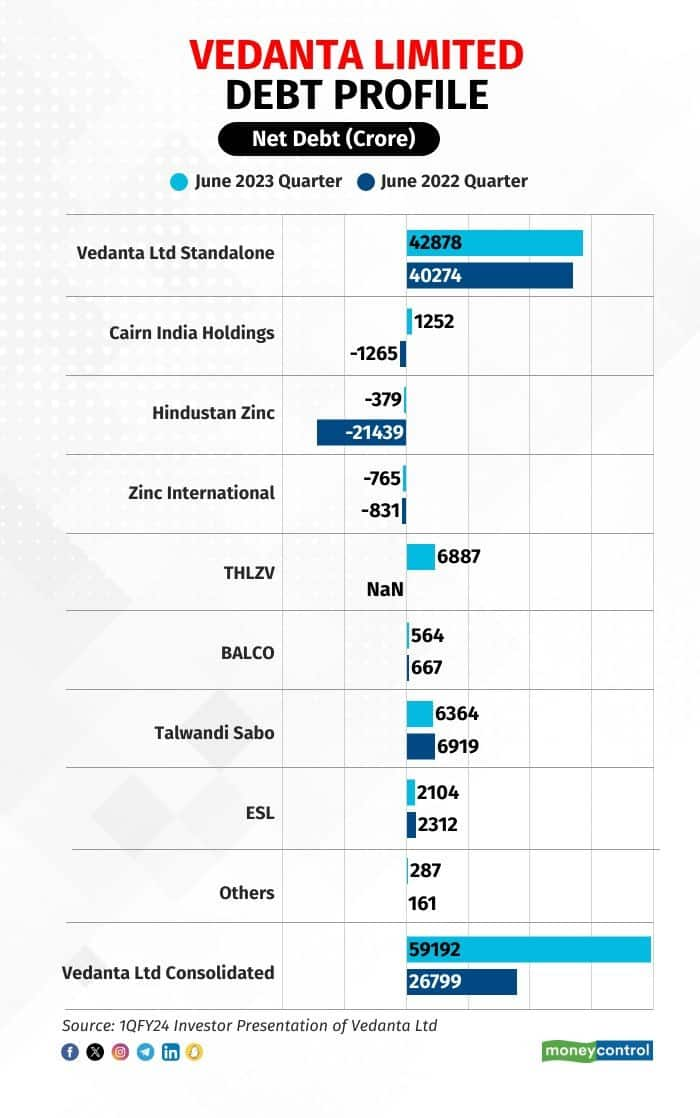

As of June end 2023, Vedanta Limited's consolidated net debt stood at Rs 59,192 crore. Gross debt stood at Rs 73,484 crore, with cash and cash equivalents of Rs 14,292 crore. Debt rationalisation has been a priority for the management, as perceived lending limits and equity capital market access is relatively restricted under the current structure.

"Company law is clear on how to allocate debt in case of demergers. We will follow that process," said Misra.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.