Varanium Cloud Limited, which listed on NSE's SME Platform or NSE Emerge on September 27, 2022, and its promoter and managing director Harshawardhan Hanmant Sabale have been banned from the securities market.

The stock closed at Rs 42.45 today or 3.03 percent higher than the previous close. It also hit its 52-week low today.

The company allegedly misutilised its initial-public offer (IPO) proceeds and used dubious transactions to paint a false picture of good financial health and promising growth prospects to the general public. This allegedly helped its promoter entities to exit the company "at the cost of gullible investors", said an interim order issued by the market regulator on May 10.

The indicative returns earned by Sabale by selling shares of Varaniam is Rs 17.61 crore.

Also read: MC Investigates: How elaborate FPI scams groom, persuade people to give away crores of rupeesThrough the interim order, the Securities and Exchange Board of India (Sebi) has also restrained Sabale from acting as a director/key managerial personnel of any listed company or its subsidiary or any company that intends to raise money from the public.

The order stated, "What has emerged clearly from the examination done by SEBI and NSE is the fact that Varanium through its Promoter, Mr. Harshawardhan Hanmant Sabale, spun an intricate web of apparently dubious transactions and tried to paint a picture that did not represent the fundamentals of the Company."

It added, "The Company made public announcements meant to give an impression to unsuspecting investors that Varanium was a top notch IT service provider that was entering greenfield areas."

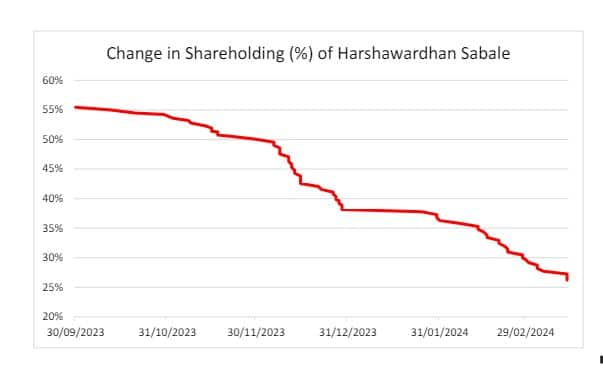

The regulator's investigations showed that Sabale kept reducing his stake in the company...

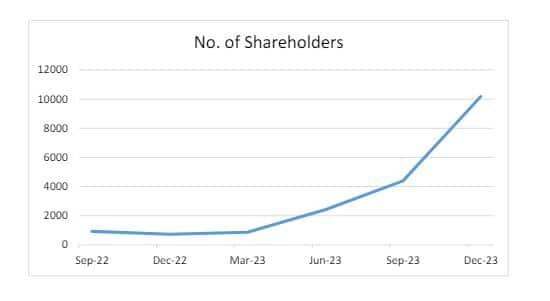

...the number of public shareholders kept increasing, as shown below.

The order pointed out that the number of public shareholders increased from around 1,000 in September 2022 to more than 10,000 in December 2023. During this period the share price of the company also went up.

"The promoter, taking advantage of such price rise, off-loaded

shares and made huge gains," said the order.

Misutilisation of IPO ProceedsThe order stated, "The genesis of the prima facie violations observed in the instant matter has its roots in the SME IPO of Varanium which thereafter continued through the bonus issue and stock split followed by the Rights Issue. It has prima facie emerged that the money raised through the IPO and subsequent Rights Issue was not used for the intended purpose mentioned in the offer documents."

Varanium was found to have transferred at least Rs 18.43 crore--or 46 percent of its IPO proceeds--to an entity named BM Traders. BM Traders, a proprietary business of a certain Raj Kishanchand Jagtani, was involved in the wholesale business of fruits and vegetables. Its reported income during the assessment year 2024 was a mere Rs 6.47 lakh.

In a bank correspondence dated April 29,2024, BM Traders stated that it dealt with agricultural products and did not have any employee in the business. During a site visit to the business address of BM Traders by the bank's officials, it was found that it was a residential address and had no business activity.

Link to Panama PapersOne of its major buyers was found to be registered in an address that was shared by various companies found in the Panama Papers, as available on International Consortium of Investigative Journalists' Offshore Leaks Database. The database is an attempt to compile names of companies and trusts incorporated in tax havens and to expose the people behind them.

In FY23, 83.91 percent of Varanium's sales valued at Rs 326.22 crores was made to a company named Amtelfone. In the first half of FY24, 71.44 percent of Varanium's sales valued at Rs 268.1 crore was made to the same company.

As per Varanium’s reply to the National Stock Exchange (NSE), services provided to Amtelfone (a Distributor of VoIP Services for the Middle Ease and North Africa or MENA region) was VoIP services on a wholesale SoftwareAs-A-Service (SaaS) basis.

Also read: Bombay High Court orders arrest of Varanium Cloud promoter Sabale; stock hits 5% lower circuitData available on public domain showed that Amtelfone’s address to be Suite 9, Ansuya Estate, Revolution Avenue, Victoria, Mahe, Republic of Seychelles. This was an address that was shared by many companies named in the Panama Papers.

Sebi's interim order stated: "Other than the above, no information about Amtelfone was found in public domain. Even as per OpenCorporates, no company named ‘Amtelfone Incorporated’ was found by NSE."

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.