The market closed flat for the third consecutive session following a phase of consolidation and rangebound trading, while volatility remained elevated on May 2. Bears continued to dominate market breadth, with 1,487 shares declining versus 1,047 advancing on the NSE. Benchmark indices may once again attempt to test the previous day's highs, but sustaining those levels is the key to watch amid ongoing consolidation. Below are some short-term trading ideas to consider:

Rajesh Palviya, Senior Vice President Research, Head Technical Derivatives at Axis Securities

Steel Strips Wheels | CMP: Rs 213.5

On the daily chart, Steel Strips Wheels has confirmed a "rounding formation" breakout at Rs 210 on a closing basis. Additionally, the stock also witnessed a breakout from a "down-sloping channel" at Rs 203. These breakouts have occurred with significant volumes, indicating strong participation. The stock is comfortably trading above its 20-, 50-, 100-, and 200-day SMAs, reaffirming bullish sentiment. The daily, weekly, and monthly Relative Strength Index (RSI) also suggest buying interest at current levels. Investors should consider buying, holding, and accumulating this stock.

Strategy: Buy

Target: Rs 232, Rs 250

Stop-Loss: Rs 200

Garden Reach Shipbuilders and Engineers | CMP: Rs 1,882.8

On both daily and weekly charts, Garden Reach Shipbuilders has decisively broken above a key multiple-resistance zone between Rs 1,780 and Rs 1,800 on a closing basis, signaling a strong return of bullish momentum. The breakout is supported by heavy volumes, indicating increased market participation. A daily "Bollinger Band" buy signal further points to building momentum. The stock is positioned above its 20-, 50-, 100-, and 200-day SMAs, reinforcing the bullish view. The RSI on both daily and weekly charts supports a buy stance. Investors should consider buying, holding, and accumulating this stock.

Strategy: Buy

Target: Rs 2,085, Rs 2,285

Stop-Loss: Rs 1,800

Honasa Consumer | CMP: Rs 252.55

On the daily chart, Honasa Consumer has confirmed a short-term trend reversal, forming a series of higher highs and higher lows. It has also broken out above a down-sloping trendline at Rs 241. Over the past few weeks, rising volumes suggest growing investor interest. The stock is now above its 20-, 50-, 100-, and 200-day SMAs, underlining bullish sentiment. A daily Bollinger Band buy signal further confirms increasing momentum. Investors should consider buying, holding, and accumulating this stock.

Strategy: Buy

Target: Rs 270, Rs 285

Stop-Loss: Rs 239

Rajesh Bhosale, Technical Analyst at Angel One

Bharat Electronics | CMP: Rs 311.35

After hitting an all-time high of nearly Rs 340 in July 2024, Bharat Electronics saw a gradual correction over the past year. However, in recent weeks, the stock has staged a sharp rebound, breaking out above a falling channel pattern and confirming a bullish reversal. This move establishes a higher high and higher low structure, signaling the beginning of a new bullish cycle. The RSI Smoothened indicator has crossed above 60, highlighting increasing positive momentum. We recommend buying Bharat Electronics around Rs 311–Rs 308.

Strategy: Buy

Target: Rs 340

Stop-Loss: Rs 295

UPL | CMP: Rs 680.8

Despite broader market weakness, UPL has demonstrated relative strength. On the weekly chart, the stock is forming a higher high and higher low pattern, with dips consistently attracting buying interest. Over the past month, prices consolidated, but a breakout above the upper range now suggests the uptrend is resuming. Strong volume during upward moves and lighter volume on declines indicate accumulation. We recommend buying UPL in the Rs 680–Rs 685 range.

Strategy: Buy

Target: Rs 745

Stop-Loss: Rs 655

Anshul Jain, Head of Research at Lakshmishree Investments

GlaxoSmithKline Pharmaceuticals | CMP: Rs 2,852.8

GlaxoSmithKline Pharmaceuticals is forming a bullish 171-day-long cup and handle pattern on the daily chart, with a neckline breakout level at Rs 2,950. The base formation shows signs of institutional accumulation, supported by multiple volume spikes. Several candles have closed with above-average volume, affirming consistent buying activity. A breakout above Rs 2,950 could propel the stock toward the Rs 3,200 zone in the near term.

Strategy: Buy

Target: Rs 2,950, Rs 3,200

Stop-Loss: Rs 2,775

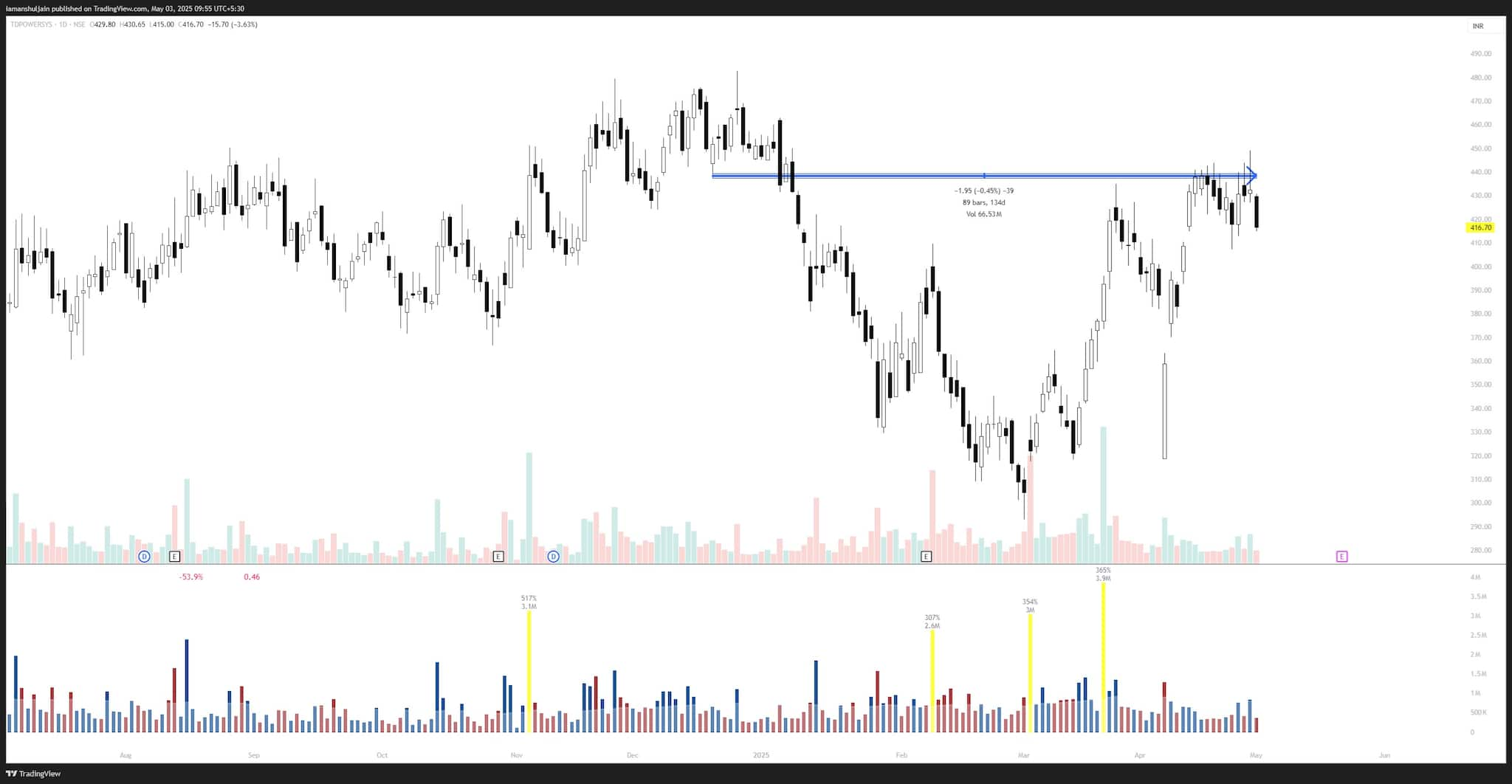

TD Power Systems | CMP: Rs 416.7

TD Power Systems is developing a bullish 89-day-long rounding bottom formation, with a neckline breakout level at Rs 440. The chart shows evident signs of institutional accumulation, highlighted by high volume spikes. Multiple daily candles have also closed with volume above the 50-day average, strengthening the bullish case. A breakout and sustain above Rs 440 will confirm bullish intent and could lead the stock to Rs 520 in the short to medium term.

Strategy: Buy

Target: Rs 455, Rs 505

Stop-Loss: Rs 385

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.