The benchmark indices remained consolidative for another session on February 27, closing flat-to-negative and extending the downtrend for the seventh consecutive session. Bears continued to control the market breadth, with a total of 2,162 shares facing selling pressure compared to 459 advancing shares on the NSE. The consolidation is expected to continue until the indices decisively break the range of the last three days on either side. Below are some trading ideas for the near term:

Chandan Taparia, Head Derivatives & Technicals, Wealth Management at Motilal Oswal Financial Services

SRF | CMP: Rs 2,854

SRF has retested its breakout from a consolidation zone on the daily chart, accompanied by higher-than-average traded volumes. The Stochastic indicator has bounced from its oversold zone, supporting the bullish sentiment.

Strategy: Buy

Target: Rs 3,030

Stop-Loss: Rs 2,775

Berger Paints | CMP: Rs 505.25

Berger Paints has broken out of a consolidation zone and is inching higher despite broader market weakness. Rising volumes confirm the price movement. The MACD (Moving Average Convergence Divergence) indicator is rising, supporting the uptrend.

Strategy: Buy

Target: Rs 528

Stop-Loss: Rs 493

Mandar Bhojane, Equity Research Analyst at Choice Broking

Bajaj Finance | CMP: Rs 8,705.4

Bajaj Finance has broken out from a symmetrical triangle pattern on the daily chart, signaling bullish sentiment. The price is consolidating above the breakout level, indicating strong momentum. Increasing trading volume and the formation of higher highs and higher lows further confirm the uptrend. The RSI (Relative Strength Index) is at 71, trending upwards, reflecting strengthening bullish momentum. These indicators suggest the stock is poised for a rally. To manage risk, traders should set a stop-loss at Rs 8,200. If the momentum sustains, short-term targets of Rs 10,000 and Rs 10,200 could be achieved.

Strategy: Buy

Target: Rs 10,000, Rs 10,200

Stop-Loss: Rs 8,200

Zomato | CMP: Rs 229

Zomato is forming higher lows while trading below a descending trendline on the daily chart, suggesting a potential bullish reversal. The stock has been consolidating near its key support level, indicating accumulation by buyers. Increased trading volume highlights growing buying interest and supports the possibility of continued bullish momentum. A breakout above Rs 235 could trigger a rally toward immediate targets of Rs 260 and Rs 270. On the downside, support at Rs 223 provides a favourable buying opportunity for investors. To minimize risks, a stop-loss at Rs 216 is advisable to safeguard against unexpected reversals.

Strategy: Buy

Target: Rs 260, Rs 270

Stop-Loss: Rs 216

Vidnyan S Sawant, Head of Research at GEPL Capital

Aarti Pharmalabs | CMP: Rs 740.25

Aarti Pharmalabs has been trading in an uptrend, demonstrating strong price stability despite market volatility, highlighting its high relative strength. On the daily scale, the stock has witnessed a bullish mean reversion from the 12-day EMA (Exponential Moving Average), signaling a continuation of its upward trajectory. Additionally, the MACD momentum indicator remains in buy mode, further reinforcing the bullish outlook.

Strategy: Buy

Target: Rs 861

Stop-Loss: Rs 684

Narayana Hrudayalaya | CMP: Rs 1,491

Narayana Hrudayalaya remains in a strong uptrend, with dips finding support near the key 12-month average. This week, the stock broke out of a 13-month consolidation phase with strong volume, indicating its readiness to extend its uptrend. Additionally, the MACD momentum indicator is inching higher, signaling a pickup in momentum.

Strategy: Buy

Target: Rs 1,711

Stop-Loss: Rs 1,398

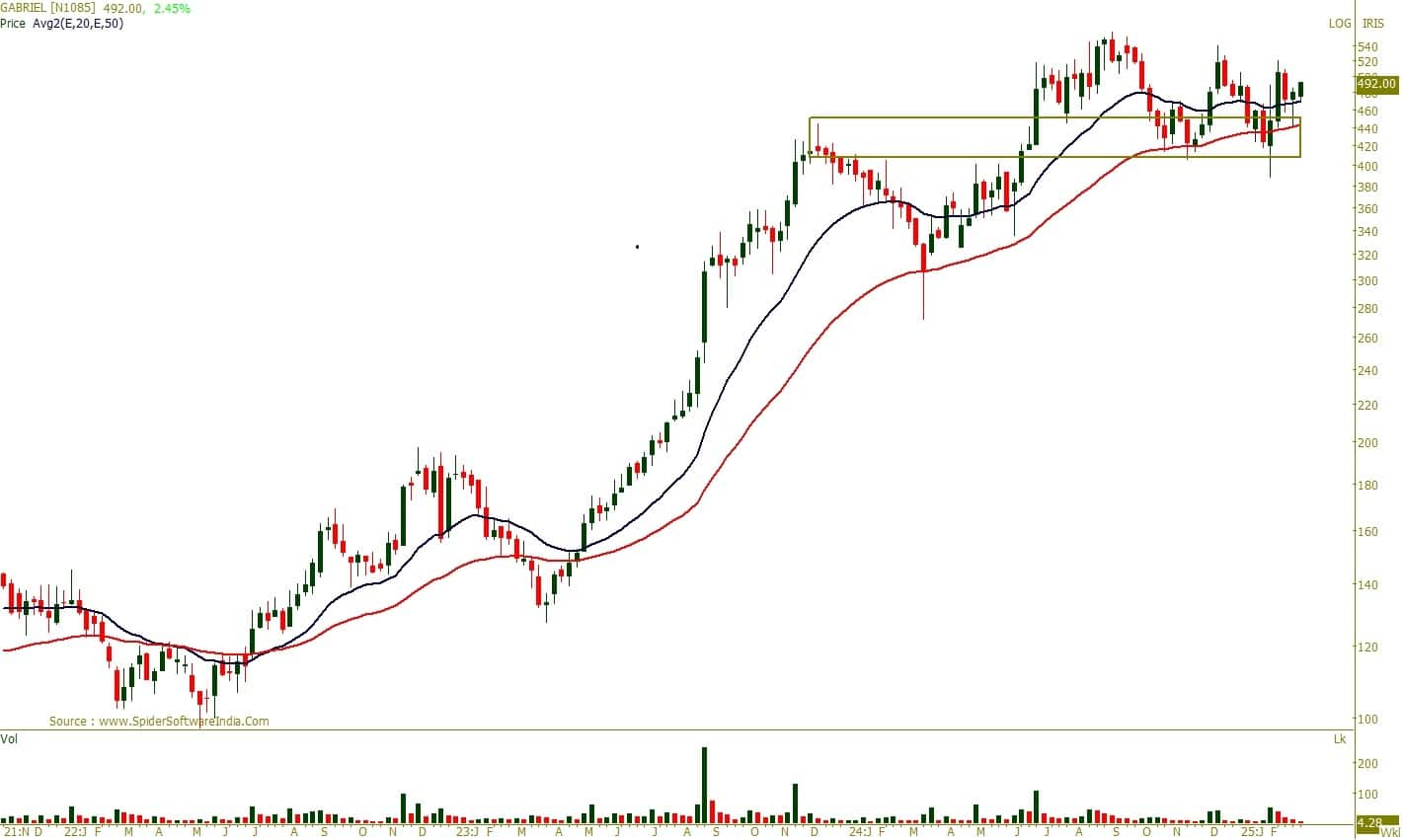

Gabriel India | CMP: Rs 483.1

Gabriel India has exhibited a strong structural shift on the weekly scale, with a polarity reversal where the December 2023 resistance has now turned into support. Around this key level, the stock has formed a double-bottom pattern, signaling a bullish reversal from neutral to positive. On the daily scale, it has respected the 50% Fibonacci retracement level, reinforcing a positive price action outlook.

Strategy: Buy

Target: Rs 560

Stop-Loss: Rs 457

SBI Cards and Payment Services | CMP: Rs 856.75

SBI Card has demonstrated a strong turnaround on the weekly scale, breaking out from a multi-year sloping trendline drawn from the 2021 swing high. On the daily scale, the stock is forming higher tops and higher bottoms, reflecting high relative strength compared to the broader market. Additionally, the MACD indicator signals momentum acceleration, further reinforcing the bullish outlook.

Strategy: Buy

Target: Rs 978

Stop-Loss: Rs 806

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!