The benchmark indices extended their downward move for the second consecutive session, falling 0.9 percent on July 25, with market breadth largely favouring the bears. A total of 2,179 shares were under pressure, compared to just 475 advancing shares on the NSE. The market is expected to consolidate further as long as the frontline indices continue trading below their medium-term moving averages. Below are some short-term trading ideas to consider:

Rajesh Palviya, Senior Vice President Research (Head Technical Derivatives) at Axis SecuritiesCipla | CMP: Rs 1,532.5

With Friday's strong gains, Cipla decisively surpassed its ten-month down-sloping trendline resistance at Rs 1,516 on a closing basis. This breakout was accompanied by strong volumes, indicating increased participation. Buying momentum emerged near the 20, 50, 100, and 200-day simple moving averages (Rs 1,490), which now act as a crucial support zone. The daily and weekly Relative Strength Index (RSI) indicates rising strength, while a daily Bollinger Bands buy signal suggests increased momentum.

Strategy: Buy

Target: Rs 1,600, Rs 1,685

Stop-Loss: Rs 1,490

Eternal | CMP: Rs 310.55

On the weekly chart, Zomato’s parent company Eternal decisively broke above the multiple resistance zone of Rs 300–305 on a closing basis, signaling a sustained uptrend. Surging volumes confirm increased market participation. The stock is trading well above its 20, 50, 100, and 200-day SMAs, reaffirming the bullish trend. These moving averages are also trending higher in line with the price rise, which further confirms bullish sentiment. The daily and weekly Bollinger Bands buy signal indicates strengthening momentum, while the RSI across daily, weekly, and monthly timeframes continues to rise.

Strategy: Buy

Target: Rs 350, Rs 410

Stop-Loss: Rs 300

Rajesh Bhosale, Technical Analyst at Angel OneShyam Metalics and Energy | CMP: Rs 969

Since September last year, Shyam Metalics had faced strong resistance around the Rs 950 mark. However, a clear consolidation breakout is now visible on the daily chart, indicating a shift in momentum. The stock has entered uncharted territory, reflecting inherent strength despite broader market weakness. This breakout is supported by robust volumes, and the smoothed RSI has given a fresh bullish crossover, reinforcing the positive outlook.

Strategy: Buy

Target: Rs 1,070

Stop-Loss: Rs 915

Torrent Pharmaceuticals | CMP: Rs 3,603.8

During the week, the pharma sector showcased its defensive strength by outperforming the broader market. Torrent Pharma stood out with a remarkable upmove, with every minor dip being swiftly bought into. The stock broke above its August 2024 swing highs, entering uncharted territory and confirming a strong consolidation breakout. The move was accompanied by a strong bullish candle. With momentum oscillators firmly in positive territory, the uptrend is expected to continue in the near term.

Strategy: Buy

Target: Rs 3,800

Stop-Loss: Rs 3,500

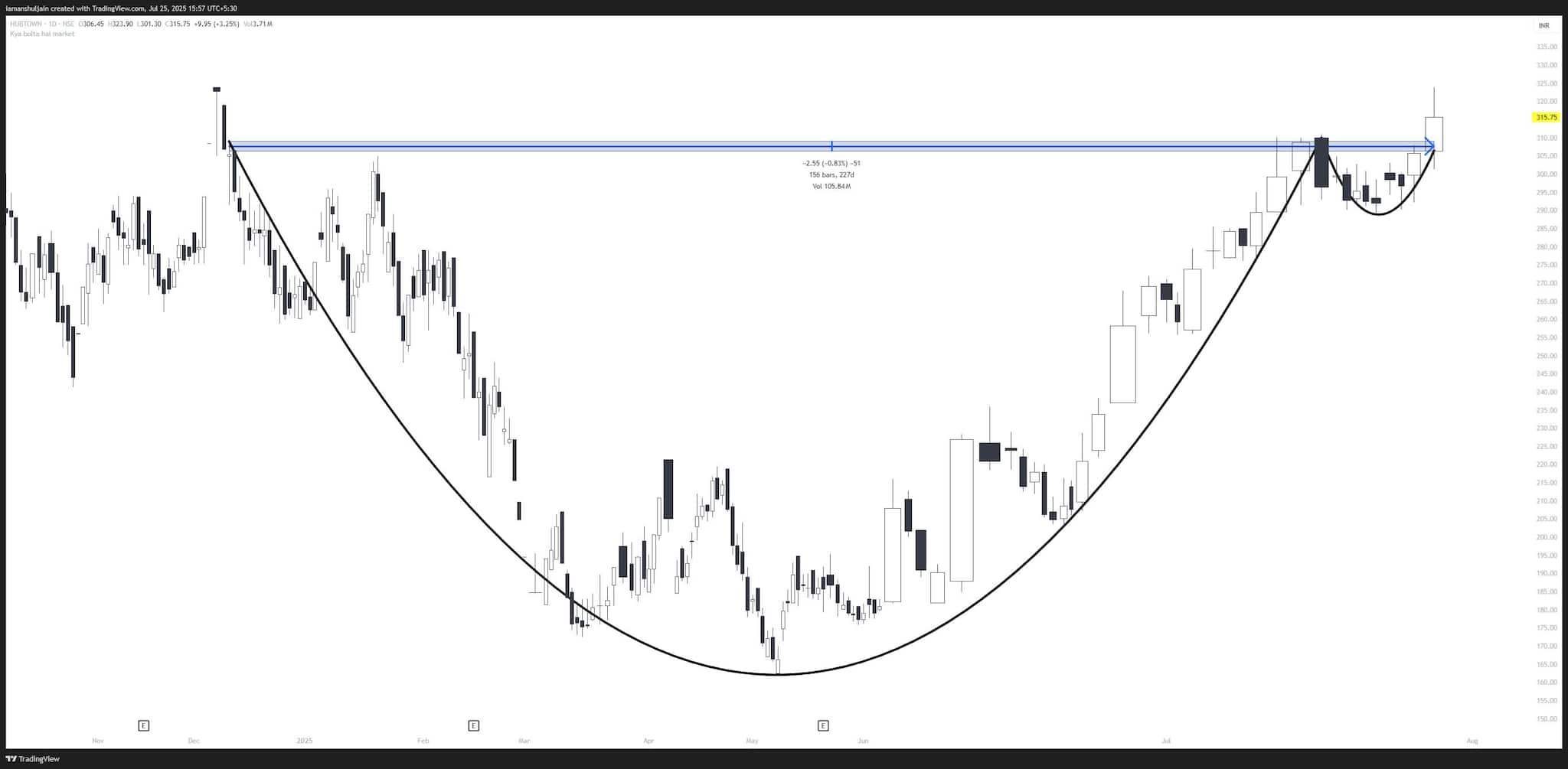

Anshul Jain, Head of Research at LakshmishreeHubtown | CMP: Rs 315.75

Hubtown has broken out of a 156-day-long Cup and Handle pattern at Rs 310, backed by strong relative volume — a clear indication of institutional participation. This validates the strength of the breakout. Momentum indicators and moving averages are well-aligned, supporting the bullish setup. The presence of high volume near the neckline adds to market confidence, suggesting a sustained upmove. The stock appears poised for continued strength in the near to medium term.

Strategy: Buy

Target: Rs 390

Stop-Loss: Rs 285

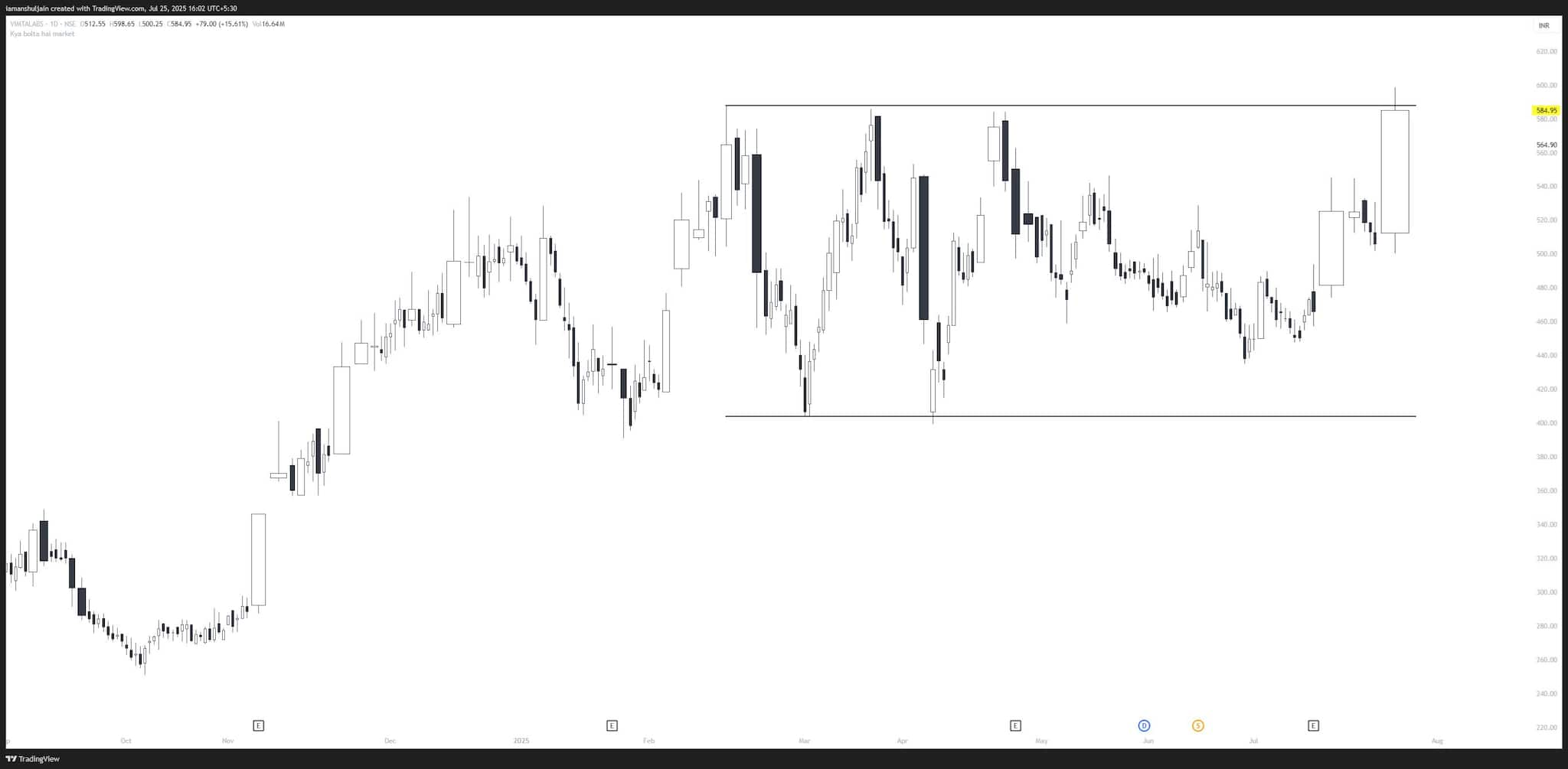

Vimta Labs | CMP: Rs 585

Vimta Labs is on the verge of a bullish breakout from a rectangle box pattern, with the breakout level placed around Rs 590. The last two candles in the base have shown an explosive surge in volume — over 4,000 percent above the 50-day average — clearly pointing to institutional interest. This volume buildup, combined with aligned momentum indicators, signals strong potential for a sustained breakout. A decisive move above Rs 590 will confirm the breakout, with a likely initial target of Rs 700. The combination of chart structure, volume, and momentum indicates a high-probability trade setup favouring the bulls.

Strategy: Buy

Target: Rs 700

Stop-Loss: Rs 530

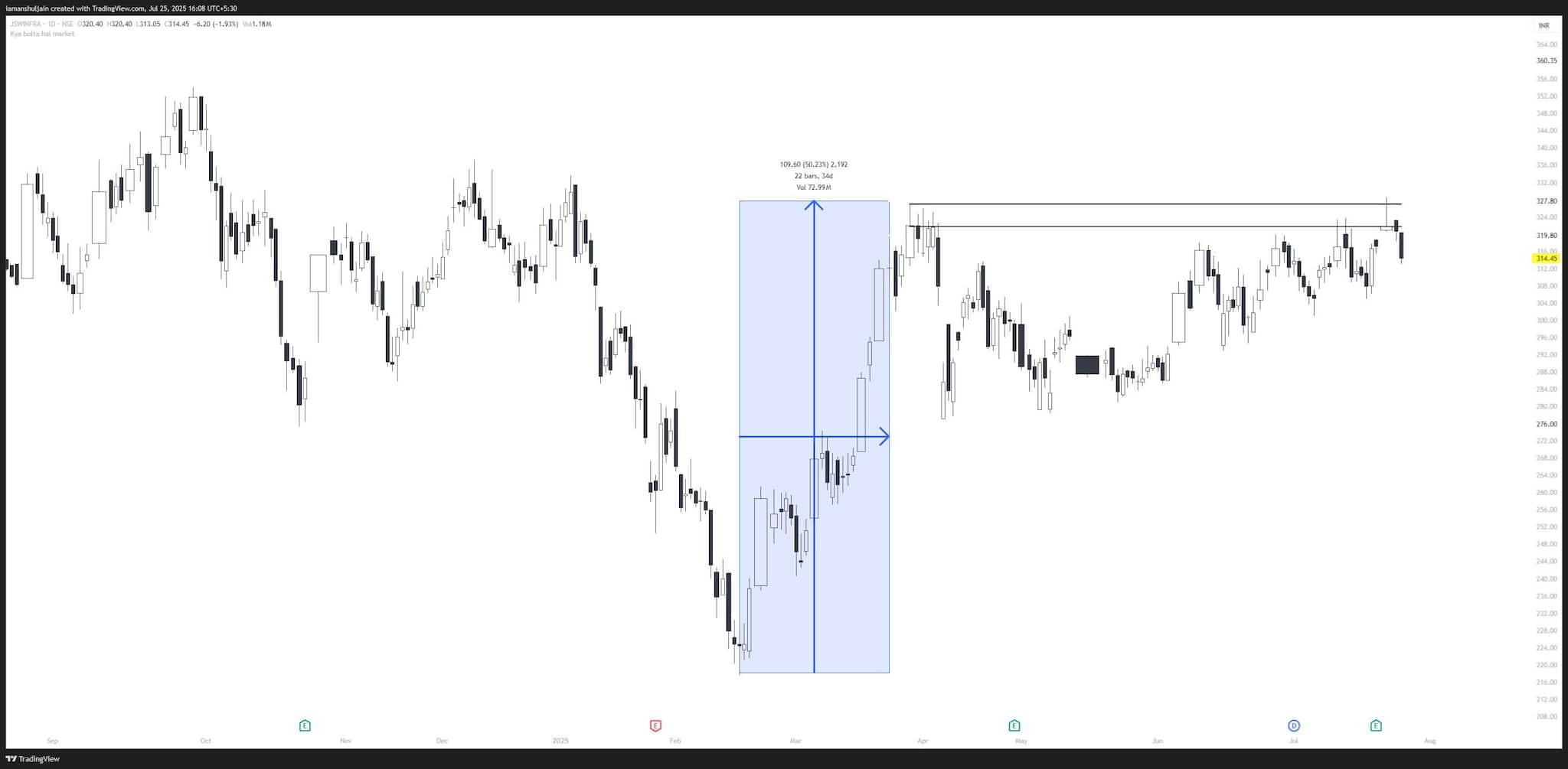

JSW Infrastructure | CMP: Rs 314.5

After a sharp 50 percent rally in just 22 days (February - April 2025), JSW Infrastructure is currently consolidating in a bullish Volatility Contraction Pattern (VCP) on the daily charts. The volume structure is textbook — expanding on up days and contracting on down days — suggesting institutional accumulation. Momentum indicators are beginning to turn higher, pointing toward an imminent breakout. A decisive close above Rs 330 will confirm the breakout, paving the way for a move to fresh all-time highs. Post-breakout, the stock has the potential to rally towards the Rs 390 zone in the short to medium term.

Strategy: Buy

Target: Rs 360, Rs 390

Stop-Loss: Rs 298

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.