The tone of benchmark indices remained subdued throughout last week, resulting in modest gains for both Nifty and Sensex. Broader indices however outperformed significantly, with gains ranging from 3.82 to 4.81 percent, surprising participants. According to experts, this week, the initial hurdle for the Nifty will be seen around 23,500, which has acted as a barrier in the past. Once this level is surpassed, Nifty could rally towards 23,900-24,000, which represents the retracement zone of recent correction. On the lower side, the supports are at 23,300, followed by the 23,000-23,900 zone. Any dips towards the support levels should be viewed as buying opportunities.

Traders are advised to look for stock-specific opportunities and trade with a positive bias.

Here are 15 data points to help you identify profitable trades.

Key Levels for the Nifty 50:

Supports based on pivot points: 23,186.93, 23,114.67, and 22,929.92

Resistances based on pivot points: 23,371.68, 23,484.17, and 23,668.92

Special Formation: On the weekly chart, the Nifty index has formed a "Doji" candlestick pattern, indicating indecisiveness among market participants.

Key Levels for the Bank Nifty:

Resistances based on pivot points: 50,148.32, 50,515.73, and 51,145.93

Supports based on pivot points: 49,518.12, 49,255.33, and 48,625.13

Special Formation: The broader trend for the Bank Nifty is positive as it has been forming a ‘Higher Top Higher Bottom’ structure. The immediate support for the index is placed around 49,500, followed by the 40-day EMA support around 49,200. On the higher side, 50,300 is the resistance level. If surpassed, the index could rally towards the previous high of 51,000-51,200 in the near term.

Also read: Trading Plan: Will Nifty and Bank Nifty breakout of consolidation this week?

Nifty Call Options Data: According to weekly options data, the 23,500 strike (with 83 lakh combined OI) had the maximum Call open interest, acting as a key resistance level for the Nifty in the short term. This was followed by the 23,800 strike (41 lakh combined OI).

Nifty Put Options Data: On the Put side, the maximum open interest was at the 23,000 strike (with 1.04 crore combined OI), acting as a key support level for the Nifty. This was followed by the 23,300 strike with 61 lakh combined OI.

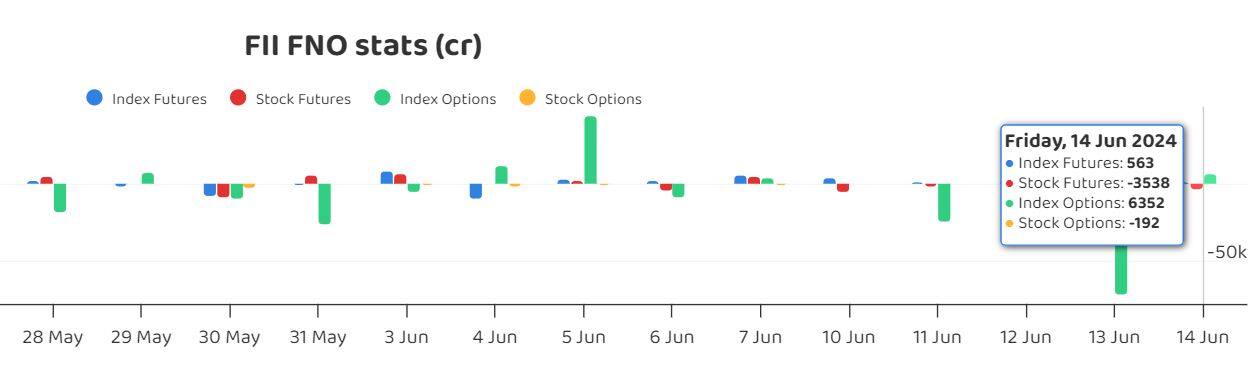

FII Funds Flow (Rs crore):

Put-Call Ratio: The Nifty Put-Call ratio (PCR), indicating market sentiment, improved significantly to 1.3 compared to 1.02 on June 11. An increasing PCR above 0.7 or surpassing 1 generally indicates bullish sentiment, while a ratio below 0.7 or moving towards 0.5 indicates a bearish mood.

Nifty Max Pain Point: The Nifty max pain point has moved higher to 23,300.

India VIX: Volatility continues to decrease as VIX - the fear index - continues to see a decline, closing 4.93% lower on an intraday basis on Friday to settle at 12.82.

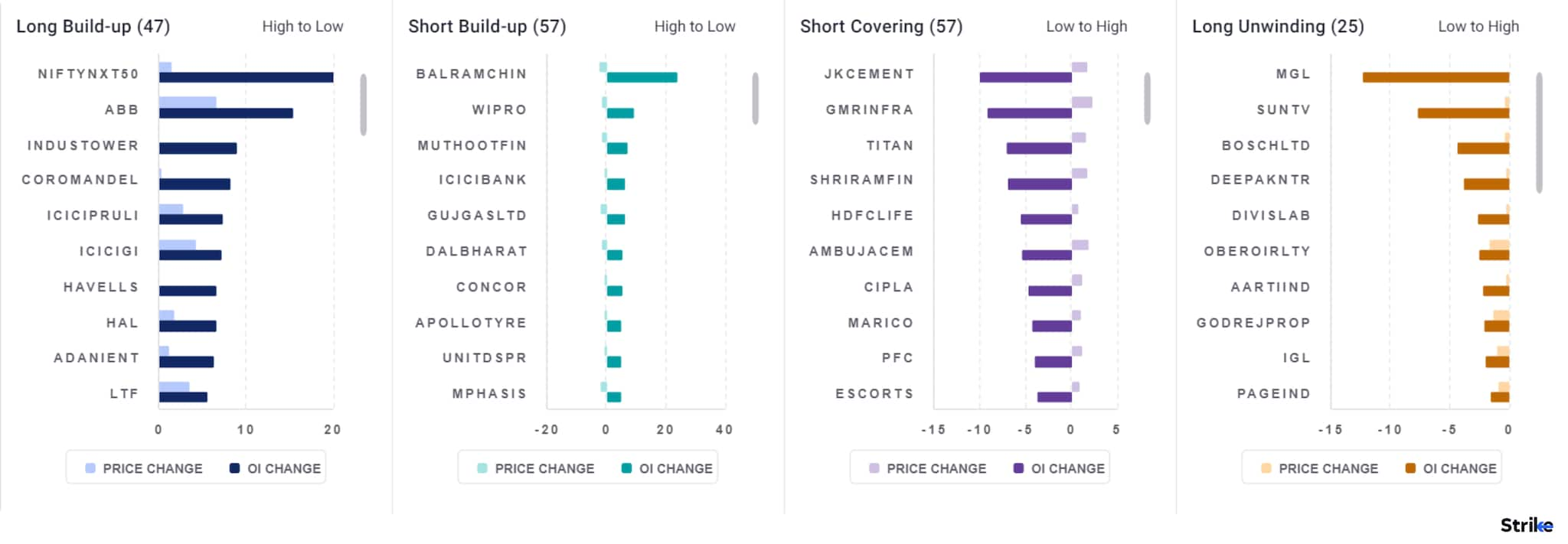

Long Build-up (47 Stocks): A long build-up was seen in 47 stocks, indicated by an increase in open interest (OI) and price.

Long Unwinding (25 Stocks): 25 stocks saw a decline in open interest (OI) along with a fall in price, indicating long unwinding.

Short Build-up (57 Stocks): 57 stocks saw an increase in OI along with a fall in price, indicating a build-up of short positions.

Short-Covering (57 Stocks): 57 stocks saw short-covering, indicated by a decrease in OI along with a price increase.

Stocks Under F&O Ban: Securities banned under the F&O segment include companies where derivative contracts cross 95 percent of the market-wide position limit.

Stocks in F&O Ban: HindCopper, Sun TV, GMR Infra, India Cement, Balrampur Chini, and SAIL.

Stocks added to F&O Ban list: Sun TV

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before making any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.