A volatile day on markets but bears pushed the index towards its crucial support level of 10,700 on Tuesday, and a slip below 10,700-10650 in Wednesday’s sessions could further weigh on the markets.

The index formed a bearish belt hold kind of pattern after an inverted candle which suggests that momentum is lacking. Although the index is trading well above its crucial short-term moving averages, traders should avoid creating aggressive long positions on dips.

The Nifty50 slipped on the back of profit booking losing marginal percentage though it closed above its crucial psychological support level of 10700. A bearish momentum was seen due to profit booking across indices from Nifty bank to Smallcap and mid-cap as well.

“The Nifty made a bearish belt hold today post a shooting star pattern recorded on Monday, indicating a follow up selling momentum. A bearish belt hold is a bearish reversal pattern which is characterized by same open and high of the trading session,” Mustafa Nadeem, CEO, Epic Research told Moneycontrol.

“A bearish belt hold is a bearish reversal pattern which is characterized by same open and high of the trading session. In short term, the support which is important for bulls is 10590. This is a crucial support and a close below that will cause a deeper correction to 10400,” he said.

Nadeem is of the view that resistance for the Nifty is placed at 10770 - 10800 since there are multiple confluences of resistance along with 161% of the previous swing. “We remain cautiously optimistic only above 10750 on closing basis while we also suggest to trail stop-loss aggressively to 10600 mark in the case already in the trend,” he said.

We have collated the top fifteen data points to help you spot profitable trade:

Key Support & Resistance Level for Nifty:

The Nifty closed at 10,700.45, down 41 points on Tuesday. According to Pivot charts, the key support level is placed at 10,671, followed by 10,642. If the index starts to move higher, key resistance levels to watch out are 10,745 and 10,791.

Nifty Bank:

The Nifty Bank closed at 25,974.90, down 94 points. Important Pivot level, which will act as crucial support for the index, is placed at 25,892, followed by 25,809. On the upside, key resistance levels are placed at 26,096, followed by 26,219.

Nifty Bank ended down after making a fresh all-time high of 26,136 while it closed below 26k level on a weaker note. PSU banks, along with NBFCs ended lower in the session weighed down by a rise in yields.

“Banks are caught up in between surging yields (which entails MTM losses) and still tepid credit demand environment. So it’s a difficult time for deployment of funds,” Lalitabh Shrivastawa, AVP Research, Sharekhan told Moneycontrol.

“While the yield surge will impact most banks, in our view PSU banks with a large dependency on treasury profits and large corporate (for credit growth) will be more impacted,” he said.

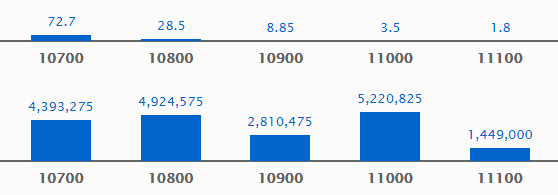

Call Options Data:

Maximum call open interest (OI) of 52.20 lakh contracts stands at strike price 11,000, which will act as a crucial resistance level for the index in the January series, followed by 10,800, which now holds 49 lakh contracts in open interest, and 10,700, which has accumulated 43 lakh contracts in OI.

Call writing was seen at a strike price of 11,000, which saw the addition of 4.2 lakh contracts, followed by 10,900, which saw the addition of 4.5 lakh contracts and 10,800, which saw the addition of 4.3 lakh contracts.

Call unwinding was seen at 10,600, which saw shedding of 2.2 lakh contracts, followed by 10,500 at 1.3 lakh contracts.

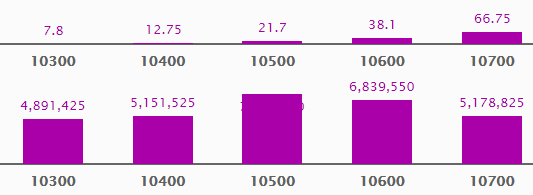

Put Options Data:

Maximum put OI of 75 lakh contracts was seen at strike price 10,500, which will act as a crucial base for the index in January series; followed by 10,600, which now holds 68 lakh contracts and 10,700 which has now accumulated 51 lakh contracts in open interest.

There was hardly any Put Writing but unwinding was seen at 10,500 which saw shedding of 7 lakh contracts in Open Interest, followed by 10,700 (sheds 4 lakh contracts), and 10,400 (sheds 3.7 lakh contracts).

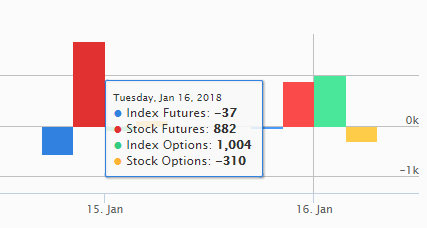

FII & DII Data:

FII & DII Data:

Foreign institutional investors (FIIs) bought shares worth Rs 693 crore, while domestic institutional investors sold shares worth Rs 246 crore in the Indian equity market, as per provisional data available on the NSE.

Fund Flow Picture:

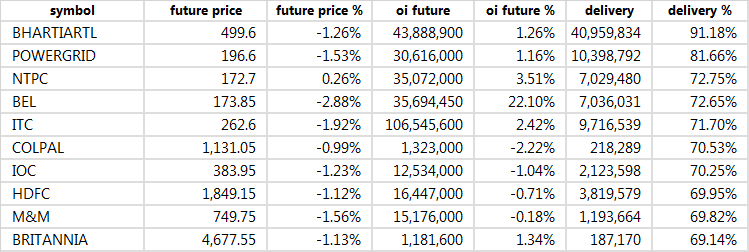

Stocks with high delivery percentage:

High delivery percentage suggests that investors are accepting the delivery of the stock, which means that investors are bullish on the stock.

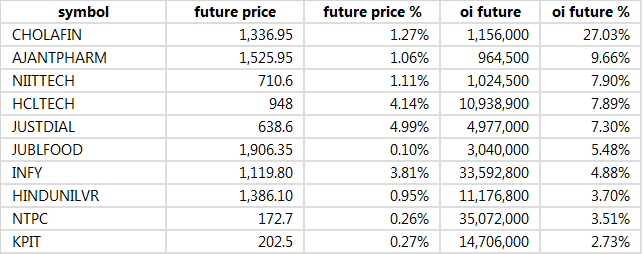

23 stocks saw long build-up:

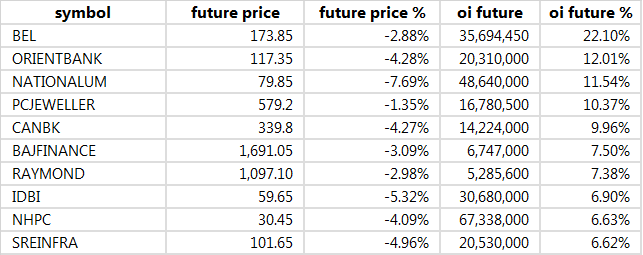

16 stocks saw short covering:

A decrease in open interest along with an increase in price mostly indicates short covering.

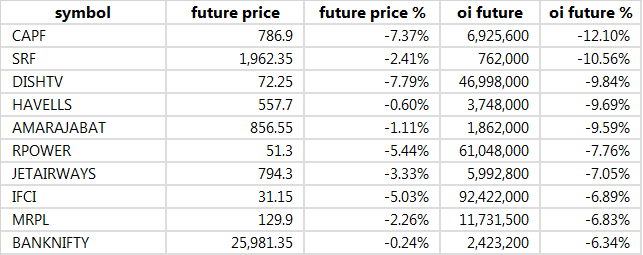

88 stocks saw short build-up:

An increase in open interest along with a decrease in price mostly indicates short positions being built up.

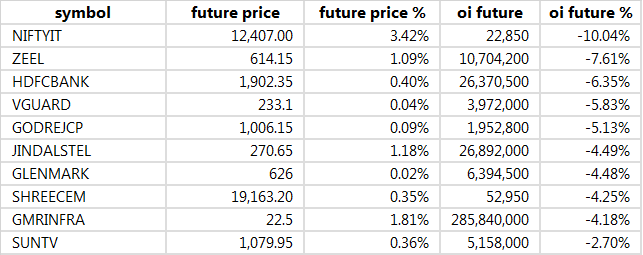

88 stocks saw long unwinding:

Long unwinding happens when there is a decrease in OI as well as in price.

Bulk Deals:

Bharti Airtel: SRS Partners (Cayman) LLC bought 3.8 crore shares at an average price of Rs499.10

Bharti Airtel: Merrill Lynch Markets Singapore PTE Ltd sold 3.8 crore shares at an average price of Rs499.10

Sybly Industries Ltd: KLB Securities Pvt Ltd sold 2.5 lakh shares at an average price of Rs7.85

(For more bulk deals click here: https://goo.gl/qrXHCH)

Analyst or Board Meet/Briefings:

Indowind Energy: A meeting of the board of directors of Indowind Energy Ltd will be held on January 17 for the approval to issue and allot up to 3 crore warrants convertible into equity shares of the company to promoters and non-promoters.

Stocks in news:

Sun Pharma: Sun Pharmaceutical Industries Ltd including its subsidiaries and/or associated companies) on Tuesday announced that its wholly-owned subsidiaries have reached an agreement with Ironwood Pharmaceuticals, Inc. and Allergan plc to resolve the patent litigation.

ICICI Lombard: Leading private general insurer ICICI Lombard today reported a 5.20 percent year-on-year increase in net profit at Rs 231.76 crore for the December quarter.

Reliance Nippon: Reliance Nippon Life Asset Management reported 25 percent jump in profit after tax to Rs 130 crore for the December quarter of the current fiscal.

GAIL India: Gas utility GAIL (India) Ltd has renegotiated the terms of a long-term liquefied natural gas (LNG) purchase deal with Russia’s Gazprom PJSC, the Indian company said on Tuesday, in third such negotiation by India to make the imported fuel affordable to its price-sensitive customers.

BSE Ltd: BSE Ltd on Tuesday said its board has approved a plan to buy back shares worth Rs166 crore, a move that comes within one year of its listing.

TCS: India’s largest IT services firm Tata Consultancy Services (TCS) on Tuesday said it has signed an over GBP 500 million ($690 million) deal with M&G Prudential, the UK and European savings and investments business of Prudential plc.

Bajaj Finance: Bajaj Finance today said it will acquire 12.60 percent stake in mobile wallet company Mobikwik as against 10.83 per cent stated earlier due to a change in the conversion price of the compulsory convertible cumulative preference shares.

Den Networks

The company had posted a net loss of Rs 38.75 crore during the same period of the previous fiscal, Den Networks said in a regulatory filing.

GAIL India has in the past renegotiated LNG deals with Qatar's RasGas and Exxon Mobil Corp, as spot prices declined substantially amid a supply glut.

Tata Motors

Jaguar Land Rover launches new of Range Rover Evoque priced at Rs 50.20 lakh. The vehicle is powered by a 2-litre Ingenium diesel engine. It has features such as WiFi hotspot, keyless entry and powered gesture tailgate as standard on all variants.

MCX

Q3 net profit down 45 pc to Rs 18.7 cr. The company had clocked a net profit of Rs 34.04 crore in the same quarter last year, the exchange said in a BSE filing.

Bayer Cropsciences

Bayer expects CCI nod by April-May for $66 billion Monsanto deal. India is one of the 30 countries whose approval is needed for the merger to go through. As many as 14 countries have approved the merger.

RIL

Reliance Industries has declared a 30 percent increase in the installed capacity of its export-focused oil refinery, a government report showed, increasing the size of the world's largest refinery complex.

15 stocks under ban period on NSE

Security in ban period for the next trade date under the F&O segment includes companies in which the security has crossed 95 percent of the market-wide position limit.

Securities which are banned for trading include names such as Balrampur Chini, CAPF, Dish Tv, Fortis Healthcare, HCC, IFCI, India Cements, Jet Airways, Jindal Steel, JP Associates, Jain Irrigation Systems Ltd, Kaveri Seeds, Reliance Comm, Reliance Power, and Wockhardt.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.