Healthy buying in most sectors helped the market benchmarks, the Sensex and the Nifty, extend their gains into the second consecutive session on August 24.

The Sensex jumped 403 points, or 0.73 percent, to settle at 55,958.98 while the Nifty ended the day with a gain of 128 points, or 0.78 percent, at 16,624.60.

Broader markets outperformed the benchmarks. The BSE Midcap index closed with a gain of 1.52 percent while the smallcap index jumped 1.69 percent.

Nifty formed a bullish candle on the daily scale with a long lower shadow which indicates that declines are being bought.

"We can now expect the index to extend the move towards lifetime high territory of 16,700-16,750, while on the downside, support is at 16,500 -16,380 levels," said Siddhartha Khemka, Head - Retail Research, Motilal Oswal Financial Services.

We have collated 15 data points to help you spot profitable trades:Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels for the NiftyAccording to pivot charts, the key support levels for the Nifty are placed at 16,530.9, followed by 16,437.2. If the index moves up, the key resistance levels to watch out for are 16,682.7 and 16,740.8.

Nifty BankThe Nifty Bank surged 588 points, or 1.67 percent, to 35,712.10 on August 24. The important pivot level, which will act as crucial support for the index, is placed at 35,256.3, followed by 34,800.5. On the upside, key resistance levels are placed at 35,981.6 and 36,251.1 levels.

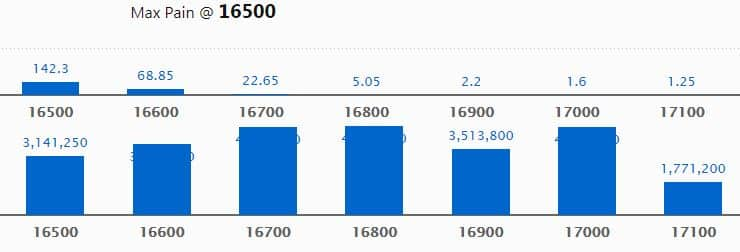

Maximum Call open interest of 47.41 lakh contracts was seen at 16,800 strike, which will act as a crucial resistance level in the August series.

This is followed by 17,000 strike, which holds 46.9 lakh contracts, and 16,700 strike, which has accumulated 46.7 lakh contracts.

Call writing was seen at 16,800 strike, which added 7.93 lakh contracts, followed by 16,900 strike, which added 3.39 lakh contracts and 17,000 strike which added 1.07 lakh contracts.

Call unwinding was seen at 16,500 strike, which shed a whopping 21.6 lakh contracts, followed by 16,600 strike which shed 16.9 lakh contracts, and 16,400 strike which shed 5.98 lakh contracts.

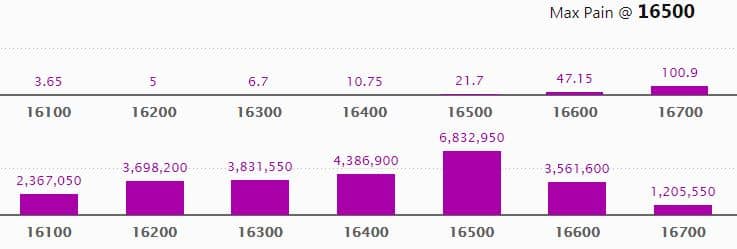

Maximum Put open interest of 68.33 lakh contracts was seen at 16,500 strike, which will act as a crucial support level in the August series.

This is followed by 16,400 strike, which holds 43.87 lakh contracts, and 16,300 strike, which has accumulated 38.32 lakh contracts.

Put writing was seen at 16,600 strike, which added 25.96 lakh contracts, followed by 16,500 strike which added 24.22 lakh contracts, and 16,400 strike which added 5.57 lakh contracts.

Put unwinding was seen at 16,900 strike, which shed 1.5 lakh contracts, followed by 16,100 strike which shed 1.31 lakh contracts.

A high delivery percentage suggests that investors are showing interest in these stocks.

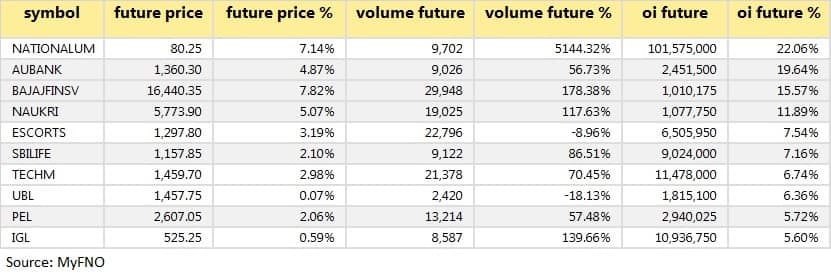

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions.

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the 10 stocks in which short-covering was seen.

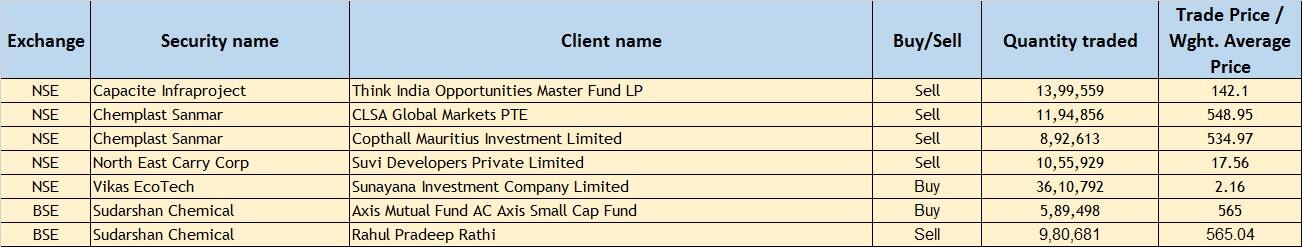

(For more bulk deals, click here)

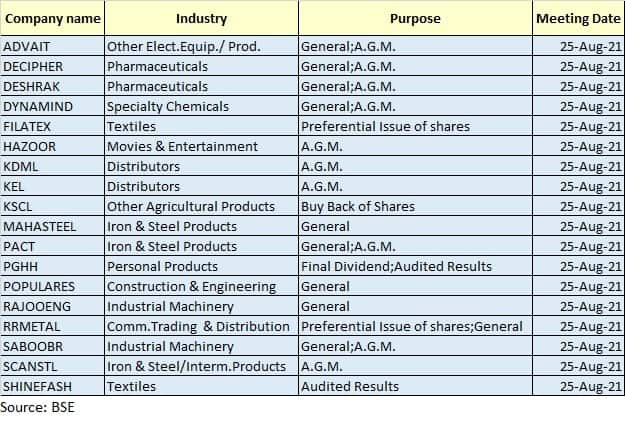

Board meetings

Wipro: The company has been awarded a strategic multi-year contract to partner with E.ON in its digital transformation journey in the financial area. Besides, it said it will open a new delivery centre in Sherwood, Arkansas.

Tata Steel: Brickwork Ratings upgrades the ratings for the unsecured Non-Convertible Debentures/Bond Issues aggregating Rs 4,000 crore of the company from BWR AA/Stable to BWR AA+/Stable.

Dollar Industries: CARE Ratings revised the credit rating from CARE A+; Positive to CARE A+; Positive for long-term facilities and reaffirn1ed the existing credit rating CARE A1+ for short-term facilities/Commercial Paper issue.

IndusInd Bank: India Ratings assigns the bank’s Tier II Bonds rating at ‘IND AA+’/Stable.

CreditAccess Grameen: The company board approved the issuance of non-convertible debentures aggregating up to Rs 100 crore.

Sterling Tools: ICRA has reaffirmed the long-term as well as short-term credit ratings of the company.

Brigade Enterprises: CRISIL Ratings has upgraded the long-term rating for the credit limits of the company from banks to CRISIL A+/stable from CRISIL A/stable.

Fund flow

Foreign institutional investors (FIIs) net sold shares worth Rs 1,644.91 crore, while domestic institutional investors (DIIs) net bought shares worth Rs 2,380.05 crore in the Indian equity market on August 24, as per provisional data available on the NSE.

Stocks under F&O ban on NSEFour stocks - Canara Bank, Vodafone Idea, NMDC and SAIL - are under the F&O ban for August 25. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!