The Indian equity benchmarks ended in the green, tracking positive global cues, on August 24.

The 30-share Sensex closed 364 points, or 0.95 percent, higher at 38,799.08 and the Nifty settled at 11,466.45, up 95 points, or 0.83 percent.

As per Siddhartha Khemka, Head - Retail Research, Motilal Oswal Financial Services, global cues were positive after US regulators authorised the use of blood plasma from recovered patients as a treatment option.

"On the domestic front, favourable government policies continue to push markets higher, especially midcaps and smallcaps. Chemical stocks were in action after the government imposed anti-dumping duty of $137 per tonne on phosphoric acid import from Korea for five years," Khemka said.

Going forward, he expects the positive momentum in the market to continue in the near term driven by positive news flows around the vaccine development and favourable policies. However, he does not rule out intermittent profit-booking given the tepid economic data and lofty valuations. "Technically, the Nifty may advance towards 11,600 while support exists at 11,200," he added.

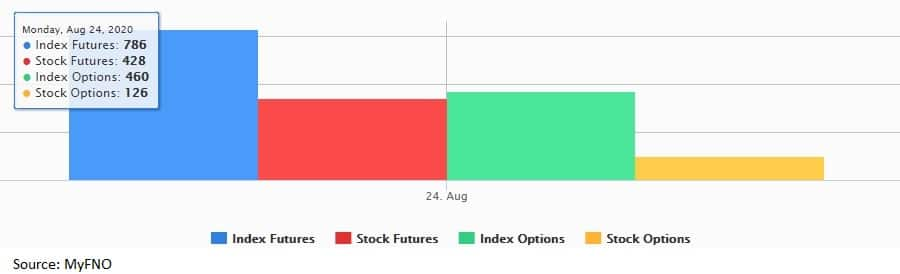

We have collated 14 data points to help you spot profitable trades:Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty According to pivot charts, the key support level for the Nifty is placed at 11,419.07, followed by 11,371.63. If the index moves up, the key resistance levels to watch out for are 11,505.57 and 11,544.63.

Nifty Bank The Bank Nifty outperformed the Nifty, closing 2.39 percent higher at 22,833. The important pivot level, which will act as crucial support for the index, is placed at 22,529.57, followed by 22,226.13. On the upside, key resistance levels are placed at 23,016.97 and 23,200.93.

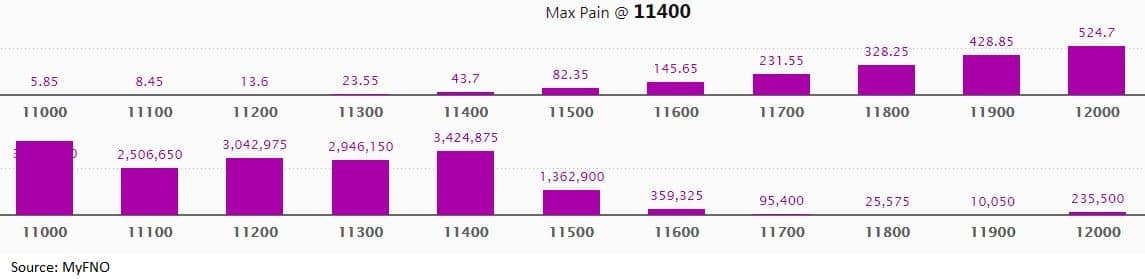

Call option data Maximum Call open interest of 36.17 lakh contracts was seen at 11,500 strike, which will act as crucial resistance in the August series.

This is followed by 11,600, which holds 29.30 lakh contracts, and 11,700 strikes, which has accumulated 28.19 lakh contracts.

Call writing was seen at 11,800, which added 3.4 lakh contracts, followed by 11,600, which added 2.28 lakh contracts, and 11,700 strikes, which added nearly 2 lakh contracts.

Call unwinding was seen at 11,400, which shed 4.9 lakh contracts, followed by 11,900 strikes, which shed 3.8 lakh contracts.

Put option data Maximum Put open interest of 39.33 lakh contracts was seen at 11,000 strikes, which will act as crucial support in the August series.

This is followed by 11,400, which holds 34.25 lakh contracts, and 11,200 strikes, which has accumulated 30.43 lakh contracts.

Put writing was seen at 11,400, which added 17.53 lakh contracts, followed by 11,500, which added 6.78 lakh contracts, and 11,100 strikes, which added 6.74 lakh contracts.

Put unwinding was witnessed at 12,000, which shed 18,825 contracts.

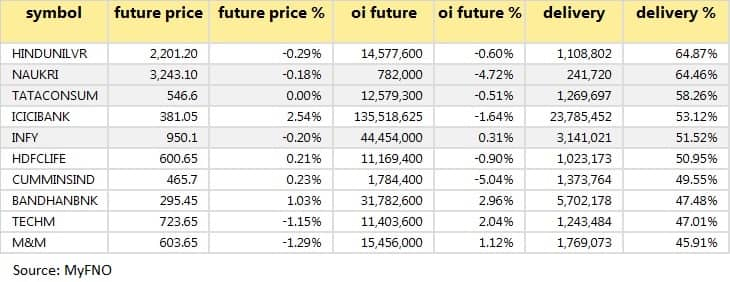

Stocks with a high delivery percentage A high delivery percentage suggests that investors are showing interest in these stocks.

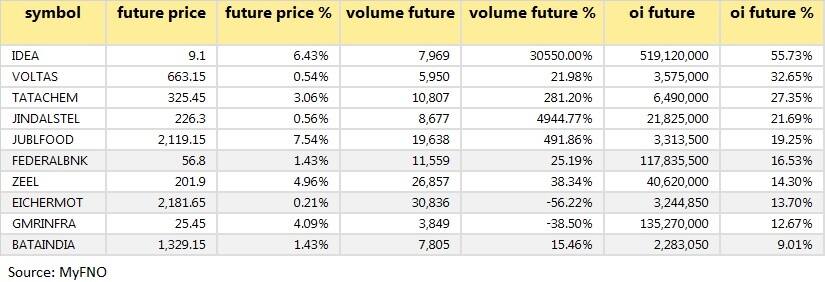

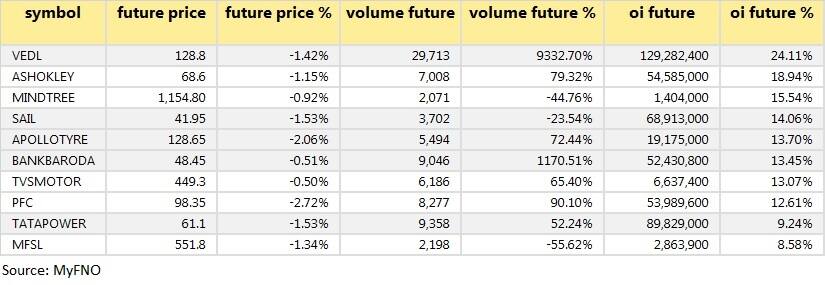

38 stocks saw long build-up Based on the open interest future percentage, here are the top 10 stocks in which long build-up was seen.

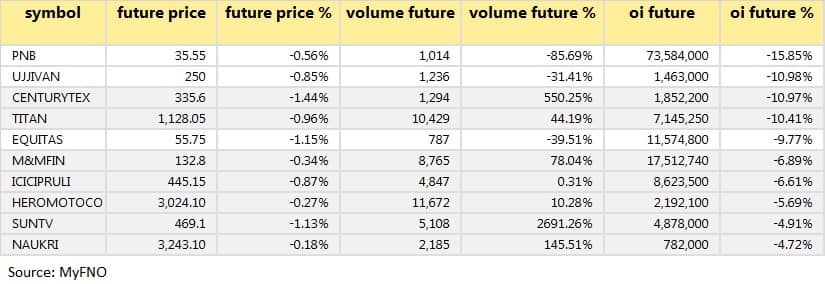

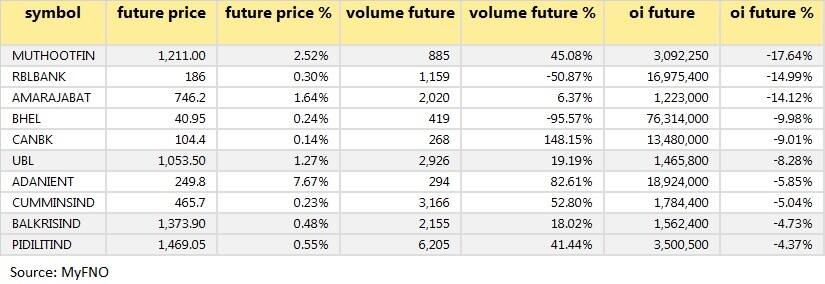

35 stocks saw long unwinding Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

36 stocks saw short build-up An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which short build-up was seen.

29 stocks witnessed short-covering A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

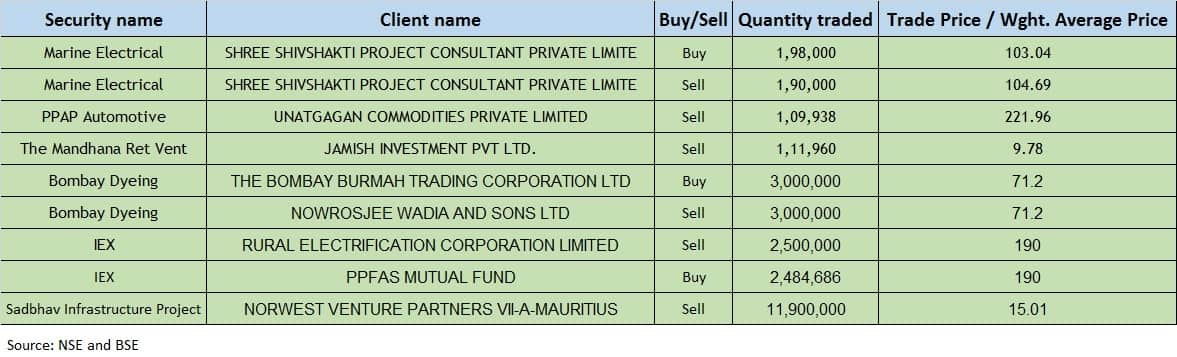

Bulk deals  (For more bulk deals, click here)

(For more bulk deals, click here)

Results on August 25 Atul Auto, Can Fin Homes, IRCON International, Jyoti Resins and Adhesives, Kirloskar Electric Company, Phillips Carbon Black, Ruchira Papers, Panache Innovations, Goodluck India, Hindustan Hardy Spicer, etc.

Stocks in the news Axis Bank:The lender proposed to acquire 17 percent share of Max Life, resulting in total ownership of 18 percent post the transaction.

Jet Airways announced the 14th meeting of Committee of Creditors (CoC) is scheduled to be held on August 25.

Wipro announced a partnership with a standard initial margin model (SIMM) vendor, Quaternion Risk Management to offer SIMM-in-a-box to financial institutions covered under uncleared margin rules (UMR).

IRB Infrastructure Developers:Q1 loss at Rs 30.14 crore against a profit of Rs 206.62 crore YoY. Revenue from operations at Rs 1,022.3 crore against Rs 1,773.04 crore YoY.

NOCIL: Consolidated Q1 FY21 PAT at Rs 11.95 crore against Rs 32.88 crore YoY. Revenue from operations at Rs 106.51 crore against Rs 229.59 crore YoY.

JSW Energy:Executive Director and CFO Jyoti Kumar Agarwal has tendered his resignation.

Fund flow

FII and DII data Foreign institutional investors (FIIs) net bought shares worth Rs 219.07 crore, whereas domestic institutional investors (DIIs) sold shares worth Rs 335.64 crore in the Indian equity market on August 24, as per provisional data available on the NSE.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!