The Indian market scaled new peaks in the week ended January 17 with Sensex climbing Mount 42k for the first time. Optimism over the upcoming Budget on February 1 and the ongoing Q3 earnings season helped bulls maintain their hold on the D-Street.

The rally finally seems to be getting broad-based as Nifty Midcap and Smallcap indices managed to outperform the frontliners. Both indices logged 4 percent gains in the week gone by, compared to the BSE Sensex and Nifty50 which gained 0.8 percent each.

"Markets will witness higher volatility but in terms of price, they might just move higher before the Budget," said Jimeet Modi, Founder & CEO, SAMCO Securities & StockNote told Moneycontrol.

Experts are expecting the positive momentum to continue in the upcoming week, though some correction could be in the offing given the premium valuations. Stock-specific activity will guide the market as we get deeper into the earnings season, they added.

According to Santosh Meena, Senior Analyst at TradingBells, midcap and smallcap spaces are likely to continue their outperformance where a sector-specific move can be seen on pre-Budget news flows.

We have collated 15 data points to help you spot profitable trades:

Key support and resistance level for Nifty

According to the pivot charts, the key support level for Nifty is placed at 12,320.63, followed by 12,288.97. If the index moves up, key resistance levels to watch out for are 12,384.73 and 12,417.17.

Nifty Bank

The Nifty Bank ended 0.83 percent lower at 31,590.65. The important pivot level, which will act as crucial support for the index, is placed at 31,432.93 followed by 31,275.17. On the upside, key resistance levels are placed at 31,761.03 and 31,931.37.

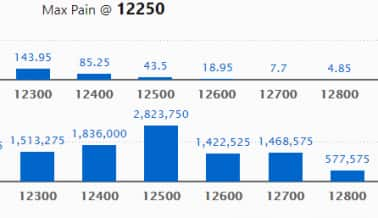

Call options data

Maximum call open interest (OI) of 28.23 lakh contracts was seen at 12,500 strike price. It will act as a crucial resistance level in the January series.

This is followed by 12,400 strike price, which holds 18.36 lakh contracts in open interest, and 12,300, which has accumulated 15.13 lakh contracts in open interest.

Significant call writing was seen at the 12,700 strike price, which added 1.51 lakh contracts. Call unwinding was witnessed at 12,500 strike price, which shed 2.14 lakh contracts, followed by 12,600 strike, which shed 0.99 lakh contracts.

Put options data

Maximum put open interest of 37.13 lakh contracts was seen at 12,000 strike price, which will act as crucial support in the January series.

This is followed by 12,200 strike price, which holds 25.97 lakh contracts in open interest, and 12,300 strike price, which has accumulated 18.76 lakh contracts in open interest.

Put writing was seen at the 12,300 strike price, which added 2.15 lakh contracts, followed by 12,400 strike which added 1,52 lakh contracts. Put unwinding was seen at 12,000 strike price, which shed 4.94 lakh contracts, followed by 11,900 strike which shed 2.72 lakh contracts.

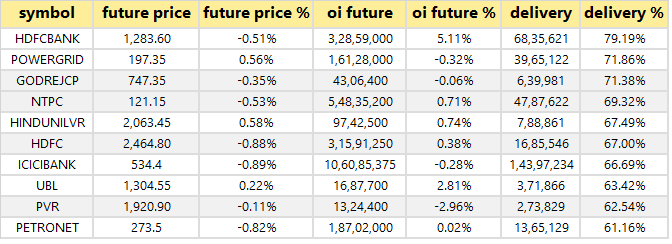

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

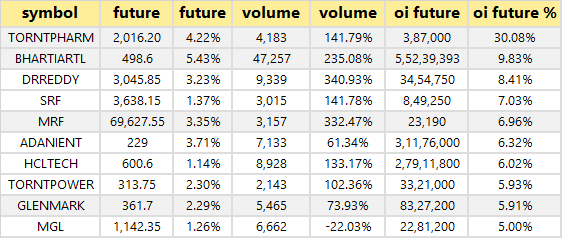

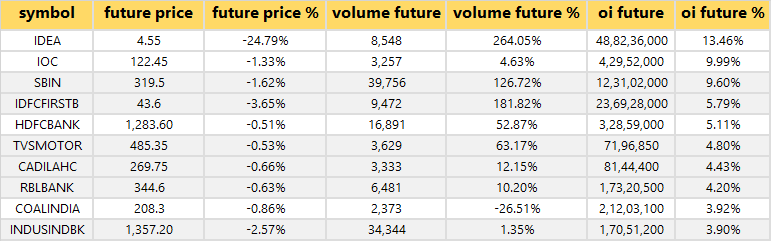

41 stocks saw long build-up

Based on open interest (OI) future percentage, here are the top 10 stocks in which long build-up was seen.

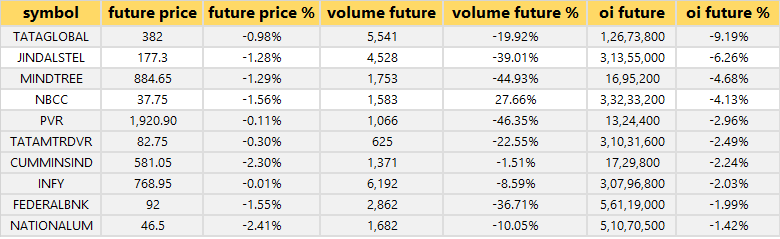

28 stocks saw long unwinding

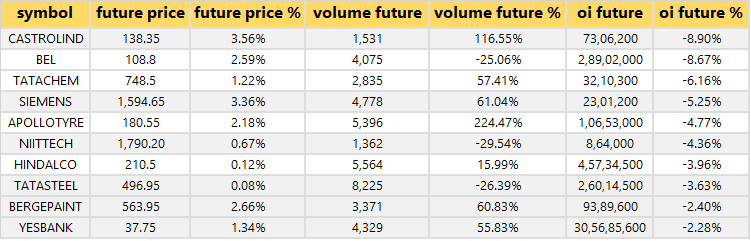

39 stocks saw short build-up

39 stocks witnessed short-covering

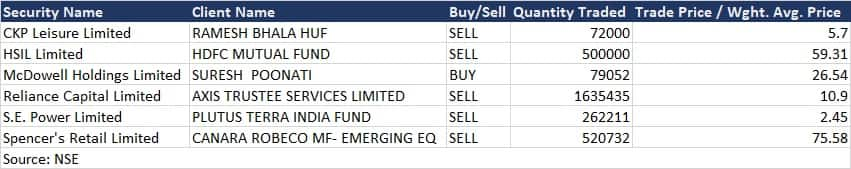

Bulk deals

(For more bulk deals, click here)

Upcoming analyst or board meetings/briefings

Indian Bank: To consider and approve the financial results for the period ended December 31, 2019.

APL Apollo: To consider and approve the financial results for the period ended December 31, 2019.

ITI Limited: A meeting of the Board to be held on January 22, 2020, to consider and approve the price band for equity shares to be allotted.

Lloyds Steel: To consider and approve the financial results for the period ended December 31, 2019.

Stocks in news

Results: Kotak Mahindra Bank, Can Fin Homes, Just Dial, KEI Industries, Federal Bank, Monnet Ispat & Energy, Hindustan Zinc, HFCL, ICICI Securities, Bank of Maharashtra

Reliance Industries: The company reported the highest-ever quarterly consolidated net profit of Rs 11,640 crore for Q3FY20 against a CNBC-TV18 poll of Rs 11,333 crore. Its net profit jumped 13.5 percent year-on-year (YoY) against Rs 10,251 crore reported in the corresponding quarter of the previous financial year.

HDFC Bank Q3: Profit jumped 33 percent, but asset quality weakened and provisions spiked. Profit during the quarter increased to Rs 7,416.5 crore, from Rs 5,585.85 crore in the same period last year. Net interest income grew by 12.7 percent to Rs 14,172.9 crore compared to year-ago.

TCS: Tata Consultancy Services reported tepid growth numbers for the December quarter. Its net profit was at Rs 8,118 crore, up 0.2 percent year-on-year (YoY) against Rs 8,105 crore reported in the corresponding quarter of the previous financial year.

IndusInd Bank: Bank registered a 32 percent growth in Q3FY20 profit and 34.3 percent growth in net interest income compared to the same quarter last year. Asset quality was also stable with gross non-performing assets (NPA) in Q3 falling 1bps to 2.18 percent and net NPA declining 7bps to 1.05 percent QoQ.

Lupin: Lupin received five observations from the US health regulator after inspection of its Vizag facility in Andhra Pradesh. The inspection of company's Vizag API manufacturing facility by the United States Food and Drug Administration (USFDA) has been completed, Lupin said in a filing to BSE.

Chennai Petro Q3 : Consolidated net profit at Rs 11.29 crore against loss of Rs 213.6 crore QoQ. Consolidated revenue went down 1 percent at Rs 9,146.7 crore against Rs 9,237.7 crore QoQ.

PNC Infra: The company bagged order worth Rs 639 crore from NHAI.

GMR Airports: The company won a contract for duty-free shops at Kannur international airport in Kerala.

Cyient: The company's third-quarter profit grew by 10.4 percent sequentially to Rs 107.6 crore on revenue of Rs 1,105.9 crore. Rupee revenue fell 4.6 percent compared to Rs 1,158.9 crore in the September quarter, while dollar revenue declined 5.5 percent quarter-on-quarter (QoQ) to $155.2 million in the quarter ended December 2019.

L&T Finance Holdings: The company reported a marginal 1.8 percent rise in consolidated net profit to Rs 591.47 crore during the third quarter ended on December 31, 2019. Net profit in the year-ago period stood at Rs 580.96 crore.

PFC: Power Finance Corporation raised $750 million through the issuance of overseas bonds to fund business expansion plans.

Blue Dart Express: The company reported a consolidated net loss of Rs 31.92 crore for the quarter ended December on 31, 2019.

L&T Technology: L&T Technology Services posted a 10 percent rise in consolidated net profit at Rs 204 crore during the quarter ended December 31, 2019, mainly on account of business growth in North America.

ICICI Lombard: ICICI Lombard General Insurance posted a 23 percent year-on-year (YoY) rise in its December quarter net profit at Rs 294.11 crore.

HCL Technologies: HCL Technologies reported a 16 percent year-on-year (YoY) and 14.6 percent quarter-on-quarter (QoQ) rise in its net income at Rs 3,037 crore for the quarter ended December 2019.

FII and DII data

Foreign institutional investors (FIIs) bought shares worth Rs 264.26 crore, while domestic institutional investors (DIIs) sold shares of worth Rs 500.17 crore in the Indian equity market on January 17, provisional data available on the NSE showed.

Fund flow

Stock under F&O ban on NSE

Yes Bank is under the F&O ban for January 20. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclosure: Reliance Industries Ltd. is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.