The S&P BSE Small and Midcap indices hogged limelight so far in the year 2017 with plenty of stocks registering gains of over 100 percent. However, stock selection under this theme remains the key for generation consistent wealth creation.

Mutual fund manager increased their exposure in some of the beaten down stocks while added more positions in stocks which have already given a stellar performance so far in the year 2017.

Mutual Fund managers added AU Small Finance bank, the recently listed IPO in their portfolio. The other stocks which grabbed fund managers attention were KPIT Technologies which negative returns so far in the year.

Other stocks which grabbed fund managers attention include names like Indiabulls Real Estate which rose 232 percent, followed by Escorts which gained 109 percent, and Reliance Capital rose 84 percent so far in the year 2017, according to data provided by Morningstar India.

“A large number of mid and small cap stocks have seen stellar moves. But sustainable stock price appreciation has happened only for companies which have delivered profit growth and earnings visibility,” Sahil Kapoor, Chief Market Strategist, Edelweiss Broking told Moneycontrol.

“Over the last 3 years, we analysed a basket of 1600 stocks and found market cap gains of 55 percent on an average for stocks which have seen profitability growth of more than 50 percent over this period. This is in comparison to stocks which have seen an erosion of 20 percent in the cumulative market cap where profits have fallen more than 50 percent on average,” he said.

The S&P BSE Smallcap index rose 31 percent followed by the S&P BSE Midcap index which rose 28 percent so far in the year 2017 compared to 19 percent return recorded by the S&P BSE Sensex.

One of the major contributors to the rally in the broader market is the steady flow of liquidity by mutual funds. Investments in MF’s have seen a robust growth of 22-28 percent per annum.

According to industry leader AMFI, the Average Assets under Management (AAUM) in the country at the end of July 2017 was at Rs20.42 lakh crores while Assets under Management (AUM) were placed at Rs19.97 lakh crores.

However, if investors plan to invest in small and midcap stocks via direct equity they should avoid penny stocks and basic research is a must. Because most stocks which have given stellar returns which now appear attractive could be suffering from poor liquidity and fundamentals.

“Small cap stops have poor liquidity and high promoter’s holding. Hence the same should be invested with caution. Further investment is on the case to case basis,” Vijay Singhania, Founder-Director, Trade Smart Online told Moneycontrol.

“In general the valuations of all Midcap and small stocks are very high and perhaps it is not the right time to invest in such stocks,” he said.

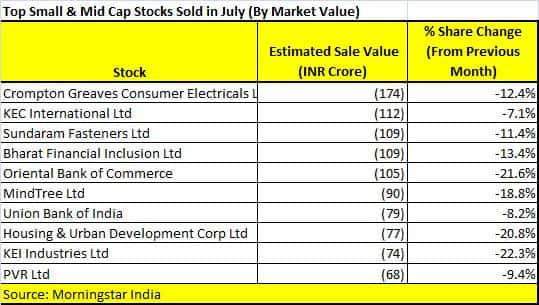

Top stocks which fund managers sold during the month of July in the small and midcap space include names like Crompton Greaves, KEC International, Sundaram Fasteners, Bharat Financial, OBC, MindTree, Union bank of India, HUDCO, KEI Industries and PVR, according to data provided by Morningstar India.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.