Bengaluru-based Smallcase Technologies is paving the way for modern investors allowing them to choose from professionally-tailored baskets of stocks that reflect an investing idea or strategy.

Currently, nine are offering this platform. They include Kotak Securities, HDFC Securities, 5paisa, Edelweiss, IIFL Securities, Zerodha, Axis Securities, Alice Blue and Trustline.

Moneycontrol has also collaborated with smallcase Technologies.

Take a look at some of the best performing smallcases of the last one month:

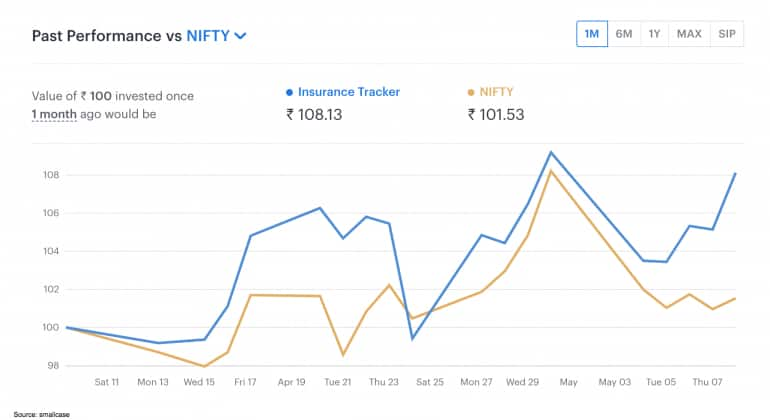

Insurance Tracker

The insurance sector is highly underpenetrated in India. According to an India Brand Equity Foundation (IBEF) report, the sector contributed to less than 4 percent of the gross domestic product in 2017 compared to the 2015 global average of 6.2 percent.

However, with India's burgeoning middle class, progressively young population and increasing awareness about financial well-being, experts estimate the market share could grow four-fold in the next 10 years from the current market size of $60 billion.

The sector has also attracted major interest from foreign institutional investors. Foreign investors have been net buyers in the insurance sectors in every month of the last financial year and have poured in Rs 833 crore till March 31 this year.

This smallcase comprises listed insurance companies to allow investors to efficiently track and invest in the insurance sector.

On a one month basis (April 9-May 8), the smallcase has returned 8.13 percent compared to Nifty50's 1.53 percent.

Some of the major stocks in the smallcase are ICICI Prudential Life Insurance Company, ICICI Lombard General Insurance Company, SBI Life Insurance Company among others. As on May 10, the minimum amount required to invest in this smallcase is Rs 7,051.

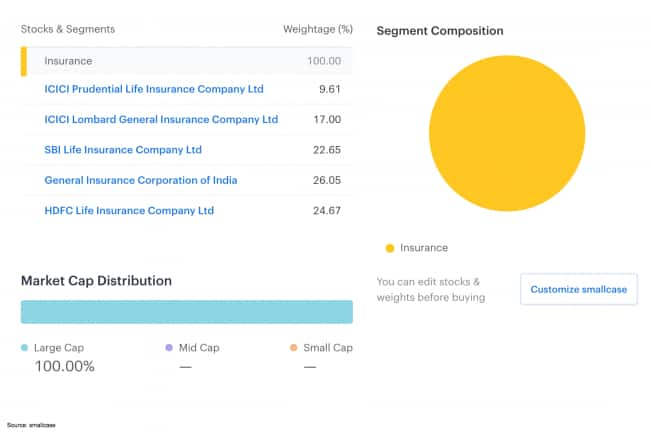

Sustainable Earnings

Often, investors tend to ignore consistent performers in favour of multi-baggers. While these stocks may show supernormal growth in the short-term, more often than not, these multi-baggers fail the litmus test of time.

On the other hand, companies with strong fundamentals and sound businesses generally beat the market ruse to emerge as wealth creators in the long run.

Also Read: Explainer | What is smallcase and how to invest using the platform?

This smallcase consists of companies that have been recording higher sales and earnings. Additionally, only the companies experiencing increasing cash flows and available at low valuations compared to their peers are included in this smallcase.

On a one-month basis (April 9-May 8), the smallcase has returned 7.9 percent.

Some of the major stocks in the smallcase are Bharat Electronics, Gujarat Alkalies And Chemicals, JB Chemicals and Pharmaceuticals among others. As on May 10, the minimum amount required to invest in this smallcase is Rs 3,248.

IT

IT

IT Tracker

In 2016-17, the global IT & ITeS market was estimated to be around $1.2 trillion. Meanwhile, the global sourcing market reached $173-178 billion. India is the leading sourcing destination across the world with a market share of approximately 55 percent.

Indian IT & ITeS companies have set up over 1,000 global delivery centres in over 200 cities around the world. The internet industry in India is likely to double to reach $250 billion by 2020, growing to 7.5 percent of the GDP.

This smallcase comprises IT & ITeS and online services companies to allow investors to efficiently track and invest in the information technology sector.

On a one-month basis (April 9-May 8), the smallcase has returned 7.16 percent compared to Nifty100's 1.36 percent.

![]()

Some of the major stocks in the smallcase are HCL Technologies, Hexaware Technologies, Infosys, among others. As on May 10, the minimum amount required to invest in this smallcase is Rs 32,980.

![]()

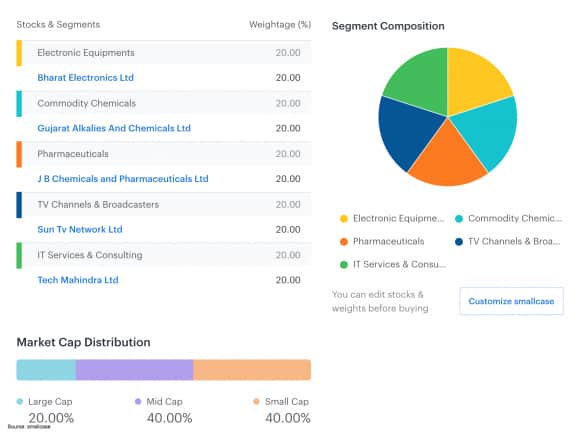

Growth & Income - Mid-Cap Version

This smallcap is based on the investment criterion set out by Kevin Matras, a US-based investment expert, in his book 'Finding #1 Stocks: Screening, Backtesting and Time-Proven Strategies'.

This smallcase selects companies having better ROE and earnings growth compared to their respective sector averages. For better suitability, all the criteria have been adapted for the Indian markets.

Also Read: We want to make investing as easy as booking a cab, says founder of smallcase

To filter poor corporate governance, this smallcase uses the P/OCF (price to operating cash flow) ratio instead of PE (price to earnings) ratio. Additionally, it only selects companies experiencing positive dividend growth.

This is a Midcap version of smallcase. Check the standard version here.

On a one month basis (April 9-May 8), the smallcase has returned 5.89 percent compared to Nifty Midcap's 2.42 percent.

Some of the major stocks in the smallcase are Alembic Pharmaceuticals, CESC, Tata Power among others. As on May 10, the minimum amount required to invest in this smallcase is Rs 6,658.

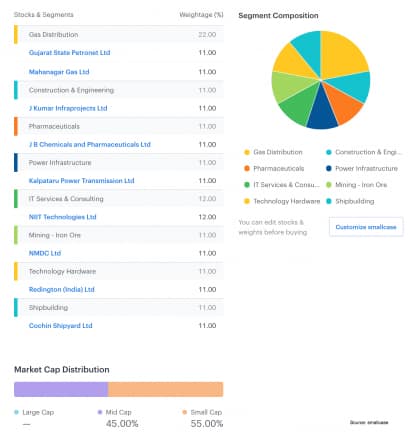

The Naked Trader

This smallcase is based on investment criteria set out by UK-based trader Robbie Burns in his book ‘The Naked Trader: How Anyone Can Make Money Trading Shares’. These criteria have been adapted to Indian stock market conditions to build this smallcase.

In a series of filters, the smallcase first checks the financial vigour of stocks by selecting ones whose revenues, earnings and dividend payouts have increased in the most recent financial year.

Next, the companies whose debt burdens are lower than their operating profits are selected. Low-debt companies pay low interest, which automatically boosts profitability. Such companies are relatively better off even during downturns such as the ones we are witnessing in the name of COVID-19.

In addition to this, the model also checks for ratios like PE, so that reasonably-priced stocks are selected.

On a one month basis (April 9-May 8), the smallcase has returned 5.07 percent compared to Nifty Smallcap 100's 2.31 percent.

Some of the major stocks in the smallcase are Gujarat State Petronet, Mahanagar Gas, J Kumar Infraprojects among others. As on May 10, the minimum amount required to invest in this smallcase is Rs 11,335.

The PE List

Private Equity (PE) is a source of funding with a long-term investment horizon, usually for private companies in the growth phase.

PE firms conduct extensive due diligence regarding the company’s business model, management team, industry dynamics, growth prospects, etc. before investing.

These firms usually become a part of the board and offer advice, support, introductions, etc. related to operations, strategy, and financial management of the company.

This combination of funding and expertise usually results in good growth prospects for the company receiving the funding.

This smallcase consists of stocks in which PE firms hold high stakes.

On a one month basis (April 9-May 8), the smallcase has returned 4.87 percent compared to Nifty Midcap's 2.42 percent.

Some of the major stocks in the smallcase are Capacite Infraprojects, Parag Milk Foods, IDFC First Bank among others. As on May 10, the minimum amount required to invest in this smallcase is Rs 12,041.

Metal Tracker

The metals and mining sector has benefitted greatly from the infra push in India. The automotive industry, power and cement industry has also aided the growth.

India currently produces around 88 minerals which mainly include 50 non-metallic, 24 minor, 10 metallic, 4 fuel and 3 atomic minerals.

India is the third-largest producer of coal and steel, fourth in terms of iron ore production and has the seventh-largest bauxite reserves.

This smallcase comprises aluminium, copper, manganese, iron & steel and diversified companies to allow investors to efficiently track and invest in the metals and mining sector.

On a one month basis (April 9-May 8), the smallcase has returned 4.61 percent compared to Nifty Multicap's 1.48 percent.

![]()

Some of the major stocks in the smallcase are Hindustan Zinc, Hindalco Industries, National Aluminium Company among others. As on May 10, the minimum amount required to invest in this smallcase is Rs 3,202.

![]()

Auto Tracker

Despite its recent troubles, the auto industry continues to be a stronghold for the India Inc, contributing to about 7.1 percent of the country's GDP.

The sector is estimated to grow at around 10-15 percent to reach $16.5 billion by 2021 from around $7 billion in 2016.

This smallcase comprises automobiles, auto parts, batteries and tyre companies to allow investors to efficiently track and invest in the automobile sector.

On a one month basis (April 9-May 8), the smallcase has returned 4.12 percent compared to Nifty Midcap's 2.42 percent.

![]()

Some of the major stocks in the smallcase are Apollo Tyres, Hero MotoCorp, Sundram Fasteners among others. As on May 10, the minimum amount required to invest in this smallcase is Rs 16,216.

![]()

Pharma Tracker

Indian pharmaceutical sector is estimated to grow to $55 billion by 2020, thereby emerging as the sixth-largest pharmaceutical market globally by absolute size.

Branded generics dominate the pharmaceuticals market, constituting nearly 80 percent of the market share in terms of revenues. The sector’s revenues are expected to grow by 8 percent YoY through fiscal 2020.

Pharma sector is also expected to generate 58,000 additional job opportunities by 2025.

This smallcase comprises pharmaceutical and life sciences companies to allow investors to efficiently track and invest in the pharma sector.

On a one month basis (April 9-May 8), the smallcase has returned 4.02 percent compared to Nifty100's 1.36 percent.

![]()

Some of the major stocks in the smallcase are Alembic Pharmaceuticals, Alkem Laboratories, Divi's Laboratories among others. As on May 10, the minimum amount required to invest in this smallcase is Rs 19,046.

![]()

CANSLIM-esque

CANSLIM is an investment model from American stockbroker and investor William O’Neil.

The model revolves around seven criteria - current earnings, annual earnings, the new factor, supply and demand, leader vs laggard, institutional ownership and market direction. These criteria have been modified for the Indian stock markets.

This smallcase consists of companies that have recorded greater than 10 percent earnings per share growth over the previous 2 years and also have high return on equity. High EPS growth in tandem with high ROE indicates that the company is making money at a fast pace while managing capital efficiently.

Future expectations regarding earnings growth have also been taken into account.

Additionally, only stocks that have been showing strong upward price movement and have performed better than 75 percent of all stocks over the previous 1 year are included.

On a one month basis (April 9-May 8), the smallcase has returned 3.52 percent compared to Nifty50's 1.53 percent.

Some of the major stocks in the smallcase are Astral Poly Technik, Varun Beverages, Hindustan Unilever among others. As on May 10, the minimum amount required to invest in this smallcase is Rs 53,835.

(Note: Constituents of the aforementioned smallcases were last reviewed on March 13, 2020, and will be next reviewed on Jun 13, 2020.)

This is a partnered post.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.