The Indian market remained volatile and shed nearly 2 percent in a holiday-shortened week amid FII selling, rising bond yields and investor worries about possible aggressive rate hikes by central banks as inflation soars to new highs in several countries.

The Sensex shed 1,108.25 points, or 1.86 percent, to close at 58,338.93, while the Nifty50 fell 308.65 points, or 1.73 percent, to end at 17,475.7 levels in the last week ending April 13.

"The truncated week witnessed some cool-off in the index as market participants looked to lighten up their positions ahead of the long weekend. The index ended below 17,500 mark with a weekly loss of 1.74 percent," said Ruchit Jain, Lead Research, 5paisa.com.

Among sectors, BSE information technology and telecom indices shed 3 percent each, while metal and capital goods indices fell 2 percent each. The BSE power index, however, surged 5.2 percent.

The BSE midcap index fell 2.6 percent, smallcap 0.8 percent and the largecap Index declined 1.3 percent.

"During this corrective phase, the midcap space initially showed relative outperformance as the broader markets continued to witness good buying interest, however, the Nifty midcap index witnessed some profit booking in last couple of sessions ahead of the long weekend," Jain said.

In this recent upmove, the 20-DEMA has acted as a good support and the market closed just around this pivot point, he said.

"The Nifty 50 closed the week on a negative note taking cues from global indices and has closed just around its immediate support level of 17,450. On a weekly chart, the index has formed an evening star candlestick pattern, indicating bearishness," said Yesha Shah, Head of Equity Research, Samco Securities.

A decisive fall below 17,450 can lead to a retest of 16,900 zone, Shah said. “Thus, traders should maintain a mild bearish outlook going into the next week. A move above the immediate resistance level of 17,850 can negate the bearish outlook," Shah added.

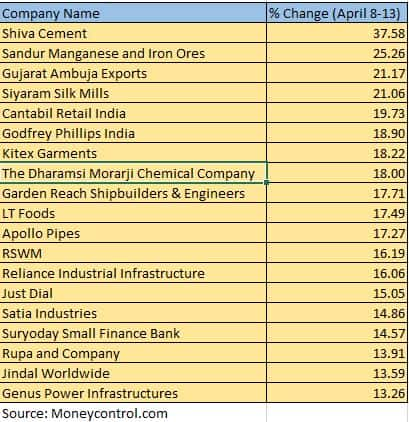

A good week for some midcapsIn the last week, nearly 35 smallcap stocks, including Shiva Cement, Sandur Manganese and Iron Ores, Gujarat Ambuja Exports, Siyaram Silk Mills, Cantabil Retail India, Godfrey Phillips India, Kitex Garments, The Dharamsi Morarji Chemical Company and Garden Reach Shipbuilders & Engineers, rose between 10-37 percent.

However, losers included Reliance Capital, Tejas Networks, Mrs. Bectors Food Specialities, Religare Enterprises, L&T Technology Services, KBC Global and Persistent Systems.

"It was certainly a bit challenging week for our markets and obviously, due to such a long gap, market participants chose to take some money off the table and did not carry over aggressive trades. Now if we take a glance at the daily time frame chart, we can see Nifty placed at a crucial juncture," said Sameet Chavan, Chief Analyst-Technical and Derivatives, Angel One.

“Firstly, the sacrosanct support of ’20-day EMA’ is positioned at 17,450 which coincides with the breakout point of the previous congestion zone. Hence till the time, Nifty is holding 17400 – 17200, we remain a bit hopeful of some recovery here."

If there are no aberrations on the global front in the coming days, any favourable cue would certainly be a cherry on the cake. On the upside, 17,700 followed by 17,850 are the levels to watch out for. If the Nifty has to regain any strength, it needs to surpass these barriers with some authority, he added.

“Let’s see how things pan out and in our sense, if the benchmark has to move higher from here, the banking needs to take the charge (which we are assuming on this occasion). The Bank Nifty is placed at its rock-solid support of 37,000–36,800,” Chavan said.

A move beyond 38000 would provide the impetus for the next leg of the rally. Though the broader market underwent some profit-booking in the last couple of days, smaller names are expected to outperform going forward, Chavan said.

Among midcaps losers were Bajaj Holdings & Investment, Vodafone Idea, Endurance Technologies, Aditya Birla Fashion & Retail, Union Bank of India, Container Corporation of India and JSW Energy.

Where is Nifty50 headed?Ajit Mishra, VP - Research, Religare Broking LtdThe markets will react to two major earnings—Infosys and HDFC Bank on April 18. Besides, any major development on the global front in the next four days would also impact the sentiment.

On the index front, the Nifty is respecting the first line of defence, which is the 20-EMA on the daily chart at around 17,400 and its breakdown can push the index to 17,250.

In case of a rebound, the 17,650-17,750 zone would act as the immediate hurdle. We suggest hedged bets and focus on stock selection.

Prashanth Tapse, Vice President (Research), Mehta EquitiesWeakness in the market continued ahead of the long weekend as traders preferred to cover up all open positions. Most investors preferred to stay on the sidelines ahead of the earning seasons.

Technically, weakness in the market will continue till the Nifty trades below the 17,421-mark. Technically, the make-or-break Nifty support is seen at its 200-DMA at the 17,159 mark. Intraday support at 17,427. Caution will again be the buzzword. Investors should look only for value investing with a long-term perspective.

Siddhartha Khemka, Head-Retail Research, Motilal Oswal Financial ServicesThe market is likely to remain volatile till inflationary pressure persists, raising scope for aggressive rate hike by central banks globally.

Q4FY22 result season has started with TCS number being in line with expectation. The market will on April 18 also react to index heavyweights Infosys and HDFC Bank’s numbers.

Ruchit Jain, Lead Research, 5paisa.comNext week’s opening would depend on the global market movement and if the Nifty manages to start the week on a positive note, then the 20-EMA could become a strong support.

From a broader perspective, the index may see a time- wise correction in the second half of the April series with more opportunities in sector or stock-specific momentum.

The immediate supports for Nifty are 17,370 and 17,275, while resistances are seen around 17755 and 17850, Jain said.

For the coming week, traders should focus on stock- specific trades where better opportunities are seen. “Monday’s move could set the momentum for the short term, " he said.

Foreign institutional investors (FIIs) sold equities worth of Rs 6,334.63 crore, while domestic institutional investors (DIIs) bought equities worth of Rs 1,794.36 crore.

FIIs have so far sold equities worth Rs 10,762.38 crore in April, while DIIs bought equities worth Rs 5,772.11 crore.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.