Chandan Taparia

Motilal Oswal Financial Services

Continuing with the three candlestick patterns, in this session, we will be discussing three candlesticks type Morning Star and Evening Star Pattern.

Introduction

The Evening Star pattern is a three bar candlestick pattern that usually occurs at market tops and Morning Star pattern is a three bar candlestick pattern that occurs at market bottoms.

Morning Star (Bullish Pattern):

The morning star is a bullish and bottom reversal pattern which comprises three bars. The first candlestick in the morning star pattern is a dark or red candlestick with a relatively large real body.

The second candlestick is the star, which has a short real body that is separated from the real body of the first candlestick. The gap between the real bodies of the two candlesticks distinguishes a star from a Doji or a spinning top.

The star does not need to form below the low of the first candlestick and can exist within the lower shadow of that candlestick.

The star is the first indication of weakness as it indicates that the sellers were not able to drive the price much lower than the close of the previous period. This weakness is confirmed by the third candlestick, which must be light or white in colour and must close well into the body of the first candlestick.

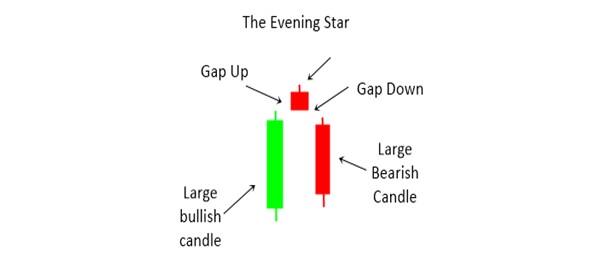

Evening Star (Bearish Pattern):

The Evening Star is a bearish and top trend reversal pattern that warns of a potential reversal of an uptrend which also consists of three bars. The first candlestick in the evening star must be light or white in colour and must have a relatively large real body.

The second candlestick is the star, which is a candlestick with a short real body that does not touch the real body of the preceding candlestick. The gap between the real bodies of the two candlesticks is what makes a Doji or a spinning top a star.

The star can also form within the upper shadow of the first candlestick. The star is the first indication of weakness as it indicates that the buyers were unable to push the price much higher than the close of the previous period.

This weakness is confirmed by the candlestick that follows the star. This candlestick must be a dark or red candlestick that closes well into the body of the first candlestick.

The author is the Associate Vice President — Analyst-Derivatives at Motilal Oswal Financial Services.Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.