Shabbir Kayyumi

Chart patterns are the foundation of technical analysis. Much of our understanding of chart patterns can be attributed to the work of Richard Schabacker, Edwards and Magee.

The way volume, support and resistance levels, relative strength index (RSI), and Fibonacci Retracements helps in technical analysis trading, stock chart patterns also contribute to identifying trend reversals and continuations.

What is a chart pattern?

The theory behind chart patterns is based on this assumption – certain patterns consistently reappear and tend to produce the same outcomes. Chart patterns helps to identify trading signals – or signs of future price movements. In technical analysis, transitions between rising and falling trends are often signaled by price patterns.

A price pattern is a recognizable configuration of price movement that is identified using a series of trend lines and/or curves.

Figure 1. Illustration of Chart Pattern (Nifty Cup & Handle Pattern)

Chart patterns are an integral part of technical analysis, but successful traders combine these techniques with technical indicators and other forms of technical analysis to maximize their odds of success.

Types of Patterns

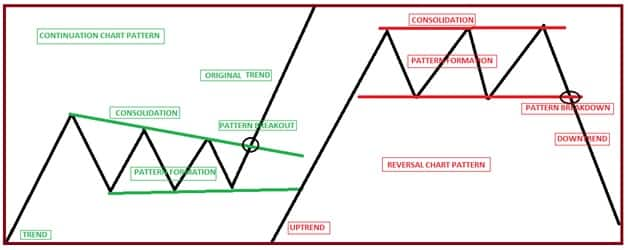

The two most popular chart patterns are reversals and continuations. A reversal pattern signals that a prior trend will reverse upon completion of the pattern, while a continuation pattern signals that the trend will continue once the pattern is complete.

However, many patterns can indicate either a reversal or a continuation, depending on the circumstances.

Figure 2. Formation of Chart Patterns

Chart patterns put buying and selling into perspective by consolidating the forces of supply and demand into a concise picture. As a complete pictorial record of all trading, chart patterns provide a framework to analyse the battle between bulls and bears as illustrated in the above diagram.

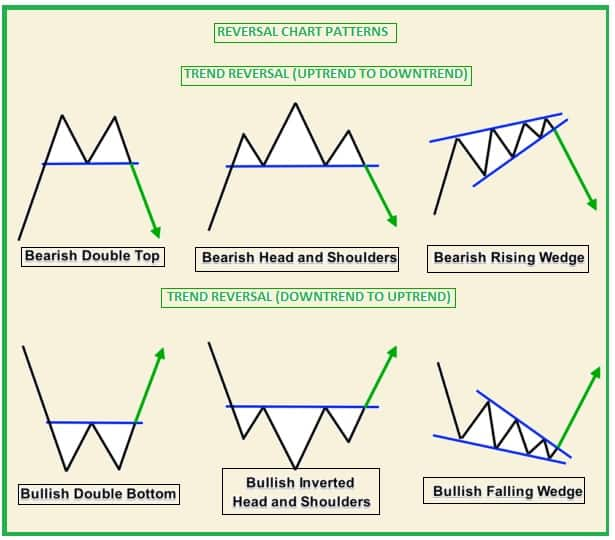

Reversal Patterns

Note that we have classified these chart patterns as to whether they are typically reversal or continuation patterns. Reversal patterns means prices are likely to reverse after completion of pattern. Below are some of the examples of reversal patterns.

• Double Top

• Double Bottom

• Head and Shoulders

• Inverse Head and Shoulders

• Rounding Bottom

• Triple Top

• Triple Bottom etc.

Figure 3. Reversal Chart Patterns

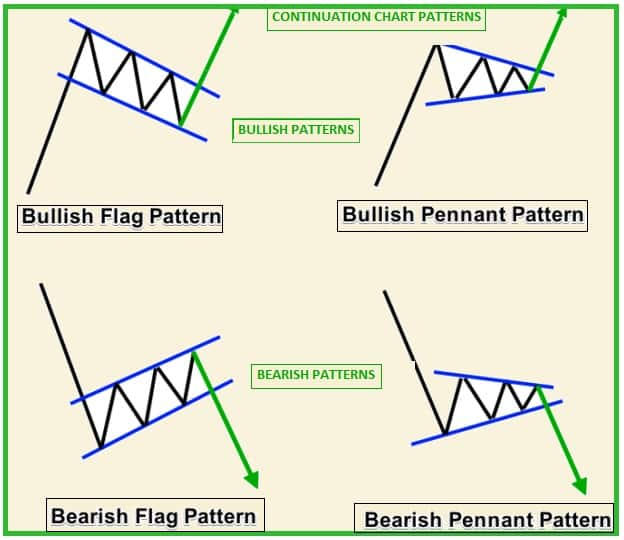

Continuation Patterns

Continuation patterns are specific formations where the price is likely to continue its original trend after completion of the pattern or pattern breakout. Some examples of continuation patterns are mentioned below.

• Flag

• Pennant

• Symmetrical Triangle

• Ascending Triangle

• Descending Triangle

• Rectangle

• Cup and Handle etc.

Figure 4. Continuation Chart Patterns

Entry and Exit

When the price moves beyond the bounds of the pattern, a breakout has occurred. Breakouts can be traded as the entry, profit target and stop level are provided by the formation. The guidelines for entering a position on a breakout/ breakdown are simple:

• Enter long if the price moves through the resistance line (break out-Buy).

• Enter short if the price moves through the support line (break down-Short).

Figure 5. Entry & Exit on Chart Patterns

When a breakout does occur, the pattern provides an entry point and stop loss for the trade. How far the breakout is likely to go can be estimated by using a profit target, attained by taking a measurement from the pattern's high and low.

Volume and Chart Patterns

Indicators such as "volume" can also add further insight when trading these patterns. Volume is invaluable when confirming chart patterns, such as head and shoulders, triangles, flags, and other patterns. A reduction in volume can usually be seen from the start of the pattern until the breakout. If volume isn’t present alongside these chart patterns breakouts, then the resulting trading signal isn’t as reliable. False breakout of pattern is witnessed in absent of volume while pattern completion.

Figure 6. Volume confirmation while Chart Pattern Breakout

Volume is important to consider in bullish breakouts. However one should not give more importance to volume in bearish price patterns, which pushes prices lower.

Timeframes & Patterns

Reversal and continuation patterns can be found across any timeframe and are used for forecasting. However on the higher timeframes daily, weekly, monthly; chart patterns are the most accurate. Traders in aggregate pay more attention to established trends, and look to filter out as much noise as possible.

Since these patterns appear on every timeframe they can be used by scalpers, day traders, swing traders, position traders and investors. Pattern formation is an ongoing process, patterns can form one after another patterns. However we can see smaller patterns inside larger patterns too.

Conclusion

• The great thing about chart patterns is that they tend to repeat themselves over and over again. This repetition helps to appeal to human psychology, particularly trader psychology.

• Chart pattern analysis can be used to make short-term or long-term forecasts.

• While many patterns may seem similar in nature, no two patterns are exactly alike. False breakouts and exceptions to the rule are all part of the ongoing education.

• In addition, pattern recognition can be open to interpretation, which can be subject to personal biases.

• Technical analysts have long used price patterns to examine current movements and forecast future market movements.

Disclaimer: The author is Head — Technical & Derivative Research at Narnolia Financial Advisors. The views and investment tips expressed by investment experts/broking houses/rating agencies on Moneycontrol are their own, and not that of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.