Nifty ended trade marginally high at the upper end of the range that also happens to be the trend line resistance placed at 11,900-11,915. A sustained trade above 11,915 will take the index higher to 12,000-12,100.

On the downside 11,600 continues to act as a major support zone, also the lower end of the trading range with 11,765 acts as immediate support.

Moreover, RSI is making higher lows after turning upward from the bull support zone of 40-45, which suggests bullishness is still intact. Further, given the fact that July is the month that belongs to the bulls and following a positive start; a sustained trade above 11,915 will only extend the bullishness.

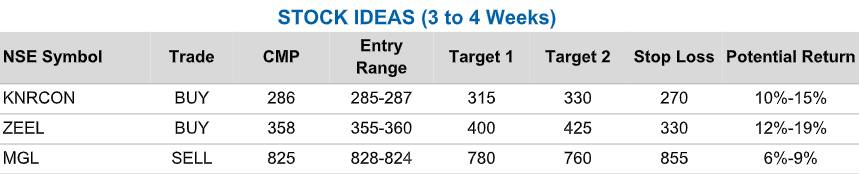

KNR Constructions: Buy | Target: Rs 315-330 | Stop loss: Below Rs 270

On the daily chart, KNR Constructions has broken out from a bullish Flag pattern resistance line placed at Rs 285 suggesting a resumption of the uptrend. Further, a sustained trade above this neckline backed by healthy volumes will extend the up move in the stock taking it higher to Rs 315-330.

Moreover, on the weekly chart, it continues to form higher highs and higher lows confirming the bull trend is dominant in the stock.

RSI has also turned north after taking support at 50 and has formed a higher low on the weekly time frame confirming bullishness in the stock.

The stock may be bought in the range of Rs 285-287 for targets of Rs 315-330, keeping a stop loss below Rs 270.

Zee Entertainment Enterprises: Buy | Target: Rs 400-425 | Stop loss: Below Rs 330

On the daily chart, Zee Entertainment Enterprises has broken out from a falling wedge pattern suggesting higher levels in the coming trading sessions. Further, on the weekly chart, it has turned upwards after taking support at the long-term trend line support placed at Rs 283. A sustained trade above Rs 370 will take it higher to Rs 400-425.

RSI has also turned higher after forming a positive divergence suggesting higher levels. The stock may be bought in the range of Rs 355-360 for targets of Rs 400-425, keeping a stop loss below Rs 330.

Mahanagar Gas: Buy | Target: Rs 760-780 | Stop loss: Above Rs 855

On the daily chart, Mahanagar Gas has resumed its downward journey after testing the neckline of the bearish flag pattern from which it had broken down indicating lower levels in the coming trading sessions.

Moreover, on a weekly time frame, it has broken down from the recent cluster of support suggesting lower levels in the coming trading sessions. Further, RSI is also favouring the bears.

The stock may be sold in the range of Rs 828-824 for targets of Rs 780-760, keeping a stop loss above Rs 855.

The author is Senior Manager, Technical Analysis, YES Securities.Disclaimer: The views and investment tips expressed by investment experts on moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.