Auto stocks outperformed the benchmark index in 2022 and analysts expect it to continue to deliver strong numbers in 2023, as well, on good volume growth and margin expansion.

The Street does not seem to be expecting Budget 2023 to be momentous for the sector, especially for fuel vehicles, but it will be closely tracking announcements aimed at driving electric-vehicle adoption. It will also be on the lookout for announcements that leave more money in the hands of the consumer, especially the rural consumer, to boost demand across auto categories.

Also read: Are ITC's shares catching a Budget chill?Optimism around the sector seems to be driven by the demand outlook. The Street expects strong demand growth across categories, thanks to the low-base effect, product launches and an improving economy.

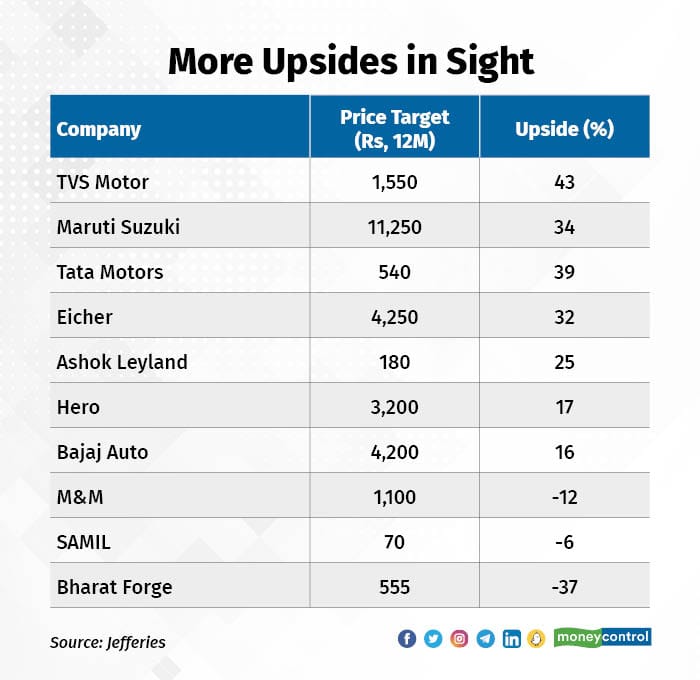

“Demand is recovering from its worst slowdown in decades, and we expect 12-18% volume CAGR for PVs, 2Ws and trucks over FY23-25E,” wrote analysts at Jefferies. This rise in volumes and margins will translate into double-digit growth in earnings over the next two to three years, according to the analysts.

(Graphics: Upnesh Raval, Rajesh Chawla)

(Graphics: Upnesh Raval, Rajesh Chawla)Jefferies' analysts expect a 2-6 ppt EBITDA margin expansion over FY22-25. Yes, metal prices are likely to have bottomed out, with China going easy on their Covid policy and with their support for the ailing property sector. But, the analysts don't see their prices go up as much as they did between 2020-22.

Added to this, most of the stocks in the brokerage’s coverage are valued attractively. The P/E on the analysts’ FY24 earnings estimates is below the stocks’ 10-year average multiple. So, they see a lot of upside in many of the auto majors.

Sharekhan expects EPS growth for FY24-25 to be in the range of 15-20%, again because of strong demand and margin expansion. “We remain positive on the automobile sector despite near-term challenges, rising inflation, and the semiconductor chip shortage,” said Piyush Parag, DVP, Fundamental Research at Sharekhan by BNP Paribas.

According to Parag, the passenger segment (2-wheelers and four-wheelers) will benefit from launches and increasing electrification, while the recovery in commercial vehicles (CVs) will continue over the next few years with improved economic activity, an affordable interest rate regime, and better financing availability.

Budget effectOver the last year, the auto sector has dealt with chip-supply shortages, delays in delivery, disruptive trends such as electrification and premiumisation, and price hikes. Budget 2022 had provided some support by setting aside 25% of the defence R&D budget for private-sector-led projects and solutions, and making higher allocations for infrastructure building and minimum support price (MSP) payments, which indirectly help boost demand for CVs and 2Ws.

Finance Minister Nirmala Sitharaman had also shared plans for a national battery-swapping policy, which had been welcomed by the industry, though the final version will be out only by 2025.

This year, the sector is likely to face challenges from chip-supply constraints and rising financing costs. The Budget isn’t expected to address any of these through a direct intervention.

Also read: Santa rally for Railway stocks| Tactical bets ahead of Upcoming Budget spur buyingAnalyst expectationsIn an interview with Moneycontrol, MOFSL’S Deputy Head of Research and Auto Analyst Jinesh Gandhi said that the brokerage does not see any major announcements directly impacting the auto sector.

“There may be initiatives on the EV side, predominantly incentives (to encourage electrification)… like extension of the FAME II (Faster Adoption and Manufacturing of Electric Vehicles) subsidy or increase in allocation towards electrification of buses under JNNURM (Jawaharlal Nehru National Urban Renewal Mission) or for last-mile connectivity,” he said, adding that indirect initiatives for the whole sector, which can boost demand, would be important.

Among indirect initiatives Gandhi listed income-tax related changes, which could affect the sector positively or negatively; any increase in the Budget (allocation) for rural markets, where there has been stress for some time; and any increase in the allocation for infrastructure spending, which could have a positive impact on the commercial-vehicle (CV) category.

Parag aired a similar view. “No major direct benefit is expected for the internal combustion (engine) segment, while the incentives for promotion of clean fuel (CNG, hybrid, hydrogen, EVs, FAME policy etc) are key things to watch out for in the upcoming Budget. Broader provisions for investment in infrastructure and allocations on rural schemes and so on would be noted down for macro readings,” he said, adding that major beneficiaries would include Tata Motors and M&M.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!