The SME IPO segment, launched more than a decade ago in 2012, has garnered unprecedented attention this year, with several public offerings drawing massive subscriptions and posting significant listing gains.

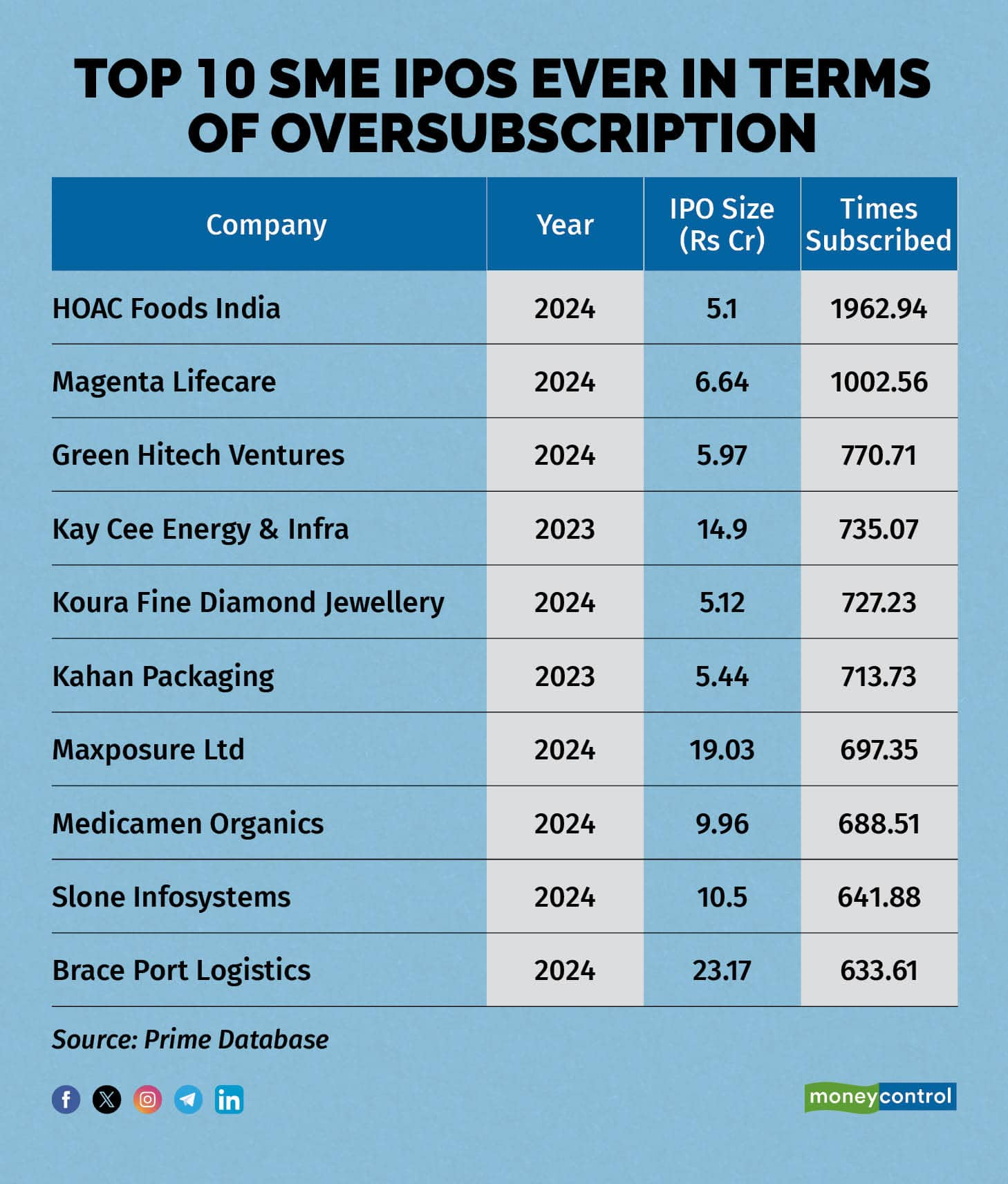

Data from Prime Database shows that the list of top 20 SME IPOs in terms of oversubscription is heavily dominated by public issues that have come to the market in 2024.

As many as 16 of the top 20 were launched in 2024, with two of the IPOs seeing subscriptions in excess of 1,000 times each – HOAC Foods India, which tops the list, was subscribed nearly 1,963 times when the issue was launched in May 2024.

It was followed by Magenta Lifecare, which was launched in June 2024, and was subscribed nearly 1,003 times.

If the top 10 SME IPOs in terms of subscriptions are taken into account, then eight of those were launched in 2024. It rises to nine if the IPO closing date of Kay Cee Energy & Infra Ltd is considered – it opened on December 28, 2023, and closed on January 2, 2024.

Further, IPOs of SMEs like Green Hitech Ventures (771 times), Koura Fine Diamond Jewellery (727 times), Maxposure Ltd (697 times), Medicamen Organics (688 times), Slone Infosystems (642 times) and Brace Port Logistics (634 times) all came in CY24 and were subscribed more than 500 times each.

If the top 10 SME IPOs in terms of oversubscription are taken into account, then eight of those were launched in 2024

If the top 10 SME IPOs in terms of oversubscription are taken into account, then eight of those were launched in 2024

This assumes significance as the trend is being witnessed at a time when a section of market participants -- along with the regulator -- have expressed concerns related to the creation of artificial demand and unsustainable valuations in the SME segment.

Also Read: Grey market premiums skyrocket for upcoming SME IPOs even as experts advise caution

“The stability in the SME market depends on regulatory measures. Until the exchange imposes limits or caps on these IPOs and their subscriptions, investor enthusiasm will continue to drive high levels of oversubscription. The demand will persist, maintaining the current trend of excessive applications,” says Kresha Gupta, Director and Fund Manager, Chanakya Opportunities Fund, a Sebi-registered AIF that invests in SME IPOs.

“The current trend of SME IPOs is not going to stop any time soon. The continuous rise in the market and active participation from domestic and foreign institutional investors are fuelling this trend. Retail investors, driven by optimism and FOMO are applying to numerous IPOs,” adds Gupta.

In an interaction with CNBC TV18, Nilesh Shah, MD of Kotak Mahindra Asset Management, said that the intense investor interest in the BSE SME index reflects the “power of money”.

Also Read: SME IPO frenzy disconnected with fundamentals and reflects the 'power of money', says Nilesh Shah

He believes that once the liquidity surge fades, fundamentals will take over. Drawing parallels to market booms in the 1990s and 2000s, Shah noted that while some SME IPOs might succeed, most are unlikely to meet investor expectations at current valuations. He also pointed out that the BSE SME IPO index, which has grown 1.4x this year, may not be justified by fundamentals despite its impressive 66% CAGR over the past decade.

However, Deepak Shenoy, Founder of Capital Mind, believes that one should not give too much importance to subscription numbers as the money stays in the applicant’s bank account and is debited only if the applicant gets an allotment.

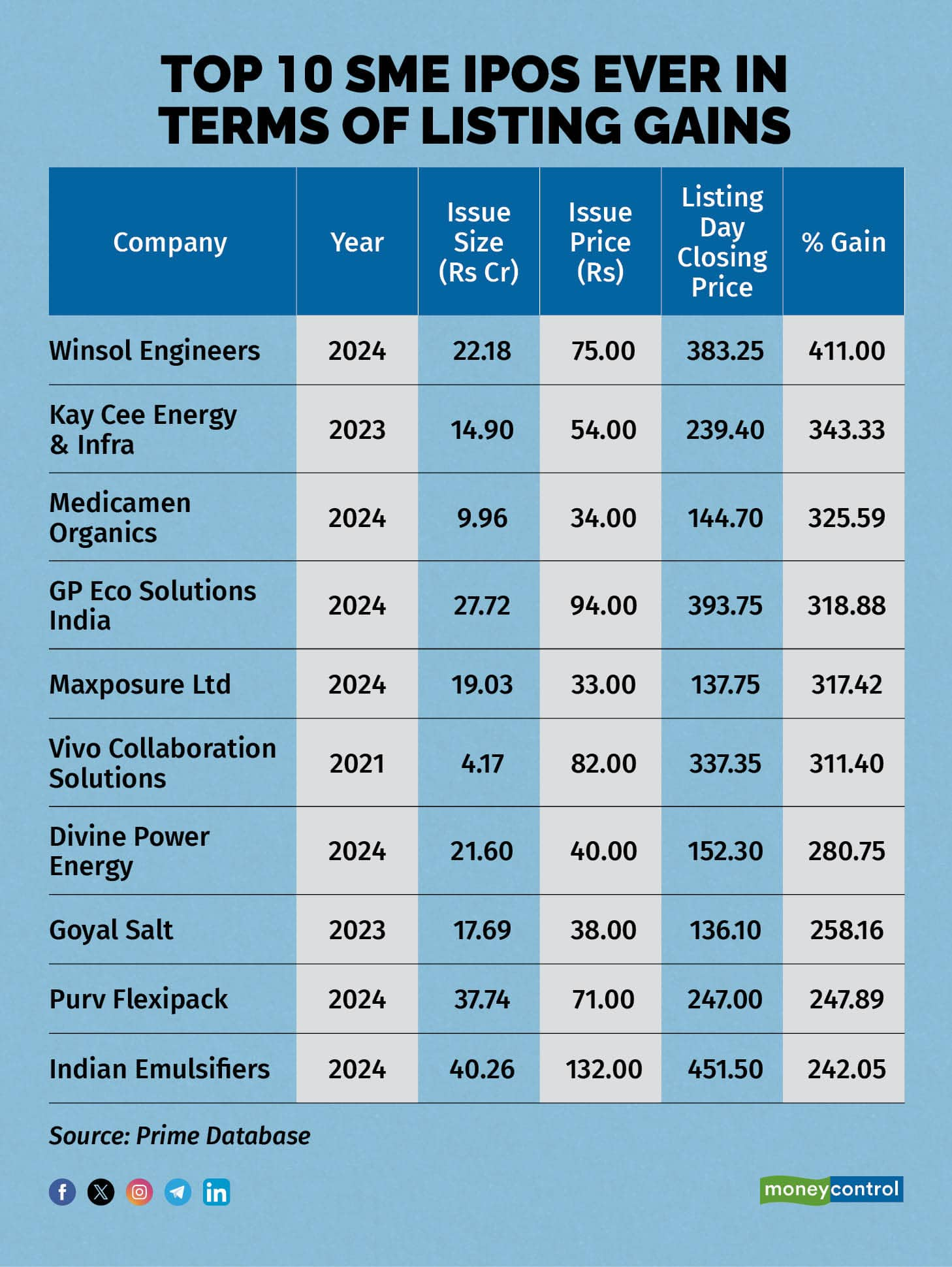

Meanwhile, in terms of listing gains as well, 2024 occupies the top five slots with SMEs like Winsol Engineers (411 percent), Kay Cee Energy & Infra (343 percent), Medicamen Organics (326 percent), GP Eco Solutions India (319 percent) and Maxposure Ltd (317 percent) delivering the best returns on the day of listing when compared to their respective offer prices.

SME IPOs of Divine Power Energy, Purv Flexipack, and Indian Emulsifiers also came in the current calendar year and feature among the top 10 in terms of the returns given on the day of listing.

Incidentally, the National Stock Exchange (NSE) announced in July that it has decided to put an overall cap of 90 percent over the issue price for SME IPOs during special pre-open session on the day of debut.

Earlier this year, Sebi chairperson Madhabi Puri Buch had also raised concerns of manipulation and froth in the segment.

Also Read: 'We see signs of manipulation in the SME segment,' says SEBI chairperson

“We do see signs of manipulation in the SME (small and medium enterprises) segment… We are able to see certain patterns. However, as per our regulation, the way that we need to construct the entire case, we do need to take some time to do that in a robust manner,” Buch had said in March.

Gupta of Chanakya Opportunities Fund, however, believes that SME exchange has given robust performance and the new investors participating in the capital market have seen the market only go up.

Retail investors feel that the potential to make money in the SME market is easier and hence everyone wants to get a share in these companies resulting into oversubscription against the allotment size, says Gupta.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.