In a surprise move, both small and mid-caps indices outperformed Nifty and Sensex in the last week of February which could also suggest that trend might be shifting towards non-index names. However, for the month of February, both small & mid-cap indices closed in the red.

The S&P BSE Small-cap index rose 3.4 percent and the S&P BSE Mid-cap index gained 2.3 percent for the week ended March 1 compared to 0.5 percent rise in the Sensex and 0.67 percent gain seen in the Nifty50.

The week packed a punch of big returns from small-caps, as over 100 stocks gave double-digit returns. As many as 107 stocks in the S&P BSE Small-cap index rallied 10-40 percent in just five days.

Stocks which gave double-digit returns include names like Wabco India, Granules India, Arvind, Dish TV, Global Offshore, Dhanlaxmi Bank, Force Motors, Himadri Speciality, Swan Energy, Minda Corporation, Rolta India, Punj Lloyd, Prime Focus, Andhra Cement among others.

In the S&P BSE Mid-cap index, only 4 stocks gave double-digit returns which include names like NALCO, Tata Communications, Reliance Capital, and Adani Power.

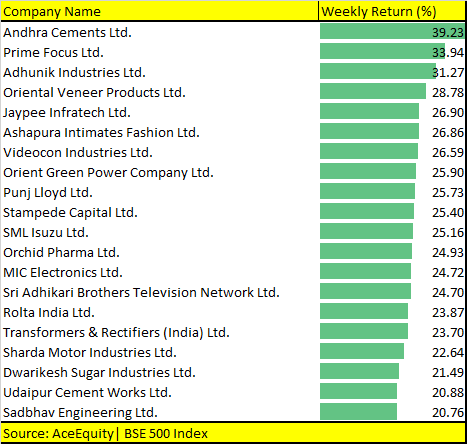

Here is a list of top 20 stocks out of 107 from the S&P BSE Small-cap index which have given double-digit returns:

Although Small & Midcap indices closed in red for February, a reversal in the trend seen in the last week of February suggest that there is a possibility that the broader market might have bottomed out. Yes, further data will confirm the trend.

"Price damage in a new pocket cannot be ruled out. We have seen different scrips and sectors get negatively impacted on a given day. However, I do feel that the broader market has bottomed out," Amar Ambani, President & Head of Research, YES Securities told Moneycontrol.

"The recovery though, will not be V-shaped. The bottoming-out process will take longer. While stocks can bounce 20-30 percent, but we’re unlikely to see midcaps and small caps back to their earlier highs for at least 15-18 months," he said.

If someone is looking to buy into the broader market space then the decision has to be made on a case to case basis. There can’t be an umbrella approach while shortlisting stocks, but, yes, there is value emerging in most of the small & midcap, suggest experts.

Value has emerged, not just in pockets, but in abundance, provided holding horizon is three years or more. In times like these, check for the strength of promoter, balance sheet and whether growth prospects are intact, they say.

"Based on board index like Nifty500, we can assess that about 60-65 percent of the stocks are currently valued below its seven-years average valuation on P/E basis which is very attractive," Vinod Nair, Head of Research, Geojit Financial Services told Moneycontrol.

"This is a good time to develop a portfolio of quality mid & small caps with a two to three years investment perspective. We can conclude that the majority of stocks have corrected well but few blue-chips and sectors like FMCG, Consumer Discretionary, Chemicals and IT are on the higher side," he said.

Disclaimer: The views and investment tips expressed by investment expert on moneycontrol.com are his own, and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.