September 01, 2021 / 16:25 IST

Shrikant Chouhan, Executive Vice President, Equity Technical Research, Kotak Securities:

Markets witnessed profit-taking as rampaging bulls took a break after three days of rally. Benchmark Nifty has formed a bearish candle which indicates that profit booking at higher levels could continue in the near future. However, the medium-term trend remains bullish.

As the rally has been overstretched, markets may witness narrow range activity. For the trend following traders, the 16980-16950 level would be the key level to watch out for. On the flip side, 17150-17200 could act as an intraday resistance level. In case of intraday correction, contra traders can take a long bet near the support level of 16950 with a strict 35 points stop loss.

September 01, 2021 / 16:13 IST

Sahaj Agrawal, Head of Research- Derivatives at Kotak Securities

Nifty continues to trade with a positive bias for the medium term and is expected to test 18,000 and above. Trend support for the index is seen at 16,760 levels.

In the short term since the movement has been aggressive, some corrections cannot be ruled out. We believe buying on dips is advisable in the broader markets. We expect positive bias in realty and auto stocks, while BFSI space remains in momentum and should be held onto.

September 01, 2021 / 16:10 IST

Ajit Mishra, VP - Research, Religare Broking:

Markets took a breather after the recent surge and settled with a cut of nearly half a percent. The benchmark started on a positive note despite mixed global cues however it could not hold gains at higher levels as investors chose to book profits as the day progressed. Consequently, the Nifty closed lower by 0.3% at 17,076 levels.

The sectoral indices witnessed a mixed trend wherein IT and metals were the top losers, while realty posted strong gains of nearly 5% followed by PSU bank and media. The broader market also continued its positive momentum and ended higher in the range of 0.3-0.8%.

Markets may see some consolidation ahead and it would be healthy. We reiterate our view to focus on the banking index for further directional move in Nifty. On the downside, the Nifty may find support around the 16,900 zone. Considering the trend, traders should continue with the “buy on dips” approach.

September 01, 2021 / 16:08 IST

S Hariharan, Head - Sales Trading, Emkay Global Financial Services:

“In conjunction with sharp appreciation in INR (USD dropped from 74.3 to 72.8) over the last 3 sessions, FII flows into equities have also picked up pace. This is in some part attributable to inflows at MSCI rebalance on 31 Aug. Alongside these flows, FIIs have also been increasing net long positions in single stock futures for the entire month of Aug – an increase of nearly $3.5 bn.

Nifty continued to out-perform mid-cap & small-cap indices, as Retail sentiment continues to be relatively weak – Retail net long positioning in single stocks has come down by $2 bn. FMCG and consumption-related plays continue to be the leaders in the rally, while sentiments appear to be cooling in IT sector on account on rich valuations and consensus over-weight positioning.

Banking continues to be the weakest sector relative to the market. Strong liquidity conditions both domestically & abroad have helped push through a heavily loaded IPO pipeline, and domestic MFs have seen strong responses to new fund offers as well.

September 01, 2021 / 16:03 IST

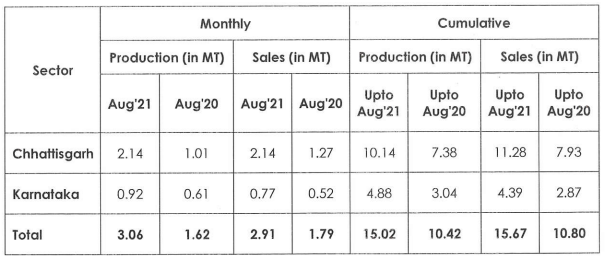

NMDC August production up 88.9%:

NMDC August production was up 88.9% at 3.06 mt versus 1.62 mt and its sales were up 62.6% at 2.91 mt versus 1.79 mt, YoY.

September 01, 2021 / 15:58 IST

Deepthi Mathew, Economist at Geojit Financial Services:

The favourable base effect aided the domestic economy to clock a double-digit growth rate. When compared to Q1FY20, India's economy contracted by 9.2 percent. It shows that the economy is still on the recovery path. Government spending and the export sector registered strong growth, relative to the pre-covid level of Q1FY20 at 7.35 percent and 8.7 percent, respectively.

September 01, 2021 / 15:55 IST

Vedanta announces interim dividend of Rs 18.50 per share

Mining major Vedanta Limited has announced a first interim dividend of Rs 18.50 per share. The decision was confirmed at the meeting of Board of Directors held on September 1, the company said in a regulatory filing.

Vedanta ended at Rs 297.95, down Rs 4.95, or 1.63 percent on the BSE.

September 01, 2021 / 15:55 IST

S Ranganathan, Head of Research at LKP securities:

On a day of high volatility, indices gave up gains as profit booking was seen across IT & metal names. The pace of vaccinations during the last couple of days enthused market participants even as the street took stock of GDP and GST numbers today, the focus now shifts to few high-frequency consumption indicators.

September 01, 2021 / 15:46 IST

Vinod Nair, Head of Research at Geojit Financial Services:

Despite a strong opening due to favourable GDP data, domestic indices failed to hold onto its early gains due to profit booking strategy from the recent rally. India’s GDP rose due to the low base effect and was powered by private consumption expenditure & investment. The auto sector showed a flattish trend as sales for August saw a decline following supply constraints.

September 01, 2021 / 15:42 IST

Ashis Biswas, Head of Technical Research at CapitalVia Global Research:

The market witnessed some lackluster movement and an attempt to hold the level around the Nifty 50 Index level of 17100. If the market is able to sustain the level of 17000, it can witness higher levels of 17250-17300. The momentum indicators like RSI, MACD indicating a positive outlook to continue.

September 01, 2021 / 15:34 IST

Market Close:

Benchmark indices ended on negative note after hitting record levels in the early trade on September 1.

At close, the Sensex was down 214.18 points or 0.37% at 57338.21, and the Nifty was down 55.90 points or 0.33% at 17076.30. About 1461 shares have advanced, 1637 shares declined, and 150 shares are unchanged.

Asian Paints, Tata Motors, SBI Life Insurance, Axis Bank and Nestle were the top Nifty gainers. M&M, Cipla, Tata Steel, Hindalco Industries and Bajaj Finserv were among the top losers.

Among sectors, metals and IT indices fell over 1 percent each, while capital goods, power and realty indices rose 1-5 percent. BSE midcap and smallcap indices ended in the green.

September 01, 2021 / 15:23 IST

Goldman Sachs on BHEL

Goldman Sachs has maintained sell rating on the stock with a target at Rs 23 per share.

There was disappointing last few years on weak execution, high fixed costs & COVID Disruptions. However, the focus on cost rationalisation & cash collection is generating results.

It believe there is only so much that the company can do on these fronts and fundamental issues, are a lack of opportunities on thermal power, research firm added.

Bharat Heavy Electricals was quoting at Rs 54.65, up Rs 2.10, or 4.00 percent on the BSE.

September 01, 2021 / 15:21 IST

OPEC+ raises 2022 oil demand growth forecast

The OPEC+ group of oil producers has made an upward revision to its 2022 oil demand forecast ahead of a meeting on Wednesday as the group faces pressure from the United States to raise output more quicker to help to support the global economy.

Two OPEC+ sources said the group's experts have revised its 2022 oil demand growth forecast to 4.2 million barrels per day (bpd), up from the previous forecast of 3.28 million bpd.