Taking Stock: Nifty falls for the third straight day; midcaps outperform

The BSE Auto index fell 1 percent, Bank Index down 0.9 percent and FMCG index was down 0.7 percent.... Read More

| Index | Prices | Change | Change% |

|---|---|---|---|

| Sensex | 85,102.69 | -609.68 | -0.71% |

| Nifty 50 | 25,960.55 | -225.90 | -0.86% |

| Nifty Bank | 59,238.55 | -538.65 | -0.90% |

| Biggest Gainer | Prices | Change | Change% |

|---|---|---|---|

| Tech Mahindra | 1,591.80 | 21.00 | +1.34% |

| Biggest Loser | Prices | Change | Change% |

|---|---|---|---|

| Interglobe Avi | 4,923.50 | -447.00 | -8.32% |

| Best Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty IT | 38590.70 | -113.00 | -0.29% |

| Worst Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty PSU Bank | 8146.10 | -235.65 | -2.81% |

Indian markets ended on a weak note tracking sharp volatility in US stock futures and caution ahead of the quarterly earnings of index giant Reliance Industries. Nifty has formed spinning bottom formation on a daily basis, which is an indication of the indecisive trend. The benchmark index has managed to hold the level of 50 days Exponential Moving Average, which was at 11530. In the coming week, we could see stock-specific activity till the market doesn't cross the trading range of 11750 and 11530 on either side.

The markets broke yesterday's low of 11600 and this makes the Nifty bearish in the short term. Ideally it should fall further and touch 11400-11450 levels. The upside is capped at 11900-11950 so traders can consider a closing above those levels as a stop loss and initiate short positions for a target of 11400.

Markets were volatile today as reflected in the VIX which has risen close to 300bps over the last few sessions. Autos witnessed profit booking today although a late comeback by RIL ahead of its earnings today evening helped indices gain some lost ground in afternoon trade.

Indian market is moving in tandem with global trends which is displaying weakness as a new round of coronavirus lockdown is weighing on the future growth & outlook. Indian rally was supported by good Q2 results and economic data. The sustenance of economic data will be difficult in the next quarter due to restrictions affecting world growth, global uncertainties over the US presidential election and timing of stimulus.

: Benchmark indices ended lower for the third consecutive day on October 30 dragged by auto and FMCG names.

At close, the Sensex was down 135.78 points or 0.34% at 39614.07, and the Nifty was down 28.40 points or 0.24% at 11642.40. About 1322 shares have advanced, 1222 shares declined, and 167 shares are unchanged.

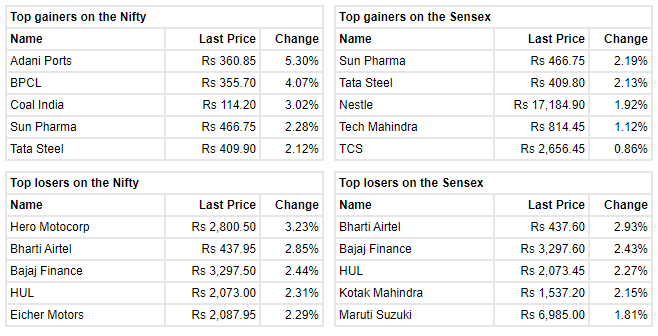

Bharti Airtel, Hero MotoCorp, Eicher Motors, Maruti Suzuki and HUL were among major losers on the Nifty, while gainers included Adani Ports, BPCL, Coal India, Sun Pharma and Tata Steel.

Except auto, bank and FMCG other sectoral indices ended higher. BSE Midcap index gained 0.6 percent, while BSE Smallcap index ended flat.

Prabhudas Lilladher increase FY21E earnings estimates by 45% to incorporate inventory gains of Rs 30 bn in H1FY21 and make minor changes and increase FY22-23E by 5%. During Q2FY21, core standalone EBIDTA adjusted for inventory gains and forex gains was low at Rs 12.5 bn (-63%QoQ) due to lower core refinery ($1.6/bbl vs $1.9/bbl in Q1FY21) and marketing earnings.

Weak global demand and high inventory levels are likely to keep crude oil prices range bound, which will support marketing margins in medium term. Meanwhile GRMs will recover with pickup in economic activity and lower operating cost (due to soft spot LNG prices) will support refining earnings.

BPCL remains one of the preferred divestment play in the oil and gas sector however, with uncertain timelines broking house cut target multiple to PER of 9x FY22E (10x earlier). Maintain buy with a target price of Rs 479 (Rs 515 earlier).

The BSE-30 Index declined 2.8% in the current week. Market mood was wary on a steady increase in daily Covid-19 cases globally despite falling cases in India and uncertainty around the upcoming US elections. Nestle and Asian Paints were among the major gainers while State Bank of India, ONGC and Sun Pharmaceuticals lost the most in the BSE-30 Index in the past week.

FPIs bought equities worth USD 695 mn over the past five trading sessions while DIIs sold USD 740 mn worth of equities in the same period. Even though second quarter corporate earnings numbers have been encouraging so far, markets are showing signs of weakness. Our advice would be to take advantage of a potential market correction to build a portfolio of good quality stocks.

The company witnessed healthy traction in order booking. This, coupled with bottoming out of retail vertical, improvement in cloud revenues and ramp up in financial services vertical, will lead to healthy improvement in revenues in the long term. Further, improving margins are expected to boost the bottomline. Hence, ICICIdirect upgrade the stock from hold to buy with a revised target price of Rs 210 (9x FY23E EPS).

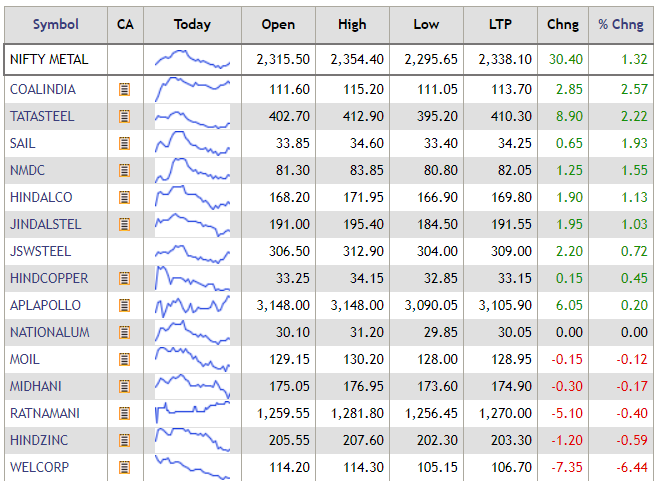

Nifty Metal Index added 1 percent supported by the Coal India, Tata Steel, SAIL:

Prices of silver and industrial metals are likely to remain negative, due to the rising global Covid infections, which are causing concerns about weaker global economic growth. Metals are also trading negative, due to the strength in the Dollar Index against major currencies. The Dollar Index has rallied from last week’s low of 92.46, to a high of 94.14 this week, which is 1.8% higher, and it is currently trading at a four-week high. Silver prices are likely to find support near the 200-days EMA at $22.05, while critical resistance is seen near $24.81-$25.98 levels.

Benchmark indices erased some of the losses but still trading lower with Nifty above 11600.

At 14:28 IST, the Sensex was down 236.26 points or 0.59% at 39513.59, and the Nifty was down 55.80 points or 0.48% at 11615. About 1145 shares have advanced, 1222 shares declined, and 129 shares are unchanged.

Net profit grew 21.7 percent at Rs 52.4 crore against Rs 43 crore (YoY). Revenue was up 16.9 percenty at Rs 1,638.7 crore against Rs 1,402 crore (YoY). EBITDA jumped 41.7 percent at Rs 89.4 crore against Rs 63.1 crore (YoY). EBITDA margin stood at 5.5 percent against 4.5 percent (YoY).