Taking Stock: Market gains for fourth day; Nifty above 18,600, Sensex up 123 points

Selling is seen in the auto, energy, pharma and metal names.... Read More

| Index | Prices | Change | Change% |

|---|---|---|---|

| Sensex | 85,712.37 | 447.05 | +0.52% |

| Nifty 50 | 26,186.45 | 152.70 | +0.59% |

| Nifty Bank | 59,777.20 | 488.50 | +0.82% |

| Biggest Gainer | Prices | Change | Change% |

|---|---|---|---|

| Shriram Finance | 854.90 | 26.75 | +3.23% |

| Biggest Loser | Prices | Change | Change% |

|---|---|---|---|

| Interglobe Avi | 5,370.50 | -66.00 | -1.21% |

| Best Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty PSU Bank | 8381.75 | 125.05 | +1.51% |

| Worst Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty Pharma | 22947.20 | -11.80 | -0.05% |

The domestic market continued its rally as recent Q4 results indicated improvement in demand. Further, expectations of a normal monsoon and a drop in international commodity prices support a rise in the margin profile.

The underlying trend is strong, supported by strong liquidity, the negative slope of the interest yield, and the forecast of strong QoQ growth in Q4 FY23 GDP versus 4.4% in Q3.

Markets managed to end higher in a range bound session, in continuation to the prevailing trend. After the flat start, it oscillated in a narrow range and settled around the upper band to close at 18,633.85 levels. Meanwhile, sectoral indices traded mixed wherein banking, financials and FMCG were in the limelight while metal, pharma and auto ended lower. The broader indices continued their gaining streak and settled marginally in the green.

Markets are gradually inching towards the record high however mixed global cues are capping the momentum. We feel the scenario may continue and that may keep the traders guessing on the sustainability of the trend. Having said that, traders should maintain a positive tone till Nifty holds 18,250 and proactively manage their positions.

Due to absence of cues from the US markets which were shut on Monday, local stocks witnessed cautious optimism with selective buying in banking and IT stocks. However, weakness in metals and oil & gas stocks limited the uptick. Investors are also awaiting the US debt agreement deal on Wednesday, as its outcome would determine the market direction in the near to medium term.

Technically, on the daily chart, the Nifty has formed a small body candle which clearly suggests the indecisiveness between bulls and bears. The intraday formation is also suggesting the continuation of a range bound activity in the near future.

For bulls, 18665 would be the immediate breakout level, above which the market could rally till 18725-18750. On the flip side, below 18550, selling pressure is likely to accelerate till 18500-18475.

The Nifty witnessed a day of consolidation today and managed to close the day on a positive note, up ~35 points. On the daily charts, we can observe that after a sharp upmove, the Nifty is witnessing consolidation which is a bullish sign. During this range-bound price action, it will prepare a base for itself and set the stage for the next leg of the upmove.

The hourly momentum indicator still has a negative crossover which points out that the consolidation is still not over, and it could lead to a rangebound price action over the next few trading sessions. In case of a huge gap up, it is unlikely to sustain at higher levels without the support from the momentum indicator.

Overall, the uptrend is intact, and this consolidation shall provide an opportunity for initiating fresh long positions. In terms of levels, 18705 – 18735 shall act as the immediate hurdle zone, while 18570 – 18500 is the crucial support zone from a short-term perspective.

Equity benchmark indices extended their winning streak for the fourth consecutive day on Tuesday, bolstered by a steady influx of foreign funds.

Despite facing volatility throughout the day, the Nifty managed to close above the 18600 level. In contrast, the trend remained unclear for the majority of the trading session. Meanwhile, the Bank Nifty closed above the 44400 mark, achieving consecutive all-time highs over the past two days.

Looking ahead, both benchmark indices are expected to undergo a slight consolidation phase or witness some profit booking. The Nifty has crucial support levels at 18500-18450, while potential resistance can be anticipated at 18700-18750 levels. Similarly, for the Bank Nifty, support is situated at 44100, whereas resistance levels are projected at 44750-44800.

Indian rupee ended lower at 82.71 per dollar against previous close of 82.63.

In the volatile session on May 30 the benchmark indices ended on a positive note with Nifty above 18,600.

At close, the Sensex was up 122.75 points or 0.20% at 62,969.13, and the Nifty was up 35.10 points or 0.19% at 18,633.80. About 1640 shares advanced, 1766 shares declined, and 112 shares unchanged.

Top gainers on the Nifty were Kotak Mahindra Bank, Bajaj Finserv, Bajaj Finance, HCL Technologies and HDFC Life and losers were Hindalco Industries, Adani Enterprises, Tech Mahindra, Tata Steel and Sun Pharma.

Selling was seen in the auto, energy, pharma and metal names, while buying witnessed in the bank, capital goods, FMCG and information technology names.

The BSE midcap and smallcap indices ended with marginal gains.

On a day when the Volatility Index dropped below 12, it was an eventful trading session today as the month of May has witnessed cash market volumes surging towards a six-month high as the return of FII's pepped up domestic investors in search of Alpha in a month which defied the usual ' Sell in May and Go Away ' rhetoric.

As markets shrugged away inflation, supply-chain disruptions and a slowdown in certain discretionary spends, buoyant FII inflows of Rs 450 billion since April has powered the Bank Nifty to its yearly-high today ahead of the MSCI rejig tomorrow. The sight of 63K on the BSE Sensex today was indeed music to Bulls who made Hay in May.

-Buy rating, target at Rs 1,570 per share

-ICICI Bank board approves to increase stake above 50% in company

-Bank would need to acquire at least 2.5% stake to classify ICICI Lombard as subsidiary

-Stake increase would be subject to RBI approval

-Material positive for Lombard as it will remove a key technical hangover

-The stock trades at 23x FY25E P/E

ICICI Lombard General Insurance Company was quoting at Rs 1,183.85, down Rs 6.50, or 0.55 percent on the BSE.

| Company | 52-Week High | Day’s High | CMP |

|---|---|---|---|

| AIA Engineering | 3033.00 | 3033.00 | 2,978.00 |

| Aurobindo Pharm | 654.95 | 654.95 | 652.65 |

| Power Finance | 181.30 | 181.30 | 181.15 |

| Ramco Cements | 919.50 | 919.50 | 919.50 |

| Equitas Bank | 89.40 | 89.40 | 87.95 |

| IDFC | 99.15 | 99.15 | 98.88 |

| J. K. Cement | 3288.90 | 3288.90 | 3,177.40 |

| Interglobe Avi | 2412.00 | 2412.00 | 2,372.00 |

| IDFC First Bank | 71.85 | 71.85 | 71.59 |

| Sundram | 1099.15 | 1099.15 | 1,098.60 |

Apollo Hospitals Enterprises has posted 50.5% jump in its Q4 Net Profit at Rs 146 crore against Rs 97 crore and revenue was up 21.3% at Rs 4,302.2 crore versus Rs 3,546.4 crore, YoY

Apollo Hospitals Enterprises was quoting at Rs 4,600.30, down Rs 45.80, or 0.99 percent.

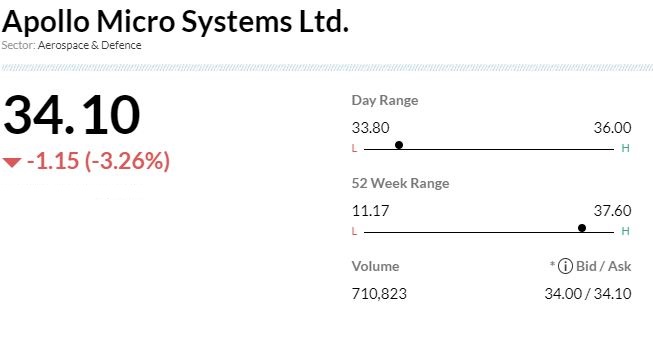

Apollo Micro Systems Ltd (AMSL) is looking to raise Rs 200 crore to execute its expansion plans through acquisition route.

A decision on the fund raising plan was approved by the board of directors at its meeting on Monday.

The board also approved appointment of Sudarshan Chiluveru, the Chief Financial Officer (CFO), as the Compliance Officer officer of the company with effect from June 1, 2023.