March 17, 2023 / 16:23 IST

Amol Athawale, Technical Analyst (DVP), Kotak Securities

What we are seeing is a relief rally backed by strong positive global cues as there are expectations that the US Fed may not take aggressive rate hike steps to tame inflation. Some of the concerns over the falling financial health of the US banking industry have also subsided, which further boosted the market sentiment. Falling crude oil prices and recovery in the metal space on hopes of revival in the Chinese economy is also providing some support to the struggling markets.

March 17, 2023 / 16:15 IST

Vinod Nair, Head of Research at Geojit Financial Services

Following the sharp rebound in the global markets, the domestic indices took a breather in hopes of relief from the global banking turmoil. Global equities reversed their selling streak on reports of a rescue package for the beleaguered First Republic Bank, along with an aid provided to Credit Suisse from the Swiss Central Bank, which would soothe concerns over the global financial stability. On the other hand, the ECB further raised its rates by 50 bps, indicating its preparedness to provide liquidity to banks upon necessity.

March 17, 2023 / 15:50 IST

Jatin Gedia, Technical Research Analyst, Sharekhan by BNP Paribas

The Nifty witnessed a volatile day of trade today. It witnessed sharp swings in both directions and ultimately closed in the green for the second consecutive day. On the way up the 40 hour moving average and the hourly upper Bollinger band placed in the range 17,150 – 17,200 acted as a strong resistance and restricted further upside and on the way down the swing low formed at 16,850 shall act as a crucial support from short term perspective.

We expect the Nifty to consolidate between these two parameters from the next few trading sessions. we believe that the pullback rally has some more steam left and the Nifty is likely to carry on this positive momentum next week as well.

March 17, 2023 / 15:33 IST

Rupee Close:

Indian rupee ended 18 paise higher at 82.55 per dollar against previous close of 82.73.

March 17, 2023 / 15:30 IST

Market Close: Benchmark indices ended higher in the volatile session on March 17 with Nifty at 17,100.

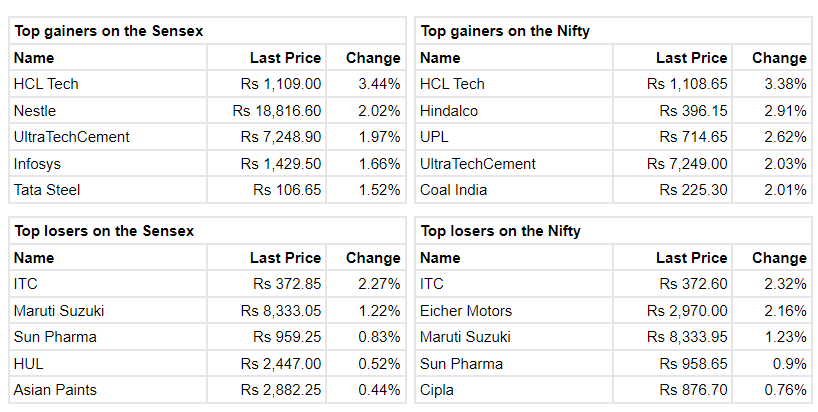

At close, the Sensex was up 355.06 points or 0.62% at 57,989.90, and the Nifty was up 114.40 points or 0.67% at 17,100. About 2008 shares advanced, 1407 shares declined, and 118 shares unchanged.

HCL Technologies, Hindalco Industries, UPL, UltraTech Cement and Nestle India were among the biggest gainers on the Nifty, while losers were Eicher Motors, NTPC, Maruti Suzuki, ITC and Asian Paints.

Barring auto and FMCG, all other sectoral indices ended in the green.

The BSE midcap was up 0.3 percent and smallcap index added 0.7 percent.

March 17, 2023 / 15:30 IST

Nomura View On Info Edge India

-Buy rating, target at Rs 4,940 per share

-Hiring slowdown in tech sector continues on Naukri business

-Focussed on mid-market on 99acres business

-Happy with early trends of business model change of Jeevansathi

-Continue to hold Zomato and PolicyBazaar as financial investments

Info Edge India was quoting at Rs 3,495.65, up Rs 69.80, or 2.04 percent.

March 17, 2023 / 15:21 IST

Morgan Stanley View On DLF

-Overweight rating, target at Rs 417 per share

-Company achieved USD 1 billion in sales from a single project at launch

-This indicates strong pent-up demand in system & strength of DLF's land bank

DLF was quoting at Rs 375, up Rs 15, or 4.17 percent.

March 17, 2023 / 15:18 IST

NCLT approves merger of HDFC & HDFC Bank

March 17, 2023 / 15:17 IST

Jefferies View On NTPC

-Buy rating, target at Rs 195 per share

-Reports suggest Malaysia's Petronas could offer USD 460 million for 20 percentstake in NTPC's RE arm

-NTPC commissioned approximately 2.9 GW RE capacity & had 4.7 GW under construction in Q3

-RE capacity is approximately 6 percentof FY24 estimates overall capacity estimates

-Speculated deal implies Rs 12.5 per share for NTPC shareholders after 20 percentholdco discount

NTPC was quoting at Rs 177.30, down Rs 2.30, or 1.28 percent.

March 17, 2023 / 15:10 IST

Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities

Global equity markets reacted to the crisis in US and European banks. Indian markets were under pressure from these global developments. Accordingly, key domestic benchmark indices Nifty-50 and Sensex-30 were down during the week. Broader indices including BSE Midcap, BSE Small-cap and majority of the sectoral indices too posted negative returns in this week.

On the economy front, India’s February 2023 CPI inflation moderated to 6.44% and trade deficit remained in check with marginal increases (over January 2023) in exports and imports. Crude oil prices corrected sharply this week amid the recent banking crisis.

The yield on the 10-year US Treasury was lower as compared with last week. Meanwhile, the European Central Bank raised interest rates by 50 bps and continued with its policy tightening measures. Market participants will keenly watch-out for next week’s Federal Reserve policy decision.

March 17, 2023 / 15:06 IST

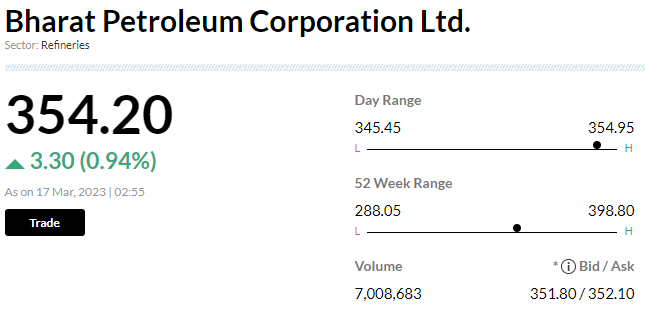

BPCL appointed G Krishnakumar as CMD of the company, reported CNBC-TV18.

March 17, 2023 / 15:03 IST

Market at 3 PM

Benchmark indices were trading firm in the final hour of the trading session with Nifty around 17,050.

The Sensex was up 296.27 points or 0.51% at 57,931.11, and the Nifty was up 97.20 points or 0.57% at 17,082.80. About 1886 shares advanced, 1381 shares declined, and 90 shares unchanged.

March 17, 2023 / 15:01 IST

G R Infraprojects emerges as lowest bidder for a project worth Rs 587.59 crore

G R Infraprojects has emerged as L‐1 bidder in financial bid opening for the tender invited by East Coast Railway for “Construction of Tunnel work between Km. 153.0 to 180.0 (Adenigarh – Purunakatak) consisting of Tunnel‐T4, T5, T6 & T7 (Apx. Length of 7.492 Km) & allied works of Khurda – Bolangir new rail line project in east coast railway.

The bid project cost is Rs 587.59 crore.

G R Infraprojects was quoting at Rs 1,021.15, down Rs 8.30, or 0.81 percent.