Taking Stock | Sensex, Nifty End Flat Amid Volatility, Small & Midcaps Outperform

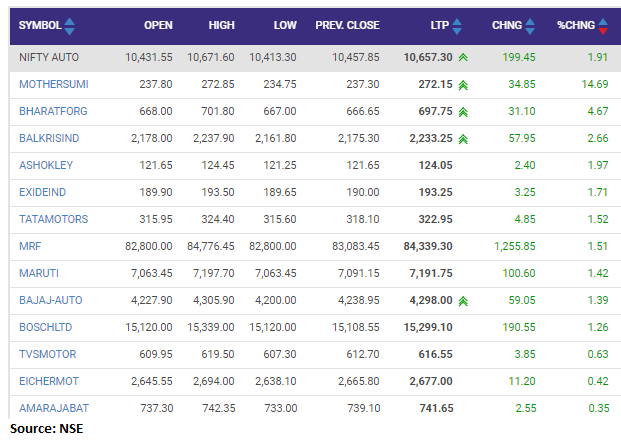

Nifty auto, metal, energy and PSU Bank indices rose 1-3 percent each. BSE Midcap and Smallcap indices added over 1 percent each.... Read More

| Index | Prices | Change | Change% |

|---|---|---|---|

| Sensex | 85,102.69 | -609.68 | -0.71% |

| Nifty 50 | 25,960.55 | -225.90 | -0.86% |

| Nifty Bank | 59,238.55 | -538.65 | -0.90% |

| Biggest Gainer | Prices | Change | Change% |

|---|---|---|---|

| Tech Mahindra | 1,591.80 | 21.00 | +1.34% |

| Biggest Loser | Prices | Change | Change% |

|---|---|---|---|

| Interglobe Avi | 4,923.50 | -447.00 | -8.32% |

| Best Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty IT | 38590.70 | -113.00 | -0.29% |

| Worst Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty PSU Bank | 8146.10 | -235.65 | -2.81% |

Index opened day with gap down but managed to grab the bullish stream in second half and closed a day at 15576 with minimal gains & formed a small bullish candle on daily chart. Again index showed good move above 15500 which suggest 15500 zone can be immediate support on the downside followed by 14400 zone & dips will be suggested again around near mentioned supports. On technical front index has given bullish flag breakout on hourly chart which suggest exiting trend can extend further towards immediate resistance zone of 15650-15700 zone.

Rupee traded weak towards 73.20 from 72.85, in the first half of day, the manufacturing index in the US provided crude positive trend which kept rupee on a weak note. Going ahead the rupee can be in range of 72.75-73.25.

On Wednesday Indian equity benchmarks made a pessimistic start tracking mixed cues from global peers. In the afternoon session, Indian equity benchmarks continued their weak trade on the back of sustained selling activities by market participants.

Most of the Asian equity benchmarks traded mixed in early deals on Wednesday, as the participants went wary amid the continued accelerating covid infections and the slowing economic activities with the lockdown restrictions to avoid fresh outbreaks.

Centre for Monitoring Indian Economy (CMIE) chief executive Mahesh Vyas has said that over 10 million Indians have lost their jobs because of the second wave of COVID-19, and around 97 percent of households' incomes have declined since the beginning of the pandemic last year.

The markets have been a tad weak today. This can be attributed to profit booking or offloading of positions. This does not disrupt the overall trend of the market which continues to look bullish. We should be looking at 15900 as the next potential target.

A good support lies at 15300 and as long as that level holds on a closing basis, the market trend is in the hands of the bulls. Traders can look at dips or intraday corrections as an opportunity to add long positions for higher targets.

Ahead of the MPC policy, domestic market continued its volatility with a mixed bias. Selling was witnessed in financials, IT and FMCG stocks but it reduced towards the close of trading. Weakness across US and Asian markets also added to the negative trend. PSU banks attracted buyers in hopes that the government will soon finalize the list for privatisation.

In the policy, RBI is expected to focus on economic growth by maintaining the status quo on policy rates and ensuring liquidity while keeping an eye on the inflationary pressure due to rising commodity prices.

Indices staged a smart recovery in late afternoon trade after being in the red for the most part of the day. Broader markets too displayed resilience as we saw interesting buying emerge in state-owned banks, auto ancillaries and in unlocking themes across sectors.

The market witnessed some lackluster movement and an attempt to hold the support level around the Nifty 50 Index level of 15500. Our research suggests, trading above 15250 is positive from a short-term perspective. Sustaining above 15250 levels, the market should gain momentum, leading to an upside projection till 15650-15700 level. The Momentum Indicators like RSI, MACD to lost their momentum after staying positive in recent time, indicating the chance of sideways correction.

Indian rupeeendedlower at 73.08per dollar, amidvolatile tradesawin the domestic equity market.It opened 18 paise lower at 73.08 per dollar against Tuesday's close of 72.90 and traded in the range of 73.04-73.31.

: Benchmark indices recovered from the day's low point and ended flat supported by the metal, auto and PSU banking names.

At close, the Sensex was down 85.40 points or 0.16% at 51849.48, and the Nifty was up 1.30 points or 0.01% at 15576.20. About 2101 shares have advanced, 951 shares declined, and 160 shares are unchanged.

UPL, Tata Steel, SBI Life Insurance, IndusInd Bank and Adani Ports were among major gainers on the Nifty, while losers included ITC, Tech Mahindra, Axis Bank, Asian Paints and Kotak Mahindra Bank.

Nifty auto, metal, energy and PSU Bank indices rose 1-3 percent. BSE Midcap and Smallcap indices added over 1 percent each.

Sun Pharmaceutical Industries today announced that one of its wholly owned subsidiaries has entered into a license agreement with Ferring Pharmaceuticals Pvt. Ltd., a subsidiary of Switzerland-based biopharmaceuticals MNC Ferring Pharmaceuticals, to commercialize a Room Temperature Stable (RTS) formulation of obstetric drug, CARITEC (Carbetocin RTS) in India.

Sun Pharmaceutical Industries was quoting at Rs 677.90, up Rs 6.65, or 0.99 percent on the BSE.

Lupin today announced that the USFDA has accepted the Biologics License Application (BLA) for its proposed biosimilar to Neulasta (pegfilgrastim) through a filing using the 351(k) pathway.

Lupin has touched a 52-week high of Rs 1,267.50 and was quoting at Rs 1,249, up Rs 40.35, or 3.34 percent on the BSE.