August 02, 2022 / 16:13 IST

Ajit Mishra, VP - Research, Religare Broking:

Markets hovered in a range and ended almost unchanged, taking a breather after the recent surge. After the flat start, the benchmark traded in a narrow band till the end. Finally, the Nifty index settled at 17,345 levels, after testing the resistance zone around 17,400 levels. Meanwhile, buying in sectors such as PSU banking, FMCG and auto and traction on the broader front kept the participants occupied.

We may see further consolidation in the index, to digest the recent gains. Meanwhile, choppiness would remain high due to the upcoming RBI policy meet outcome and prevailing earnings season. On the index front, a decisive close above 17,400 would help the index inch towards 17,800 levels. In case of any profit-taking, the 16,800-17,000 zone would act as a cushion. Participants should continue with the “buy on dips” approach.

August 02, 2022 / 16:03 IST

Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities:

Markets eked out modest gains, but more importantly continued its winning streak for the 5th straight session on selective buying in banking, auto & power stocks. However, bulls looked tired today, as at one point Sensex was down more than 300 points, but managed to reverse the trend at close.

Technically, after an intraday correction, the Nifty took support near 17200 and then recovered. The higher bottom formation on intraday charts is indicating continuation of an uptrend in the near future.

As long as the index is trading above 17200, the uptrend texture is likely to continue up to 17400-17450. On the flip side, below 17200, traders may prefer to exit from long positions, as the index could slip till 17150-17100.

August 02, 2022 / 15:58 IST

Kunal Shah, Senior Technical Analyst at LKP Securities:

The Bank Nifty index continued its upward momentum but failed to surpass the level of 38,000 on a closing basis. The index is already trading in oversold territory on the short-term time frame and a profit booking cannot be ruled out from the current levels.

The volatility is likely to increase ahead of the RBI policy and one should keep a buy-on-dip approach with immediate support at 37,400 levels.

August 02, 2022 / 15:52 IST

Rupak De, Senior Technical Analyst at LKP Securities:

Nifty remained rangebound during the day as the index remained within the bands of 17200 and 17400. On the daily chart, the index has maintained its uptrend.

The daily RSI is in bullish crossover and rising. The trend is likely to remain bullish as long as the Nifty holds above 17000. On the higher end resistance is visible at 17400-17500.

August 02, 2022 / 15:51 IST

Vinod Nair, Head of Research at Geojit Financial Services:

Global indicators did not favour bulls, with most Asian and Western markets trading over concerns of rising geopolitical tension between the US and China. Additionally, economic data point to a decrease in demand, major markets throughout the world are trading with recessionary fears.

The domestic market, however, has proven resilient thanks to increased demand in heavyweights and a strengthening Indian rupee underpinned by falling US treasury yields & FIIs buying.

August 02, 2022 / 15:35 IST

Rupee Close:

Indian rupee ended 31 paise higher at 78.71 per dollar against previous close of 79.02.

August 02, 2022 / 15:34 IST

Market

Close: Indian benchmark indices ended on flat note in the highly volatile session on August 2.

At Close, the Sensex was up 20.86 points or 0.04% at 58,136.36, and the Nifty was up 5.50 points or 0.03% at 17,345.50. About 1829 shares have advanced, 1460 shares declined, and 122 shares are unchanged.

IndusInd Bank, Asian Paints, NTPC, Maruti Suzuki and Power Grid Corp were among the major gainers on the Nifty. The losers included UPL, Hero MotoCorp, SBI Life Insurance, Britannia Industries and Tech Mahindra.

On the sectoral front, PSU Bank and Power indices rose 2 percent each, while Realty Index shed 1.7 percent.

BSE midcap and smallcap indices ended in the green.

August 02, 2022 / 15:23 IST

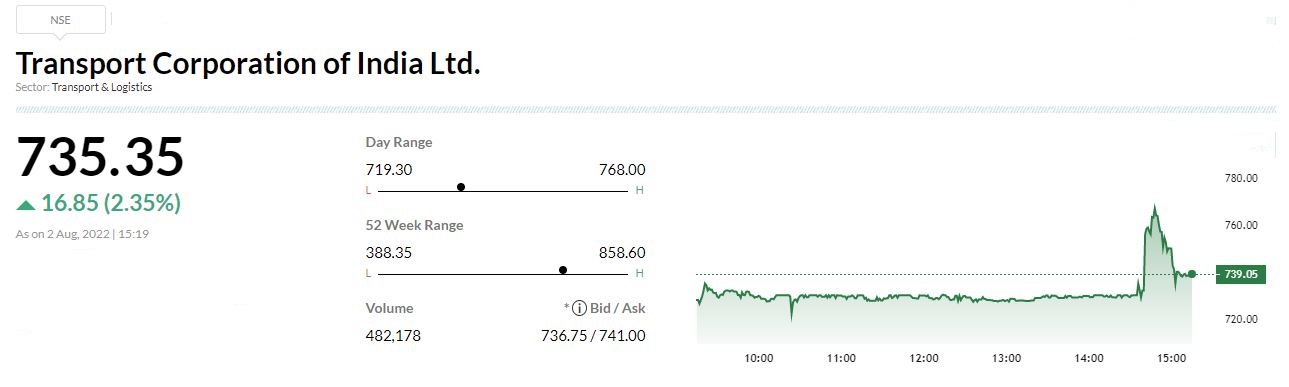

Transport Corporation Of India Q1:

Transport Corporation Of India has reported 65.9 percent rise in its Q1 net profit at Rs 77.7 crore against Rs 46.9 crore and revenue was up 29.7% at Rs 902.9 crore versus Rs 696.1 crore, YoY.

August 02, 2022 / 15:18 IST

Motilal Oswal View on ITC

We have turned constructive on the stock, led by: (a) a better-than-expected demand recovery and a healthy margin outlook in cigarettes, (b) robust sales momentum in the FMCG business, (c) lower drag from the Hotels business, and (d) better capital allocation in recent years.

While valuations of global Tobacco peers have returned to pre-COVID levels (Jan'19), at 18.8x FY24 EPS, ITC still trades at a 26 percent discount to its January 2019 valuations of 25.4x one-year forward EPS.

We maintain our earlier assigned 21x EPS multiple, a 65 percent premium to its global peer average, and roll forward to June 2024 earnings. The stock has done well, with gains of 17 percent since our upgrade to buy in June 2022. We see scope for further upside, based on a healthy earnings outlook. We maintain our 'buy' rating.

August 02, 2022 / 15:11 IST

Adani enters Industrial 5G Space

Adani Data Networks Ltd (ADNL), the digital connectivity solutions arm of the Adani Group, has acquired the right to use 400MHz of spectrum in the 26GHz millimetre wave band.

ADNL secured this spectrum for 20 years in the first ever 5G spectrum auction conducted by the Govt of India’s Telecommunications Department.

Adani Enterprises touched 52-week high of Rs 2,696 and was quoting at Rs 2,686.95, up Rs 28.05, or 1.05 percent on the BSE.

August 02, 2022 / 15:09 IST

Chandan Taparia, Vice President, Equity Derivatives and Technical, Broking & Distribution, Motilal Oswal Financial Services:

Nifty opened on a flat note and drifted towards its support zones making a low of 17215. Every declines are being bought in the market and the index is moving in a range of 150 points. India VIX has inched higher and is near 18 levels which is providing comfort to the market to scale higher. Now as long as long as the index trades above 17150 we can expect higher levels of 17350 and 17500 whereas on the lower side support is placed at 17150 and 17000. Market breadth is positive which is indicating buying interest at lower levels.

The overall trend is positive as long as the support levels are held. We can utilise any dip as a buying opportunity for higher levels. At current juncture, we are advising to be with selective stocks and one can look for buying opportunity in Kotak Bank, Bharat Forge and JK Tyre etc.

August 02, 2022 / 15:07 IST

Punit Patni, Equity Research Analyst, Swastika Investmart:

ITC has posted strong results beating expectations and performing well on all fronts. Stability in taxes and deterrent actions by enforcement agencies has enabled the company to gain volumes from the illicit channels in the cigarette business.

FMCG business has witnessed significant volume growth YOY and has been able to maintain margins despite the scorching inflationary environment. The hotel business is finally in the black and ARR & Occupancy are ahead of the pre-pandemic levels.

The Paper and Agri-Business segments have been the dark horses and have led to significant growth in terms of revenue and profitability on both YOY and QOQ basis.

We believe that the company is expected to generate higher returns over its cost of capital in the next decade due to its strong growth prospects in segments other than the cigarette and its ability to generate robust cash flows. Further, the rising investor’s interest will lead to a P/E rerating.

August 02, 2022 / 15:02 IST

Market at 3 PM

Benchmark indices were trading higher in the volatile session with Nifty above 17350.

The Sensex was up 165.11 points or 0.28% at 58280.61, and the Nifty was up 34.50 points or 0.20% at 17374.50. About 1836 shares have advanced, 1289 shares declined, and 128 shares are unchanged.