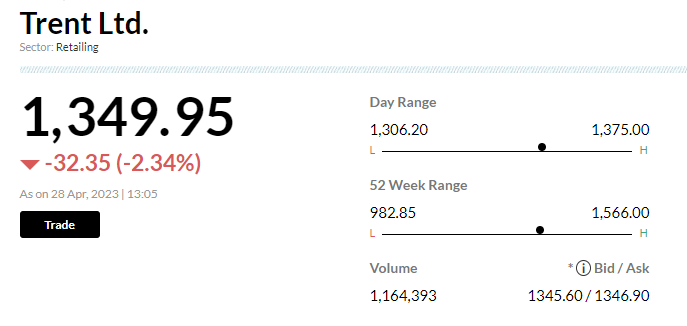

Tata Group's Trent has recorded stellar growth in topline and bottom line for the March 2023 quarter. Its net profit came in at Rs 54.2 crore against Rs 20.87 crore in the year-ago period.

Revenue from operations grew 64 percent YoY to Rs 2,182.8 crore from Rs 1,328.9 crore in Q4 FY22. While EBITDA (earnings before interest, taxes, depreciation and amortization) jumped 50.8 percent to Rs 203 crore, margins declined to 9.3 percent from 10.1 percent.

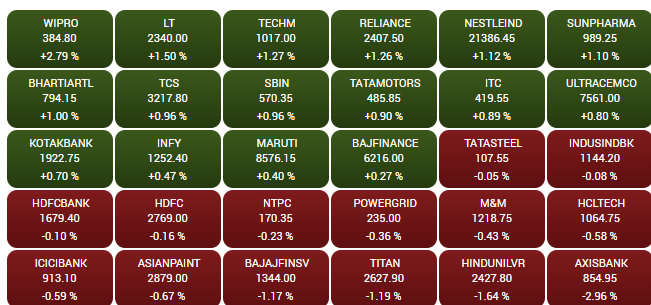

But, analysts are not too worried. According to ICICI Securities, the decline in margins can be attributed to the increased revenue share from Zudio, which accounts for approximately 35 percent of revenue based on their estimates.