April 25, 2022 / 16:25 IST

Ajit Mishra, VP - Research, Religare Broking Ltd.

Markets started the week on a muted note in continuation of the prevailing consolidation phase. Weak global cues triggered a gap-down opening in the benchmark however buoyancy in the select index majors, especially from the banking pack, capped the downside. Most of the sectoral indices ended lower and broader indices too lost in the range of 1.8-2.2%.

Markets have been witnessing erratic swings within a broader range, largely in reaction to global cues. Besides, the lack of support from the domestic front is further adding to the participants’ worries. We thus reiterate our cautious stance and suggest limiting leveraged positions.

April 25, 2022 / 16:10 IST

Gaurav Ratnaparkhi, Head of Technical Research, Sharekhan by BNP Paribas:

The Nifty had attempted a leap in the last week in order to fill up a gap area on the daily chart. The index faced fresh round of selling near the upper end of that gap area from where the index started sliding again.

The Nifty continued to roll down on April 25. It has again created a gap area on the daily chart today, which is near 17054 – 17149.

This will now act as a near term resistance zone & any attempt to fill up this gap area can be treated as a fresh shorting opportunity.

The overall structure suggests that the index is likely to stay on the downward trajectory for the short term & is expected to break the swing low of 16824 & tumble towards 16600 in the short term.

April 25, 2022 / 16:07 IST

Vinod Nair, Head of Research at Geojit Financial Services:

Global markets were painted red due to below-par earnings results, adding fresh concerns to elevated inflation, oil prices, war uncertainties and supply issue.

Fear of waning demand due to prolonged covid lockdown in China led to oil prices tumbling. Continued FII selling in India along with other global uncertainties is favouring bear trend in the short-term.

April 25, 2022 / 16:02 IST

Vishal Amarnani, Head -Fixed Income, Emkay Wealth Management:

After touching a 3-year level of 7.28%, India's 10-year bond yield has cooled off to near 7% levels. The monetary policy stance by global central banks has changed, so RBI's policy stance can’t be on a different page.

The fall in the yields could also be due to RBI buying or infusion of liquidity into the system. We are still expecting the G-Secs to touch 7.35% first and if it does not sustain that level it could rise to as high as 7.60 levels.

April 25, 2022 / 15:46 IST

Palak Kothari, Research Analyst at Choice Broking:

On back of weak global clues and rising covid cases, the Index had a gap down opening and showed weakness throughout the session as it made intraday low at 16888.70 level and closed the session at 16953.95 level with a loss of 218 points.

Technically, on an hourly chart, the index has been trading near the support zone and given closing below 17000 marks suggest bears are taking charge.

Furthermore, on a daily chart, the index has taken support from lower Bollinger band and 50% RL of previous up move, which indicates pullback can be seen in the counter. The index has given closing below 200-Daily Simple Moving Averages indicates weakness in the counter. However, the momentum indicators STOCHASTIC & MACD are trading with negative crossover on a daily Charts which indicates downside movement can be seen.

The Nifty may find support around 16800 levels, while on the upside 17240 may act as an immediate hurdle for the index. On the other hand, Bank Nifty has support at 35500 levels while resistance at 37000 levels.

April 25, 2022 / 15:34 IST

Market Close:

Benchmark indices ended lower for the second consecutive week on April 25 with Nifty below 17000 dragged by selling across the sectors amid weak global cues.

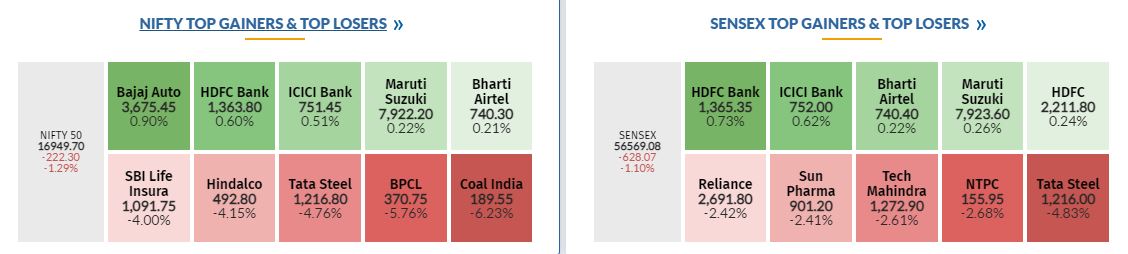

At close, the Sensex was down 617.26 points or 1.08% at 56,579.89, and the Nifty was down 218.00 points or 1.27% at 16,954.00. About 1008 shares have advanced, 2435 shares declined, and 136 shares are unchanged.

Coal India, BPCL, Tata Steel, Hindalco Industries and SBI Life Insurance were among the top Nifty losers while gainers included Bajaj Auto, ICICI Bank, HDFC Bank, Maruti Suzuki and HDFC.

Except bank, all other sectoral indices ended in the red with auto, capital goods, FMCG, healthcare, IT, power, metal, oil & gas, realty down 1-4 percent.

BSE midcap and smallcap indices lost nearly 2 percent each.

April 25, 2022 / 15:30 IST

JSW Steel clarifies on media report

It is reported in the Media recently attributing the news to unnamed sources that India’s JSW Steel Limited (“the Company”) submitted bid to buy Pawan Hans, which is under consideration by government authorities concerned, company clarifies.

It is hereby denied that JSW Steel Ltd submitted bid for acquisition of Pawan Hans Ltd and the company has no interest in this asset.The media report is baseless and has no substance, it added

JSW Steel was quoting at Rs 715.70, down Rs 7.95, or 1.10 percent on the BSE.

April 25, 2022 / 15:25 IST

Torrent Power acquires 50 MW solar power plant from SkyPower Group

Torrent Power has acquired 50 MW solar power plant from SkyPower Group.

It has entered into a Share Purchase Agreement (SPA) with SkyPower Southeast Asia III Investments and SkyPower Southeast Asia Holdings 2 for acquisition of 100% stake in Sunshakti Solar Power Projects, the special purpose vehicle that operates 50 MW solar power project in Telangana.

Torrent Power was quoting at Rs 536.40, down Rs 5.40, or 1 percent on the BSE.

April 25, 2022 / 15:20 IST

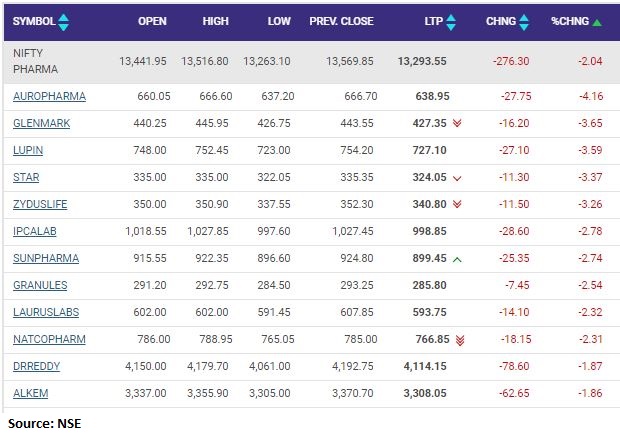

Nifty Pharma index shed 1 percent dragged by the Aurobindo Pharma, Glenmark Pharma, Lupin

April 25, 2022 / 15:18 IST

Credit Suisse keeps outperform rating on ICICI Bank

Research firm Credit Suisse has kept outperform rating with increased target price to Rs 870.

The Q4FY22 holding up on strong growth and profitability. Brokerage firm has tweaked FY23/24E by 1% on lower credit costs and continue to believe that ICICI Bank will deliver strong earnings with amongst the top picks, reported CNBC-TV18.

April 25, 2022 / 15:14 IST

Narendra Solanki, Head- Equity Research (Fundamental), Anand Rathi Shares & Stock Brokers:

Indian equity benchmarks opened in red following weak trade in Asian market peers as global sell-off triggered by aggressive US Fed tightening and China covid fears.

During the afternoon session markets failed to erase losses and traded at days low as sentiments were fragile as India's crude oil import bill nearly doubled to $119 billion in the fiscal year that ended on March 31, as energy prices soared globally following the return of demand and war in Ukraine.

Additional pressure came in as private report cut India's 2022-23 economic growth forecast by 70 basis points to 7 percent, citing slowing global growth due to high commodity prices, and weak local demand because of energy price hikes, inflationary pressures and a struggling labour market.

April 25, 2022 / 15:11 IST

BSE Information Technology index fell 1 percent dragged by the 63 Moons Technologies, Brightcom Group, Aurum PropTech

April 25, 2022 / 15:02 IST

Market at 3 PM

Benchmark indices were trading lower in the final hour of the trading with Nifty below 16700.

The Sensex was down 588.49 points or 1.03% at 56608.66, and the Nifty was down 212.20 points or 1.24% at 16959.80. About 859 shares have advanced, 2445 shares declined, and 115 shares are unchanged.