The Securities and Exchange Board of India (SEBI) has released a circular that streamlines the price band discovery of a scrip making its debut on the secondary market immediately after its IPO.

Before we unpack the nuances of how this price band is arrived at for a newly listed scrip, it is necessary to have a brief look at the growth of a particular price discovery mechanism called "call auction sessions".

Trajectory of call auction mechanism

The market regulator as far back as 2012 issued a circular prescribing parameters regarding the price discovery through call auction and the applicable price band for the first day of trading pursuant to IPO or recommencement of trading for re-listed scrips in a normal trading session. Via the new circular, SEBI is further streamlining the process of price discovery.

In a call auction session, the continuously performed order matching method conventionally practised in the market is set aside. Under call auctions, buyers quote the maximum price at which they will buy the shares and sellers also set a quote for the maximum price at which they are willing to sell. By adopting this process, the price instability in the market is controlled substantially.

Why did SEBI need to step in?

Call auction sessions are conducted on multiple stock exchanges, once a stock is set to trade for the first time after its IPO. It is a possibility that the discovered price or equilibrium price pursuant to such call auction sessions could be different on each exchange. If the difference in these discovered prices is significant, there could be a situation wherein price bands on individual exchanges are far apart from each other, giving an incorrect picture of the price band to investors.

What has SEBI mandated via the new circular?

Apprised of the peculiar problem, the market regulator, after discussion with the stock exchanges and with Secondary Market Advisory Committee (SMAC) decided that:

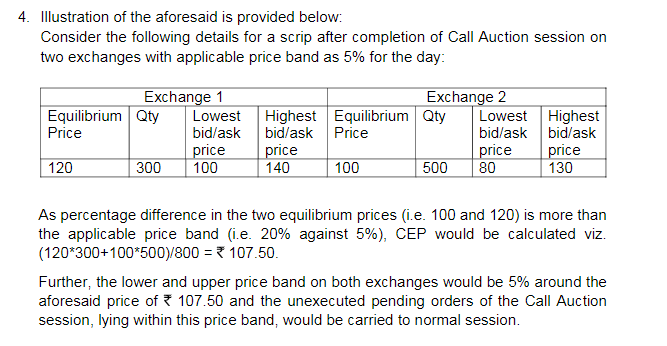

The following illustration from the circular can better explain the mathematical calculation of the CEP.

Mathematical computation of CEP

Mathematical computation of CEP

The circular shall come into effect from June 10.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.