Just when it seemed that interest rates had peaked, major central banks around the world embarked on a phase of monetary tightening, indicating that a decisive victory over inflation was still some way off.

The Reserve Bank of India kept the key policy rates unchanged for the second time in a row but it clearly mentioned that the fight against inflation was far from over.

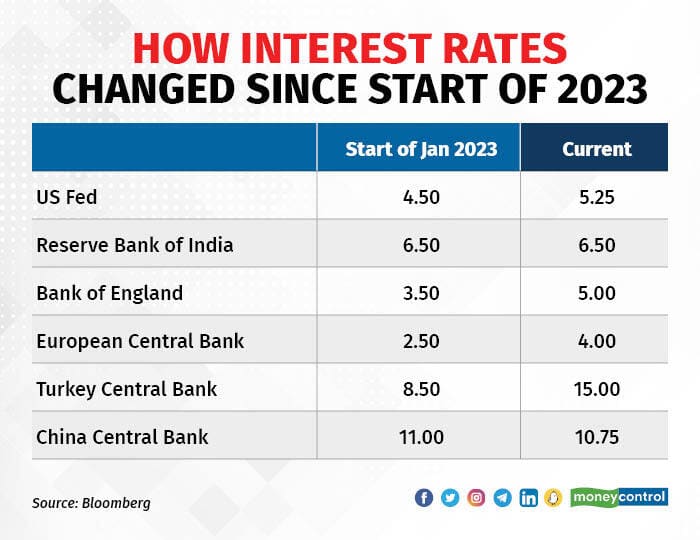

The Bank of England and the Norwegian central bank, however, raised the interest rates recently, while the European Central Bank has signalled further hikes. In Turkey, the central bank raised the rates sharply to control runaway inflation, sending the domestic currency in a tailspin.

Both the British and the Norwegian central banks took decisive actions by implementing half-point rate increases on Thursday, signalling an acceleration of their tightening measures. This followed the European Central Bank's recent decision to raise borrowing costs by another quarter of a percentage point and indicate the likelihood of another hike in July.

The Turkish central bank on Thursday delivered a massive 6.5 percentage point hike, taking the benchmark one-week repo rate to 15 percent from 8.5 percent after its inflation hit 40 percent in May. Post this, the Turkish lira saw a sharp decline of over 5 percent.

Investor confidence in the US has again turned edgy, as the US Federal Reserve has hinted at further rate hikes for the rest of 2023. The yield on two-year Treasuries reached a three-month high after Federal Reserve Chair Jerome Powell reiterated the need for additional rate hikes this year.

In Europe, concerns about the economic outlook led to an inversion in the German yield curve. In the US, unemployment benefit applications remained high, indicating a slight slowdown in the labor market. Additionally, high mortgage rates constrained demand for previously owned homes.

In India, the recent minutes from the RBI revealed a cautious sentiment. Jayanth R Varma, a member of the rate-setting panel, expressed concern that the current monetary policy is approaching levels that could potentially cause significant harm to the economy.

The RBI decided to keep the key short-term lending rate unchanged in the second consecutive review. The minutes of the meeting, however, highlighted varying opinions among the members of the six-member Monetary Policy Committee (MPC) regarding the future direction of rate hikes. Analysts are concerned over factors such as the delayed monsoon and higher prices of key vegetables like tomatoes. The MPC has indicated that it is premature to shift towards a cycle of rate cuts at this time.

China's central bank, meanwhile, took action by cutting two benchmark interest rates in an attempt to bolster economic growth. But the magnitude of rate cut was smaller than anticipated, which left investors disappointed. China's recovery from pandemic-related lockdowns and supply chain disruptions has been slower than expected, necessitating measures to address the situation.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.