PSU stocks have been witnessing healthy gains for over a year now as investors turned bullish and lapped up stocks from this space due to the government's clear intent in the disinvestment program.

The BSE PSU index has gained 38 percent in 2021 so far. It has jumped 66 percent since last year (June 12, 2020).

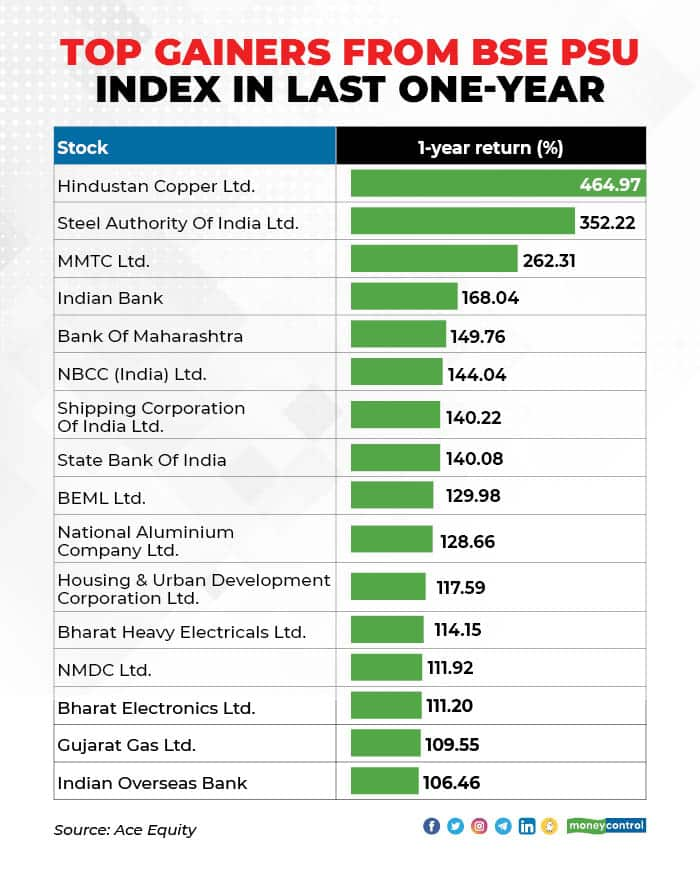

Out of the total 60 stocks in the BSE PSU index, as many as 16 have more than doubled in last one year, rising between 106 percent and 465 percent.

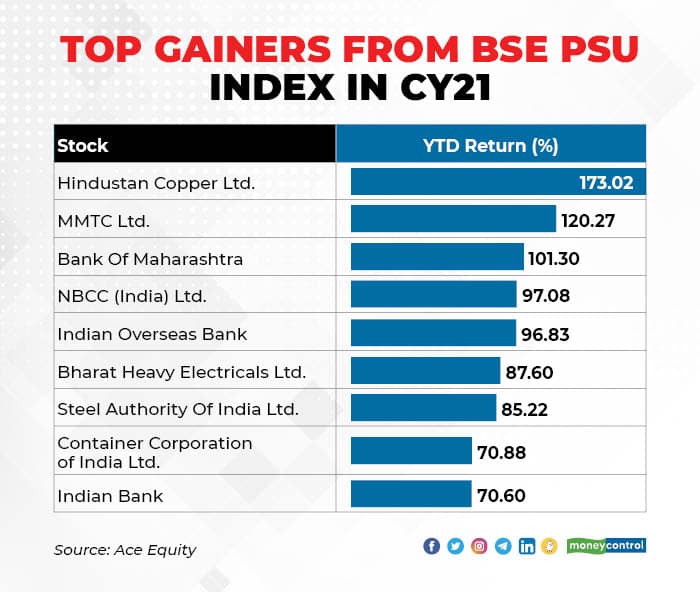

Year-to-date, shares of Hindustan Copper, MMTC and Bank Of Maharashtra have more than doubled, jumping up to 173 percent.

The government's focus on infrastructure, its visible intent of disinvestment, economic recovery and the end of the corporate NPA cycle are the main factors that have raised investors' interest in the PSU space.

The Union Budget 2021 unveiled a big plan for disinvestment, strategic sales and privatisation of PSUs which triggered a strong rally in this space.

Prashant Jain, Executive Director & Chief Investment Officer, HDFC Asset Management Company, which manages assets worth more than Rs 4 lakh crore, pointed out various companies under utilities, energy, several PSUs, EPC are trading below long-term average valuations, though companies under consumer-oriented sectors are trading higher.

"The opening up of the economy in the West and in India, end of the corporate NPA cycle, focus on infrastructure, etc. are supportive of some of the sectors that lagged behind during lockdown," said Jain.

PSU space has valuation comfort, too, which is positive as market participants are hunting for undervalued stocks.

PSU stocks, since their sharp fall in March 2020, had not participated in the market rally till they got noticed towards CY20-end when investors realised the deep value in them, Hemang Jani, Head Equity Strategist, Broking & Distribution, Motilal Oswal Financial Services pointed out.

"The long-term investors flung to these highly undervalued stocks as they saw a good opportunity to buy them at those levels. Since PSU stocks have seen strong gains and are still highly undervalued, they continuing to attract investors," Jani said.

Rusmik Oza, Executive VP, Head of Fundamental Research at Kotak Securities underscored that the BSE PSU index is still trading cheap at 9 times on a 1-year forward PE basis, as compared to 20.5 times of Nifty50.

"While the Nifty50 is trading at a new high and also at higher valuations, the BSE PSU index is still way below its previous peak on absolute levels as well as on forward PE basis. Since most pockets of the market are full in terms of valuations investors are hunting for undervalued stocks and PSU stocks fit in properly in this context," Oza said.

"The strategic divestment of select PSUs can lead to re-rating in other PSU stocks which is another trigger being seen by investors. The higher dividend yield provides some margin of safety in case of select PSU stocks," said Oza.

Value scoring over growth?The mouth-watering rise of PSU stocks has raised a question as to what should one prefer - value or growth - while betting on PSU stocks.

Jains’ flagship funds have seen a turnaround with a value investing approach, while the PSU stocks rallied over the last six months.

Jani of Motilal Oswal pointed out that very optimistic growth estimates have been built in these stocks for the next two years which if missed would result in a sharp correction in their stock prices.

On the other hand, PSUs despite their rally still have deep value in them. Besides, the earnings of some PSUs have improved considerably. Thus with markets at all-time high and Nifty valuations not being inexpensive anymore, value investing is now scoring over growth, Jani said.

What should you do?Experts are of the view that as the second wave of COVID-19 has hit the government's finances, they may be forced to accelerate the disinvestment process to generate funds. Further, the majority of PSUs operate in the core

economy and thus with economic revival gradually picking up, these companies are set to benefit especially post divestment or privatisation.

However, Jani believes one should not go overboard on PSU stocks and should be selective in their approach.

"A few select pockets in PSUs are definitely good for investment as they have been dirt cheap with a good dividend yield. Investors should individually evaluate each PSU and then invest in it based on its future potential," Jani said.

Jitesh Ranawat, Head Institutional Sales, Marwadi Shares and Finance, said investors should book profits wherever the gain is more than 300 percent as it may not be repeated going forward.

Also, as the economic activities pick up we may see companies utilising their existing capacities and might go for new capacities building which will trigger higher credit growth in the second half, said Ranawat.

"We would recommend looking at stocks in power, banking, cement, infra, capital goods space as they will be driven by the government spending program which could trigger the next move for the markets going forward," said Ranawat.

Oza said one needs to be selective in PSU stocks and invest based on merits, fundamentals and valuations.

"Wherever stocks have risen disproportionately and there is a limited upside, investors should book profit. On the other hand, investors can remain patient with stocks which are still undervalued or reasonably valued either in relation to peers or based on their historic valuation band," said Oza.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.