Prabhat Dairy shares were locked in 5 percent upper circuit for the second straight session on Monday, even though promoter created a pledge on additional 9.23 percent stake on March 13.

The stock was quoting at Rs 68.95 and there were pending buy orders of 59,188 shares, with no sellers available on the BSE, at 13:45 hours IST.

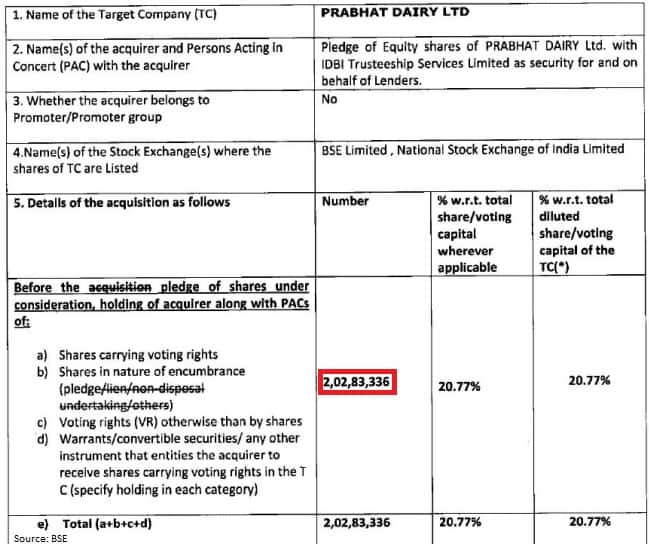

Promoters already had pledged more than 2.02 crore equity shares as of December 2018 quarter, showed BSE data. That is 41.45 percent in comparison to total promoter shareholding of 50.10 percent in the company.

The statement said additional 90.19 lakh shares, or 9.23 percent stake, is pledged with IDBI Trusteeship Services Limited as security for and on behalf of lenders.

With this, considering the release and shareholding pattern, total 30 percent stake pledged by promoters.

"This rally could be on the back of likely distribution of sale proceeds from dairy business in the form of dividend and also even if they pledged shares, the market cap is far less than the amount they are getting from dairy business sale, so no need to worry," experts said on the condition of anonymity.

In January, Prabhat Dairy said it would be selling its flagship dairy business for Rs 1,700 crore to French multinational Groupe Lactalis.

The amount at which it is selling the dairy business is much higher than the company's current market capitalisation of around Rs 670 crore.

The company entered into definitive agreements with Tirumala Milk Products, a wholly-owned subsidiary of Lactalis, for the Rs 1,700-crore sale, said the statement.

The transaction involves sale of the dairy business undertaking of Prabhat Dairy by way of slump sale on a going concern basis, as well as the sale of 100 percent shareholding in Sunfresh Agro Industries, a subsidiary of Prabhat Dairy, via a share purchase agreement, it said.

The stock surged 23 percent in last one month, but fell 59 percent in past one year.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.