The recent SEBI circular on the Multicap funds might lead to inflows into quality small & midcaps, more so into the smallcap space, suggest experts. This might push some of the smallcap stocks into the midcap category.

Although it is still a developing situation, experts feel that some amount of money, if not the earlier estimated amount of over Rs 20,000 crore, will get trickled into the broader market space.

The sharp rally in most of the mid & smallcaps has narrowed the valuation gap between the large and the midcaps. This could lead to quality stocks getting extra premium, at least in the short term.

Listen | Setting Sail: The question is not if, but when will India become a $10 trillion economy“The forward PE of Nifty Midcap Index is way above that of Nifty suggesting overvaluation in midcaps. The overall market valuations are on the higher side with Nifty trading at ~22x on a one-year forward basis,” Rusmik Oza, Executive Vice President, Head of Fundamental Research at Kotak Securities told Moneycontrol.

“Considering the rich valuations of the market and not much undervaluation of mid & small caps vis-à-vis large caps, I don’t think we will have a major change in the market-cap orientation. We might see a handful of small caps becoming mid-caps due to the SEBI circular on multi-cap funds,” he said.

Based on past experiences, only a handful of stocks on a regular basis move up from mid to largecaps although more smallcaps get converted into midcaps.

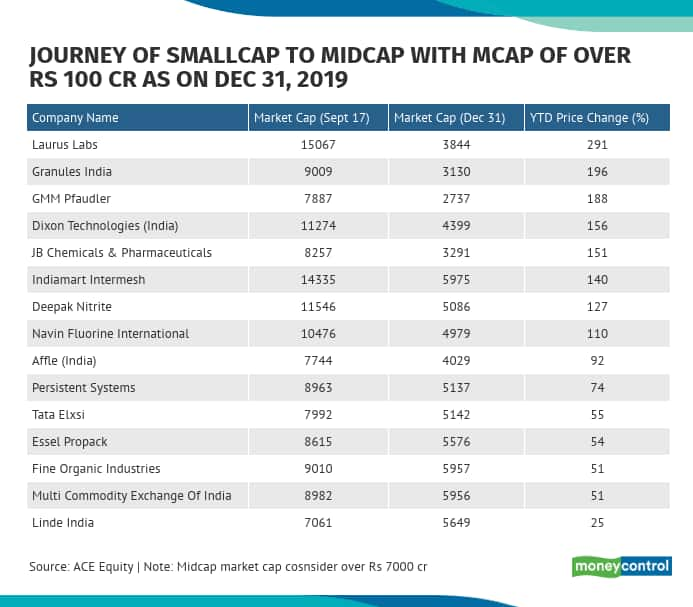

In 2020 so far, as many as 15 companies have entered the midcap category when compared to December 31, 2019. And 8 out of these 15 companies have risen rose more than 100%. These include Laurus Labs, Granules India, GMM Pfaudler and Dixon Technologies.

If we go by the cut-off definition of SEBI, top 100 stocks on the exchanges fall under the largecap category, as of June 30, 2020. The 100th stock had an average market-cap of Rs 26,677 crore during Jan-June 2020 period. Following that, number of stocks falling under the category of midcaps is another 150.

This means above Rs 7,000 crore market-cap we have just ~250 companies that cover both large & midcap space. Then, between Rs 1,000 crore and Rs 7,000 crore market-cap we have another 370 companies with most of them on the lower side of the range.

What should investors do?The classification of stocks into different market-caps has little to do with the performance in terms of return generation. There will definitely be a churn in market-cap among small and midcap stocks but it will not be widespread in terms of size, suggest experts.

“The change in market cap should not bother investors if the underlying fundamentals of the companies are strong which will eventually generate returns for the investors,” Dinesh Rohira, Founder, CEO - 5nance.com told Moneycontrol.

“Further, it should be seen how the mutual fund industry will come out after coming into terms with SEBI for the Multicap category, and how much is actually flowing in the broader market. Investors can take cues after getting a complete clarification,” he said.

If we look back to 2017-18, large became mid and the mid-cap became small in a falling cycle. Hence, market cycles could well turn the fortunes of investors.

“Just by this one prescription, it may not be wise to get too overexcited about the future of all small and midcaps. This prescription may have lifted the valuation of select stocks (80-100) that are fancied by the funds to some extent,” Deepak Jasani, Head of Retail Research, HDFC Securities told Moneycontrol.

“A lot will also depend on the flows that we get from abroad and into mutual funds. Plus the overall market sentiments should not reverse in the interim,” he said.

There is a valuation comfort for most of the small & midcaps. So if we compare it with large-cap, the valuation are still well above 5-year multiples, but for the small and midcap, valuations are still below 5-year avg multiples.

One reason for comfortable valuations could be due to the 2-years of a bear market, but now even the retail investors are becoming smarter, and wiser.

“Information is getting spread fast and rise of D-mat accounts last year also shows increased interest. Retail investors however need to be cautious while selecting good companies from these spaces as on many parameters like growth sustenance, free cash flows or improving return on equities many companies fail and many of the stories are temporary,” Pritam Deuskar, Founder of Wealthyvia.com told Moneycontrol.

“Companies where sector itself is doing better, management is focused on growing company and shareholder’s wealth creation, product or services are scalable are preferred,” he said.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.