Shares of major domestic information technology companies have been hammered, collateral damage of the reassessment unfolding globally against valuations of technology and allied sectors.

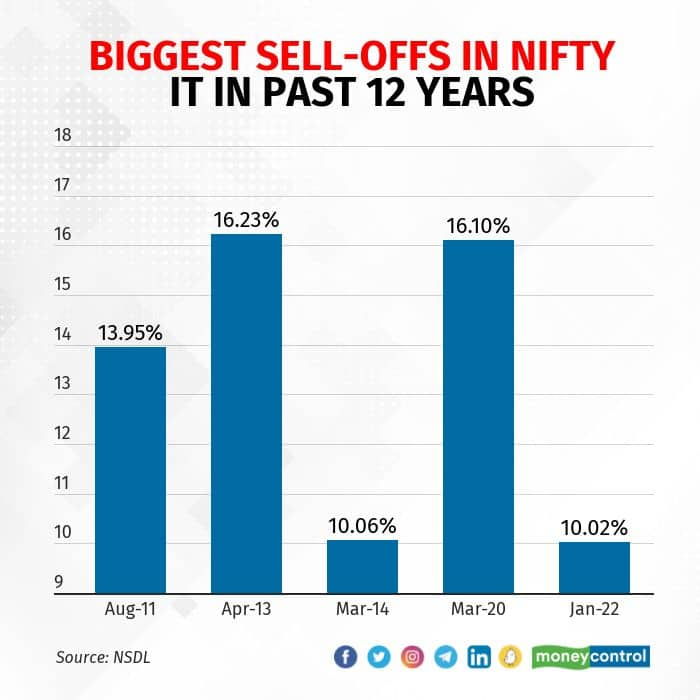

The IT sector, which was the darling of the bull market throughout most of 2020 and 2021, has seen the worst start to a calendar year since 2008, reflecting the intensity of the selloff.

The Nifty IT has fallen more than 11 percent in 2022, so far, as investors turn pessimistic over the sustainability of the sector’s rich valuations amid the possibility of a sharp increase in interest rates at home and abroad.

The sector has been clubbed by investors in the larger technology basket, which is in a bear grip for the past three months as investors bet on the US Federal Reserve raising interest rates at least four times this year alone amid multi-decade consumer price inflation.

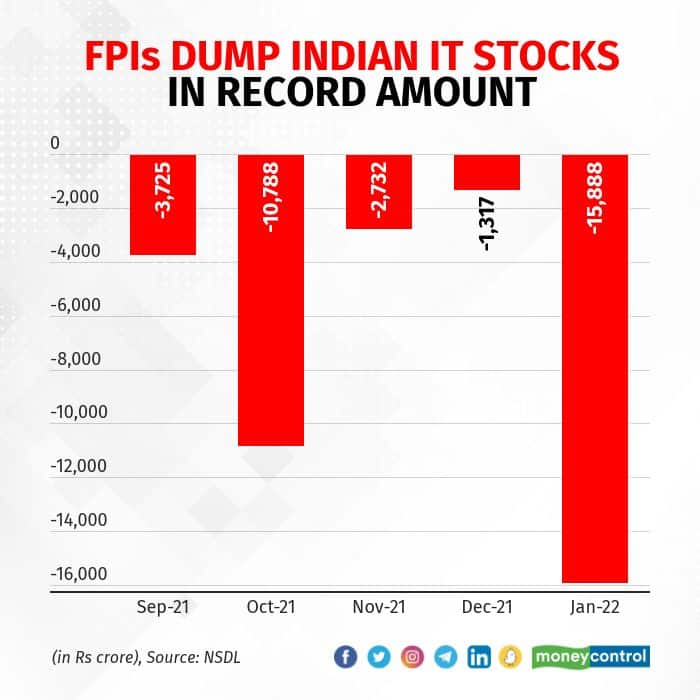

Foreign portfolio investors net sold software stocks worth Rs 16,000 crore in January, taking overall selling in the past five months to close to Rs 34,500 crore, data available on National Securities Depository Limited shows.

The sell-off also comes amid emerging doubts over the sector’s fundamentals, with sceptics pointing to lowering deal sizes in the industry, growing pressure on margins and continued challenges in retaining talent.

Among the challenges, the risk of higher attrition rates across the Indian IT sector has been the biggest concern for investors.

Nearly every major listed IT company reported a worsening of the attrition rate in the quarter ended December, which in some cases jumped to as high as 20-25 percent.

Brokerage firm Edelweiss Securities, however, argued that the surge in attrition rate is a leading indicator of the tsunami of potential deals that these companies could see over the next five years.

“A nuanced take based on our experience is that industry-wide high attrition should not be a turn-off; it is, from a forecasting perspective, a lead indicator of an extremely strong demand environment,” Edelweiss Securities said in a recent note.

The research firm expects the challenges to dissipate in the coming quarters, as the new workforce that has been hired in large numbers over the past year and a half completes training and contributes to numbers.

“Furthermore, our several interactions with global technologists experts convincingly back up our observation—that cloud sales of hyperscalers can lead to three times services revenues spread over the next five, six years,” Edelweiss said.

Industry body National Association of Software and Services Companies (NASSCOM) in 2021 predicted that IT services sector revenues could hit $300-$350 billion by 2025.

Edelweiss Securities said NASSCOM’s projection is the most pessimistic case for the sector considering the demand environment.

“We see this (correction) as an opportunity. Short-term corrections like these are an opportunity to buy from a short-term and long-term point of view,” said Vikash Khemani, founder at Carnelian Asset Advisors.

His optimism is borne out by data, too, given that over the past 13 years such episodes of more than 10 percent correction in the Nifty IT index, have only seen the index go on to give average returns of more than 110 percent before the next steep correction.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!