Indian benchmark equity indices gained on June 13, with NSE Nifty 50 hitting a new all-time, and trading firm near 23,400 on the weekly expiry day. However, the index may find it difficult to rise further, and may consolidate from these levels, said experts.

"Nifty has broken its all-time high but has struggled to move higher from these levels. This indicates mixed signals and a tug-of-war between the bulls and bears,” said Rahul Ghose, CEO of Hedged.in. “Options writers' data for today also show increased call writing above the 23,400 levels, indicating a possible correction or sideways movement from the present levels,” he added.

Ghose noted that recent indicators suggest economic activity has continued to expand at a solid pace. Job gains have remained strong, and the unemployment rate has remained low. Although inflation has eased over the past year, it remains elevated.

Nifty outlook and strategy for today's expiryTechnical view: The Nifty pivot has shifted to 23,350 levels. The buy zone for Nifty spot is in the range of 23,185 to 23,230, with the extreme low ‘buy’ at 23,000. The ‘sell’ zone is in the 23,415-23,460 range. Any breakout above this zone could lead to the index rising to 23,610. However, options data shows the max pain is at 23,200, suggesting Nifty may not sustain higher levels. Any intraday correction towards the max pain should be an opportunity to build long positions on the weekly expiry day.

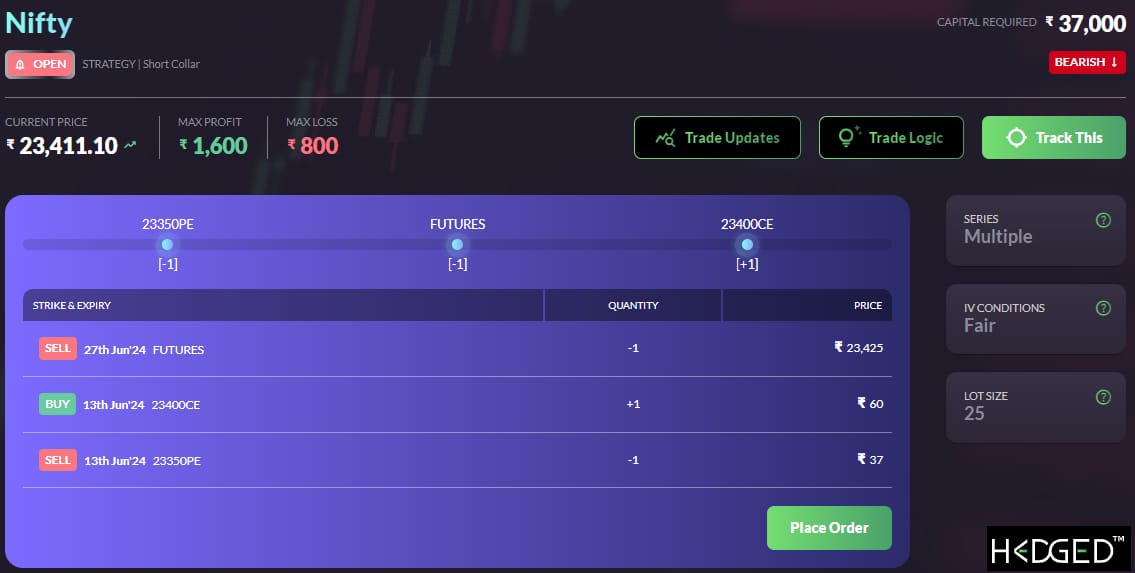

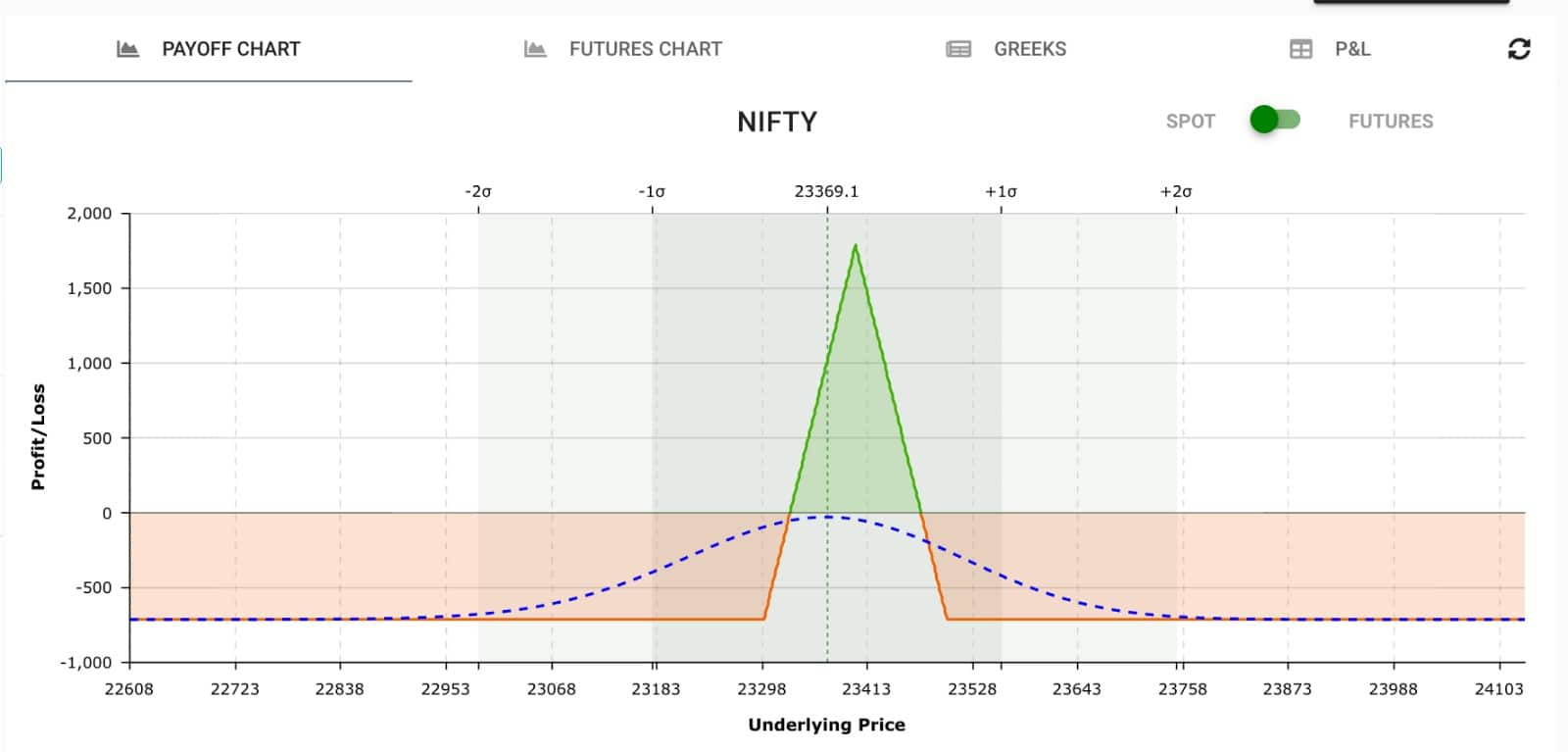

Low-risk option strategy, recommended by Rahul Ghose: With a downside view on Nifty, here is a low-risk options strategy, which profits if Nifty falls by the end of today's expiry session.

Nifty Bearish Collar

Buy 1 lot 13 June expiry 23,400 CE (call option) at CMP (current market price)

Sell 1 lot 13 June expiry 23,350 PE (put option) at CMP

Sell 1 lot 27 June expiry futures at CMP

This strategy limits potential losses to Rs 800 per unit, even if Nifty does not fall.

Trade Rules:Capital required: Rs 37,000

Entry: If Nifty trades between 23,400 and 23,450

Maximum loss: Rs 800

Target: 2-3 percent on the capital, depending on time and individual risk appetite

Trade Modifications: Protection is in place, and modification is required only if Nifty spot price goes above 23,500. If this happens, the short put can be moved up from 23,350 to 23,400 to collect more credit.

Riyank Arora - Technical Analyst at Mehta Equities:Technically, Nifty has significant resistance at 23,500 and immediate support in the 23,250-23,300 zone. Any pullback towards the support zone should offer a good buying opportunity. However, due to outstanding call writing, it may be difficult for Nifty to surpass the 23,500 mark. “We expect Nifty to stay within the 23,300-23,500 range for today's weekly expiry.”

Sell 1 lot of 13 June 23,400 CE @ Rs 41.5

Buy 1 lot of 13 June 23,500 CE @ Rs 14.2

Sell 1 lot of 13 June 23,400 PE @ Rs 78.45

Buy 1 lot of 13 June 23,300 PE @ Rs 34.25

Max Profit: Rs 1,788

Max Loss: Rs 712

Breakeven: If Nifty expires in 23,329-23,471 range

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.