Indian markets moved in a narrow range throughout the week and closed marginally lower. The week saw foreign portfolio investors selling Rs 4634.36 crore worth of shares during the week.

Despite a subdued week PSU Banks gained 4.08%, Capital Markets gained 3.35% while defence stocks rose 2.73% during the week.

Europe and US markets rebounded during the week after President Donald Trump announced the delay in introduction of a new 50% tariff on imports from the European Union.

The chart below shows the performance of world markets.

The market is currently moving within a narrow range, with no new triggers on the horizon. It may continue in this manner unless a domestic or global event influences it in one direction.

Rangebound MarketThe Nifty index closed lower for the week, while the Bank Nifty experienced a positive trend for the third consecutive week. Volume was notably high on the last trading day of the week, primarily due to some block trades. However, in the medium term, we do not see any overbought signals despite a loss of short-term momentum.

There may be a sector rotation that could improve the market outlook. The phrase "sell in May and go away" is now behind us since May has ended. June is likely to usher in a new trend, influenced by what still appears to be a considerable amount of negative sentiment.

Currently, 47% of stocks are above the 200-day moving average, which indicates we are only about halfway to the peak. This means we are no longer in an oversold position, but we haven't reached an overbought state either.

Source: web.strike.money

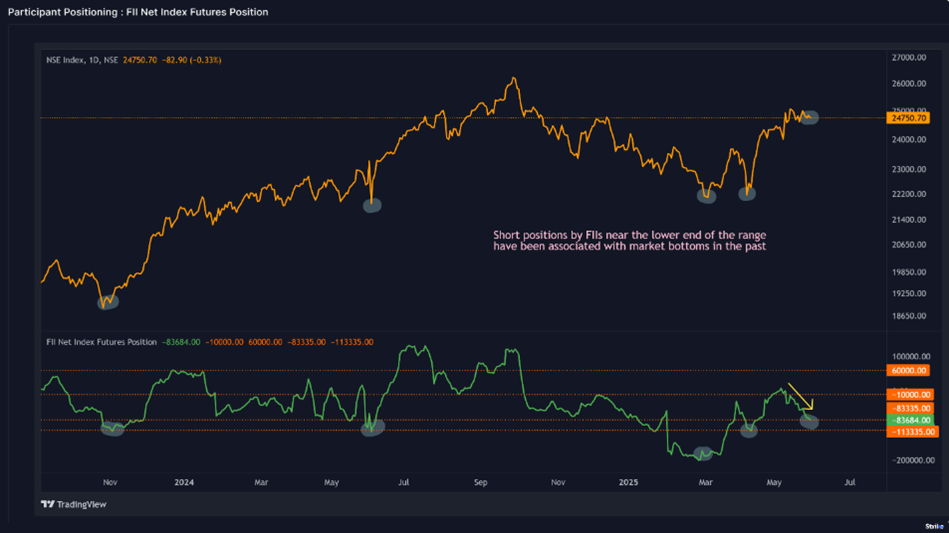

FIIs have decreased their small long positions and have increased their short positions leading into the expiry and on the first day of the new series. We are currently back at the lower red line. This negative sentiment needs to be countered by a rally in the stock market.

Source: web.strike.money

The daily swing indicator has spent the last nine days oscillating between 29 and 58, providing no clear trend signals or indications of being oversold. For now, we will focus on other matters.

Source: web.strike.money

Sector RotationNifty 50 – The Benchmark Index, corrected down by 0.41% and closed at 24750.70.

Indices positioning on Weekly Timeframe

Weakening Quadrant: None of the Sector Indices is in this quadrant.

Lagging Quadrant: Nifty Metal and Nifty Pharma continued to show weakness. Nifty IT is a relatively underperformer, but its Relative Strength momentum has increased.

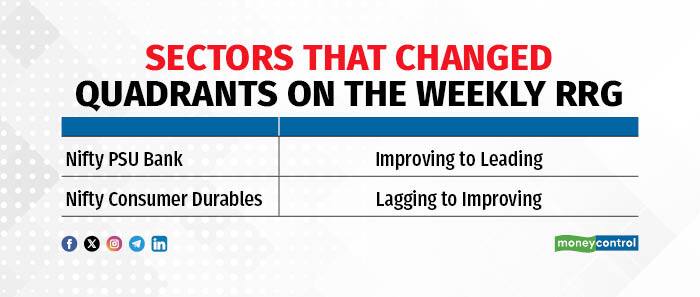

Improving Quadrant: Nifty Media, Nifty Realty, Nifty Auto and the new entrant-Nifty Consumer Durables, are showing signs of improvement where their Relative Strength, as well as their momentum, is on the rise. Whereas Nifty Energy, Nifty FMCG, and Nifty India Consumption, their Relative strength is increasing, but at a diminishing rate. If this continues, they may not enter the Leading quadrant and instead enter Lagging.

Leading Quadrant: Nifty Oil & Gas, Nifty Infrastructure, Nifty Pvt. Bank and Nifty Financial Services are stronger than the benchmark but seem to be losing their pace and headed South towards the Weakening quadrant. Nifty Bank is steady, and the sector to watch out for is the new entrant Nifty PSU Bank, with rising Relative Strength and RS momentum.

Daily RRG:

Weakening Quadrant: Nifty Oil & Gas, Nifty IT and Nifty Auto are relative outperformers but are losing their RS Momentum.

Lagging Quadrant: None of the sector indices are in this quadrant.

Improving Quadrant: Nifty Bank/Pvt Bank/Fin Service / FMCG have gained significant RS Momentum and have entered from the Lagging quadrant. If the Momentum continues, they can enter the Leading quadrant next week. Nifty Pharma, India Consumption, and Consumer Durables have shown weakness and started losing their relative strength momentum. This can take them to the Lagging Quadrant.

Leading Quadrant: Nifty Infrastructure is still playing around the fence between the Leading and Weakening quadrants. Nifty Energy, Metal, Media, and Realty have remained Leaders this week but are seen to be losing their relative strength momentum, which can drag them towards the Weakening quadrant. The Sector that could Lead next week is undoubtedly Nifty PSU Bank, which has shown an increase in its RS Momentum in this quadrant.

Stocks to watchAmong the stocks expected to perform better during the week are HDFC Life, BEL, MFSL, APL Apollo, Solar Industries, ICICI Bank, HDFC AMC, Divis Lab, Chola Fin, SBI Card and HDFC Bank.

Cheers, Shishir AsthanaDiscover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.