Dear Readers,

In a spectacular display of market dynamics, Indian financial markets soared to new heights last week, achieving significant strides within a remarkably brief timeframe and marking their most substantial weekly gain in the past 16 months. The Bharatiya Janata Party's (BJP) performance in the state elections undeniably fuelled the impetus behind this bullish surge. The markets commenced the week with a notable gap-up opening, sustaining an upward trajectory as traders hastily covered their short positions.

Benchmark indices shot up by 3.47 percent during the week, which saw renewed interest on Friday after the RBI announced its credit policy and revised its growth forecast from 6.5 percent to 7 percent.

Besides favourable political and economic conditions, fund flows further supported the market. Foreign investors made a formidable entry into the Indian market, aggressively rectifying their short positions in the derivative market and assuming substantial positions in the cash market.

Typically, following a rapid rally, the market undergoes a consolidation phase, patiently awaiting the next catalyst to determine its future trajectory.

An Over-heated Market

Nifty closed the week higher for the 6th consecutive week and at 20969 trades in new territory. As per the Fibonacci retracement/extension, 21050–21100 is likely to be a significant resistance level on the way up. In the forthcoming trading sessions, if the Nifty index is unable to close and sustain above 21100 and instead closes below 20700, then the breakout may start looking like a bull trap.

A large part of the rally in the market was FIIs covering their short positions and going long in the market (index futures) with 36,502 contracts. There is still room for them to increase their position to 60,000 contracts, considered an overbought zone, as seen in the chart below.

Source: web.strike.money

Source: web.strike.money

While FIIs have gone long on the market, clients have started shorting it. The clients' positioning in the index futures suggests we are closer to the top. Currently, it stands at 46,381 contracts. In July, the client’s net short position in the index futures was around 75000 contracts. The implication is that the Nifty index can form a medium-term top. A break of support level or closing below short-term daily averages will be an initial warning of a top formation.

Source: web.strike.money

Source: web.strike.money

The swing has cooled off in the past few days and the Nifty index has consolidated during the same time. The last time something similar happened was two weeks back. The Nifty index consolidated for a few days and the swing reading corrected from 92 and nearly fell to 28 levels. Once the Nifty index broke out from the consolidation zone, it saw a 1000-point rally.

However, in the recent runaway rally, the swing topped out at 75, and it has started to decline, indicating a loss of momentum on the upside. The past three days' low was around the 20850 level, an important support level to watch out for in the near term. A close below 20850 can lead to a short-term correction. On the flip side, if 20850 holds on a closing basis and the swing starts inching higher, we can expect a continuation of positive momentum in the near term.

Source: web.strike.money

Source: web.strike.money

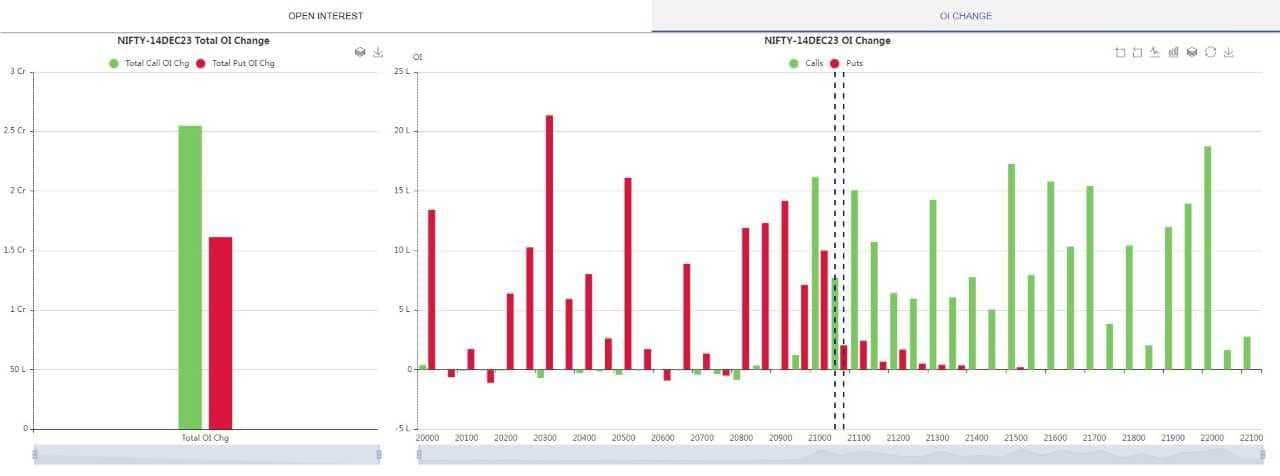

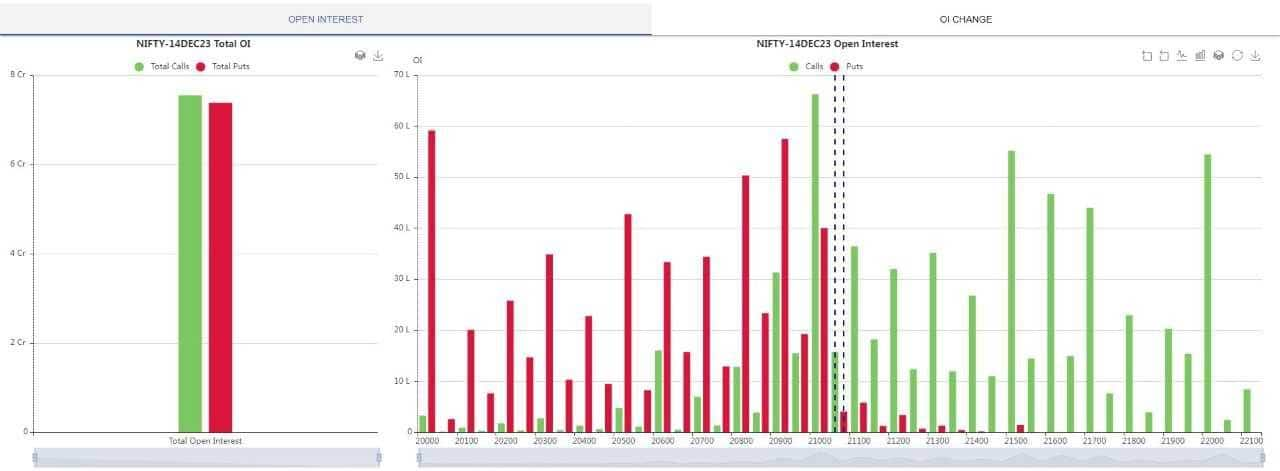

Options Data

Options data also suggests consolidation ahead. Call writers have been aggressive towards the second half of the week as profit booking started in the market, as seen in the chart below.

Source: ichart.in

Source: ichart.in

Presently, the market is evenly poised with put writers almost matching the call writers. Even the highest call and put open interest position is only one strike apart, indicating not much movement in the market, unless there is a sharp move, which can lead to a panic covering of position in either direction.

Source: ichart.in

Source: ichart.in

Indices and Market Breadth

After a long time the frontline stocks gave the smaller indices a run for their money. While the benchmark index gained 3.47 percent during the week, BSE Small-cap, BSE Mid-cap, and BSE Large-cap indices rose 3.8 percent, 2 percent and 1.3 percent, respectively and also touched record highs. Nifty touched the 21,000 level briefly before closing at 20,969.

BSE Power index was the star performer of the week, rising 13 percent, followed by BSE Oil & Gas index rising 7.6 percent, and the BSE Bank index up by 5.3 percent. BSE FMCG index moved in the other direction, falling 0.3 percent in the week.

Among the top stock performers of the week were Spencer Retail rising 51 percent, BCL Industries up by 35.69 percent and 63 Moons Technologies gaining 27.60 percent.

Among the losers were sugar counters led by Uttam Sugar Mills at 21.48 percent, Avadh Sugar & Energy at 18.39 percent and Balrampur Chini at 16.71 percent.

The week saw FIIs continued buying and injecting Rs 26,505 crore into the Indian equity markets in the first six trading sessions of this month. During the week, FIIs bought Rs 9,285.11 crore, while domestic institutions bought Rs 4326.47 crore worth of shares in the cash market.

Global Markets

World equity markets had a good run during the week, with the US markets closing higher for the sixth week running. The S&P 500 rose 0.21 percent, recording its longest winning streak since November 2019. The Dow closed marginally higher with a gain of 0.01 percent to post its sixth straight weekly gain. Nasdaq gained 0.69 percent during the week.

US markets were bullish on hopes that the Fed has finished raising rates.

The European markets also closed in the positive for the fourth consecutive week. While the DAX closed 2.21 percent higher, CAC closed 2.46 percent, and FTSE gained 0.33 percent. The All European Euro Stoxx 50 gained 2.35 percent in a week.

Asian markets, however, underperformed, with the Japanese Nikkei closing 3.36 percent lower on fears that the Bank of Japan might abandon its negative interest rate policy sooner than expected.

Shanghai fell by 2.05 percent and Hang Seng by 3.01 percent after rating agency Moody’s cut China’s outlook from “stable” to “negative”.

Stocks to watch

Though the market is expected to consolidate, some stocks continue to show strength. Stocks where strong momentum is expected to continue are Axis Bank, Can Fin Home, India Cements, PFA, REC, SBI Life, and Titan.

Cheers, Shishir Asthana

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.