As the dust appears to settle on the elections and the market regains some sense of normalcy after Manic Monday, Terrible Tuesday, and Whopper Wednesday this week, a Moneycontrol poll of market experts predicts that the Nifty could see further downside from current levels during the course of this year. The good news: about two thirds of market experts polled said the fall will be temporary and the market will close calendar 2024 higher from current levels. Nifty is currently trading close to 23,000.

The Moneycontrol poll included 24 experts across all major market categories: brokerages, mutual funds, PMS, AIF, and traders.

A total of 67 percent of the experts polled said that the benchmark 50-share Nifty is yet to touch its low for the year and could see a further dip. Interestingly, a similar percentage of respondents (66 percent) predicted a closing above 23000. At 1:49 pm, Nifty was trading at 23,232.

Follow live market updates here

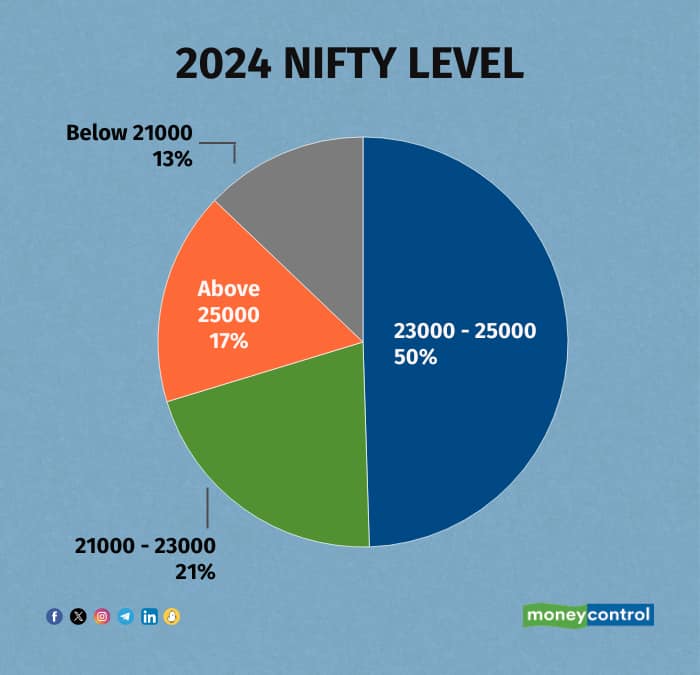

Half of the respondents were of the view that the Nifty would end the current calendar year between 23,000 and 25,000, indicating a return of 9 percent at the higher end. Sixteen percent predicted an annual closing above 25,000. Seventeen percent of respondents predicted a range between 21,000 and 23,000, indicating a downside of 9 percent, while 12 percent predicted a close below 21,000.

So far this year, the Nifty has gained 5.68 percent. The Nifty touched a low of 21,239, which is 8 percent below the current level.

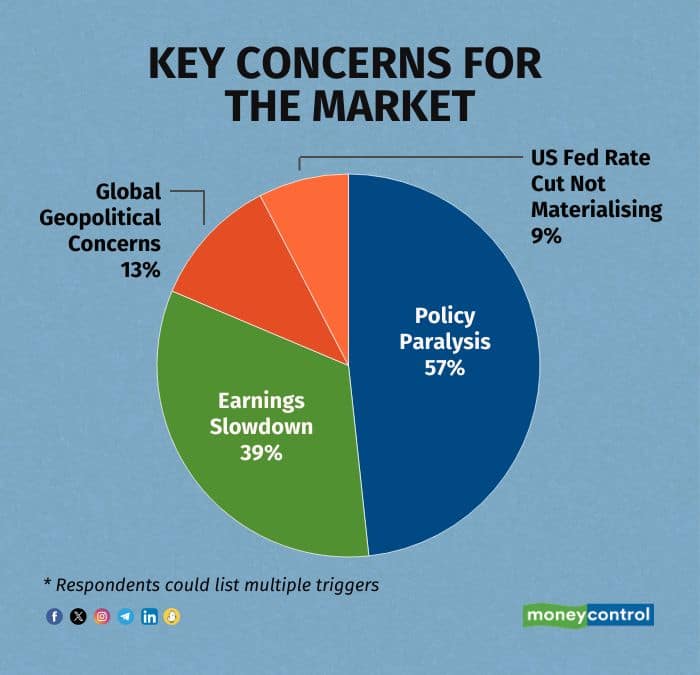

The possibility of policy paralysis and an earnings slowdown are cited as the biggest risks to markets in the coming months. However, the market could rally if factors like political stability, along with policy continuity and earnings growth, are visible in the near future, they say.

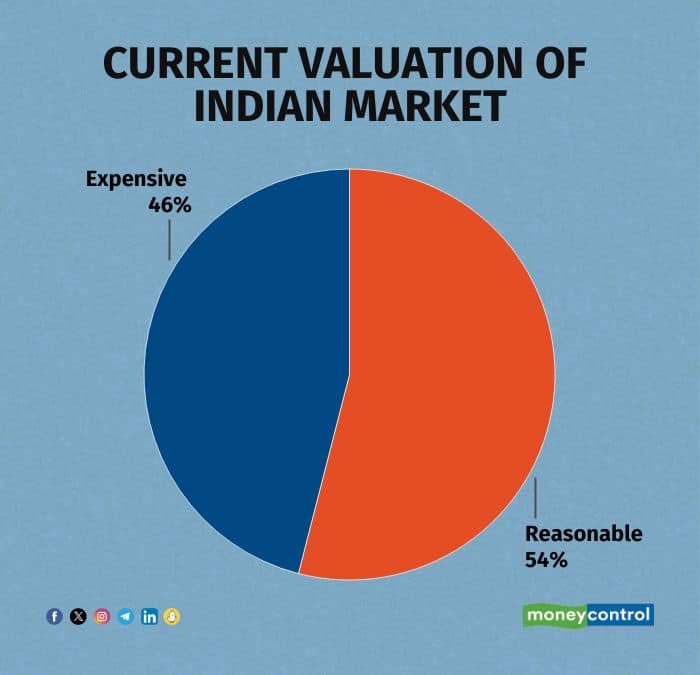

The modest expectations come as no surprise given that 46 percent of the respondents said that current valuations were expensive, while the remaining 54 percent said valuations were reasonable. No one said the market was cheap.

.

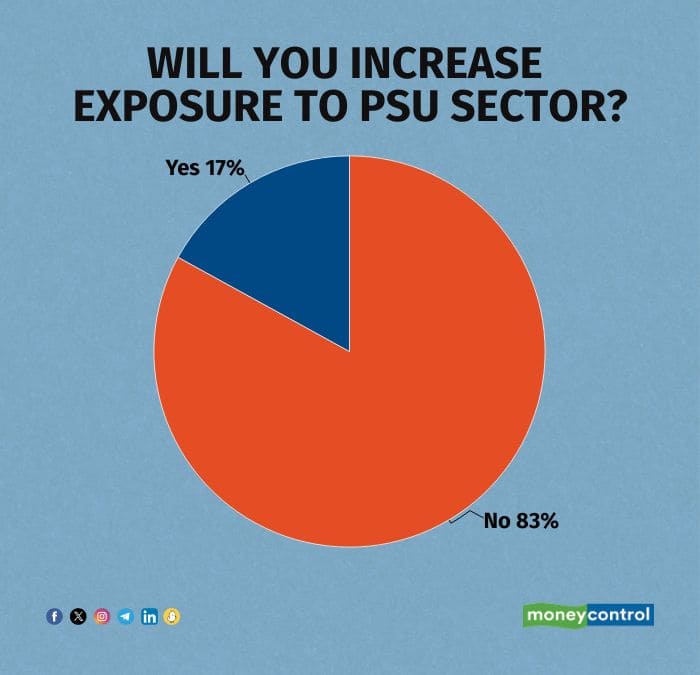

.Another interesting finding of the survey was related to the PSU segment, which has been the market darling over the past few years. This segment saw the sharpest gains in the run-up to the elections and was at the receiving end on June 4 with the steepest falls. A high 83 percent of the respondents said that they will not look at increasing their exposure to the PSU segment from their current levels.

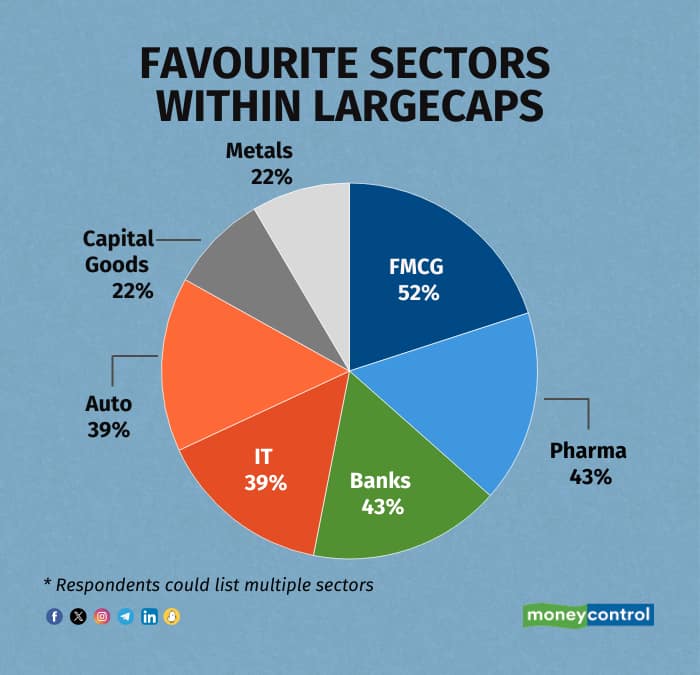

In terms of sectors, though, FMCG, pharma, private banks, auto, capital goods, and IT continued to be on the favored list of a majority of the respondents.

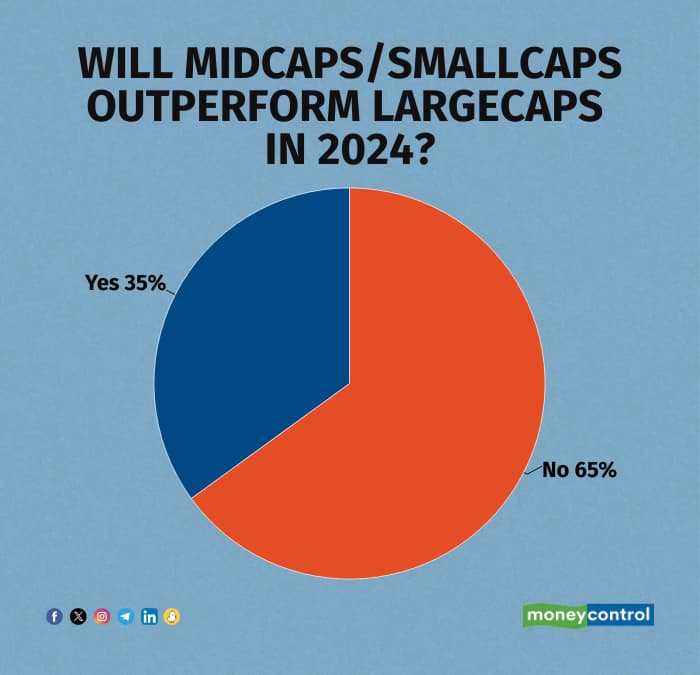

Further, 65 percent of the respondents also said that midcaps and small caps will not be able to outperform the large caps going ahead in the current calendar year.

The market was more or less divided on whether foreign investors will emerge as new buyers in the market this year. Fifty-two percent believe that FPIs will end CY24 as net buyers, while the rest stated otherwise.

.

.Clearly, the election dust is not yet settled as far from settled, it’s clear the market is bracing for a wild ride ahead. Buckle up, investors—this year promises to be anything but dull.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.