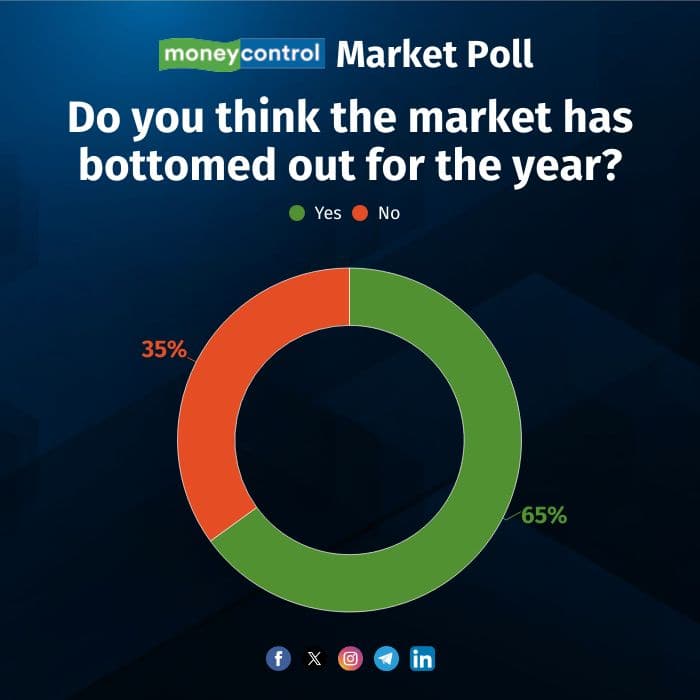

A vast majority of market participants believe Indian equities may have already weathered the worst of the recent downturn, as captured in a Moneycontrol poll of nearly 30 experts conducted recently across mutual funds, portfolio management services (PMS), alternative investment funds (AIFs) and brokerages, which showed that 65 percent of the respondents think markets have bottomed out, while 35 percent are still cautious.

This shift in sentiment comes amid signs of stabilizing investor confidence following months of turbulence, driven by global macroeconomic uncertainty, trade tensions, and sustained foreign institutional investor (FII) outflows.

Since January 2025, the Nifty 50 has gained around 6 percent, and the Sensex is up nearly 5 percent, after an interim correction of 8-9 percent, leading many to believe the rebound is an early sign of market recovery.

A June 2 report by Morgan Stanley had said that Indian markets have already priced in significant negatives since September 2024, including stretched valuations in small and midcaps, broad-based corrections hinting at macro and earnings slowdown, geopolitical volatility and the Pahalgam terror attack followed by Operation Sindoor. Despite the headwinds, largecap indices are only 5 percent away from record highs, and the implied volatility has remained contained.

“The net price action hides how much stocks have de-rated relative to long bonds, gold, and India’s share in global GDP,” the report said, adding that India’s macroeconomic fundamentals remain resilient. “We are seeing macro stability, mid-to-high teens earnings growth over the next three to five years, and a structural rise in discretionary consumption,” it added, citing a pickup in private capital expenditure and healthier corporate balance sheets. The report also emphasized the importance of steady domestic capital, especially persistent retail inflows, even during periods of heightened volatility.

While some concerns on volatility persist, the overall belief is of optimism among most market experts. In its latest equity outlook, Bandhan Mutual Fund observed that Indian markets, especially the mid and smallcap stocks, continued their upward momentum in May, buoyed by strong performance in domestically-oriented sectors.

“Continued weakness in the dollar, falling domestic interest rates, and earnings broadly in line with muted expectations helped drive the market higher,” the report said. While acknowledging the potential for continued volatility in the coming quarters, it said the domestic economy appears to be turning a corner and is better-positioned than many global counterparts.

Analysts at Motilal Oswal Financial Services (MOSL), in their Q4 FY25 review, also highlighted the sharp rebound in equities over the past two months, which has fully erased earlier year-to-date losses.

“Currently, the Nifty is trading 4.7 percent higher in CY25 YTD. With this rally, the index is valued at 21.8x FY26E earnings, close to its long-period average of 20.7x,” they noted. While near-term risks related to global macro factors, trade frictions, and earnings remain, they maintain that India's medium- to long-term growth outlook continues to be robust.

An Elara Securities report also added that several tailwinds are beginning to align such as government capex remains robust, PLI-linked manufacturing is scaling up, and Make in India continues to support formal sector capex.

On the consumption side, the report added that rising disposable income, partly driven by tax rationalization, lower energy cost, and a positive wealth effect from elevated gold prices are translating into rural and mid-tier demand recovery. India’s increasing participation in global supply chain diversification and a likely pivot to monetary easing, further strengthen the top-down case for earnings acceleration. “If these macro levers play out in tandem, there is room for upward revision to the current EPS trajectory,” the report suggested.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!