Shabbir Kayyumi Narnolia Financial Advisors

Basics of Technical Analysis: Part 2

Charts are the most basic aspect of technical analysis. Chart is a graphical representation of the price action of an asset for analysis and decision making. It’s important for traders to understand what’s being shown on a chart and the information it provides.

Charts are commonly plotted with a time as the base on the horizontal axis. It means that each data point on the chart comes from a fixed time period. For instance, if the time base is daily, each data point will represent price level(s) of each trading day.

1. Line Chart

Constructing a Line Chart : - It is extremely simple to build a line chart.

1. Mark out the closing price of each time period (daily in our case).

2. And simply connect them.

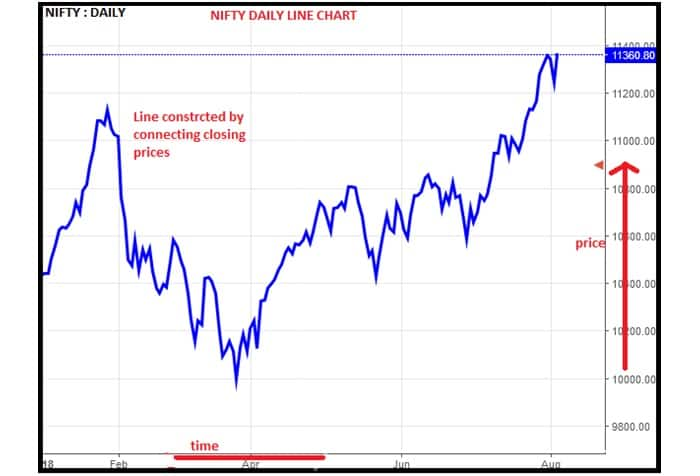

Figure 1 – Line Chart Example of NIFTY

These charts also make it easier to spot trends since there’s less ‘noise’ happening compared to other chart types. A line chart does not offer much detail as it includes only the closing price of each period. However, line charts are cleaner than other chart types.

Hence, they are great for observing price trends and many popular chart patterns like Head & Shoulders and Triangles, Rounding Bottom, etc. Looking at above line chart, one can easily conclude that prices are trading in Uptrend since April and after making a bottom around 10,000-marks, Nifty is trading higher towards 11,360 levels.

2. Bar Chart Constructing a Bar Chart : - It gives additional information than traditional line chart.

Armed with a bar chart, we can study the relationship between the highs, lows, closes, and opens of different bars. To build a bar chart, we need the following pieces of price data from each time period e.g. daily, weekly and monthly.

• Opening price (O)

• Highest price (H)

• Lowest price (L)

• Closing price (C)

Figure 2 – Bar Chart Example of SENSEX

The chart is made up of a series of vertical lines that represent the price range for a given period with a horizontal dash on each side that represents the open and closing prices. The opening price is the horizontal dash on the left side of the horizontal line and the closing price is located on the right side of the bar, indicated at right bottom corner of the above chart. If the opening price is lower than the closing price, the line is often shaded black or green to represent a rising period or bar. The opposite is true for a falling bar, which is represented by a red shade.

Looking at the SENSEX examples in figure 2, we can easily say that matching high of bars around 34600 levels has given resistance to prices and later it traded lower. One more example presented on chart is about similar lows; bars do provide support to prices, and benchmark index is trading higher after taking support from those similar lows as shown above around 36,300 levels.

3. Candlestick Chart

Constructing a Candlestick Charts:- The most simple and detail representation of price.

To build a candlestick chart, we need open, high, low & close prices data from each time period, construction is moreover similar to bar chart. The difference is that instead of a line, a wider bar or rectangle that represents the difference between the opening and closing prices is used.

Figure 3 – Candlestick Chart Example of BANKNIFTY

It originated in Japan over 300 years ago, but has since become extremely popular among traders and investors. Like a bar chart, candlestick charts have a thin vertical line showing the price range for a given period that’s shaded different colors based on whether the stock ended higher or lower.

Stocks closed higher, are shaded with green or white color, and are termed as a bullish candle; however stocks ended lower are shaded with red or black color, called as bearish candle, which is clearly visible in figure 3.

There are numerous types of candlestick chart pattern that are used to make price prediction. Figure 3 has a popular Bullish Engulfing candlestick pattern around 26800 levels, which is a bullish reversal pattern in nature. The pattern suggests that one would have gone long in Bank Nifty around 26,800. Candlestick chart pattern remains the most popular chart pattern followed by line charts.

4. Heikin-Ashi Chart (special type of chart)

Constructing a Heikin-Ashi Chart: - improvised candlestick chart.

Heikin-Ashi (HA) chart is derived from standard candlestick charts. Meaning of ‘Heikin-Ashi’ is "average bar" in Japanese. These are the formula for Heikin-Ashi bars.

• HA Close = Average of (Open, High, Low, Close)

• HA Open = Mid-point of( previous HA bar)

• HA High = Highest of (High, HA Close, HA Open)

• HA Low = Lowest of (Low, HA Close, HA Open)

As we can see from the formula, Heikin-Ashi candlesticks is plotted with both current and past price data. Hence, it produces a smoothing effect like that of a moving average. It evens out small price fluctuations to highlight price trends.

Figure 4 – Nifty Heikin Ashi Daily Chart

Essentially, we derive Heikin-Ashi charts from price. Analyzing Heikin-Ashi bars is straightforward, simple and very useful. The Heikin-Ashi technique is used by technical traders to identify a given trend more easily. It helps to understand price and trend in better way, as mentioned below.

1. When prices are trending up, Heikin-Ashi bars have no lower shadow, color green and indicates strong uptrend, as shown in Nifty HA chart (Figure 4).

2. When prices are trending down, Heikin-Ashi bars have no upper shadow, red in color and indicate strong downtrend.

3. Doji or double doji bars with both lower and upper shadows are possible turning points or trend reversal points, and can be easily spotted in Heikin-Ashi chart.

They are more like trend indicators than price charts; however one need to understand trading technique in details using HA before using it for regular trading.

Conclusion

1. Line chart can be used to interpret trends and is used to decipher popular price pattern like rounding bottom, head and shoulder etc.

2• Bar charts are more informative than old line charts, however, they lack visual appeal and one cannot identify patterns easily.

3• The most common type of chart used in trading is the Japanese candlestick chart.

4• There are two types of candlesticks – Bullish candle and Bearish candle. When close > open = It is a Bullish candle. When close < open = It is a Bearish candle.

5• Heikin-Ashi smoothen price information over two periods, it makes trends, price patterns, and reversal points easier to spot.

Disclaimer: The author is Head of Technical & Derivative Research at Narnolia Financial Advisors. The views and investment tips expressed by investment expert on moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.