July 24, 2020 / 16:38 IST

Jimeet Modi, Founder & CEO Samco Group:

Nifty50 closed higher after opening with a gap up at the start of the week. This is the sixth consecutive week that Nifty is closing with gains. The rally in the index is being supported by positive development on the vaccine front and participation from some of the heavyweights from oil & gas and IT sectors. However, the Bank Nifty which has been an all-weather partner has seen a fall in momentum. The banking index has formed a bearish shooting star pattern but managed to close on a mildly positive note. The divergence between Nifty and BankNifty is going on for last three weeks.

We continue to maintain a cautiously bullish outlook on Nifty with immediate support and resistance placed at 11000 and 11240 respectively. However, a break below 10900 may lead to short term weakness.

July 24, 2020 / 16:25 IST

S Hariharan, Head - Sales Trading, Emkay Global Financial Services:

Nifty closed the week up 2.7 percent, though market breadth was poor - midcap index was flat for the week, and equal-weight Nifty was up only 1 percent. Much of this week's strength was attributable to Reliance Industries and IT stocks. Bank Nifty is trading within a rising wedge with odds rising for a significant break-out - this weekend's earnings release from ICICI Bank can act as the trigger for this. Any move outside the 22100-23200 range in Bank nifty would be an important technical development.

ITC and Eicher Motors are also poised close to resistance from 2-3 year downward trendlines, and bear watching. Next week's derivatives expiry comes in the backdrop of significantly improved retail sentiment, with gross long open interest in single stock futures segment up 300,000 lots, and hence, has a bullish undertone. FIIs have invested USD 1 billion last week and the flow environment remains supportive of a strong market for the coming week.

July 24, 2020 / 16:14 IST

Sanjeev Zarbade, VP PCG Research, Kotak Securities:

Global markets were subdued for the week. Tensions between China and the US flared further during the week which weighed on global markets. However, Indian equities gained 3 percent in the current week, vastly outperforming their global peers. Market mood was exuberant on progress in the development of a COVID-19 vaccine, better-than-expected 1QFY20 results by banks and consumer stocks, and hopes of another round of US fiscal stimulus.

ICICI Bank, Power Grid and Reliance Industries were the top gainers while Sun Pharma, Hindustan Unilever and TCS lost the most in the BSE-30 Index. FPIs bought equities worth USD 679 million over the past five trading sessions while DIIs sold USD 261 million worth of equities in the same period. Investors need to be wary at these levels as valuations are now close to fair levels.

July 24, 2020 / 16:08 IST

Rohit Singre, Senior Technical Analyst at LKP Securities:

Nifty closed a week on positive note at 11198 with gains of nearly 3 percent and formed a bullish candle on weekly chart. Index is in V-shape recovery. If we will look at weekly chart, going forward 11k mark became good support. Holding above 11k mark, the index can see current momentum to be continue towards immediate hurdle zone of 11300-11400 zone. Nifty Bank closed the week at 22675 with gains of more than 3 percent. Now immediate support for Nifty Bank is coming near 22400-22200 zone and resistance is placed at 22800-23000 zone. Above 23k mark we may see again good move in Nifty Bank.

July 24, 2020 / 15:55 IST

JSW Steel Q1

: Revenue went down 40.5 percent at Rs 11,782 crore against Rs 19,812 crore YoY. EBITDA was down 63.9 percent at Rs 1,341 crore against Rs 3,716 crore YoY. EBITDA margin stood at 11.4 percent against 18.7 percent YoY.

July 24, 2020 / 15:45 IST

Hemant Kanawala, Head – Equity, Kotak Mahindra Life Insurance:

Shrugging of the weakness seen last week, markets rallied sharply with Nifty returning 4.8 percent and Midcap index rising 2.6 percent on the back of far stronger than anticipated results in Q1FY21 from banks, return of foreign flows (~USD 442 million over the last week) and news relating progress in government disinvestment (BPCL) and foreign investment commitments (Jio platforms, Google announcement).

On macro front, European Union countries agreed on a USD 857 billion stimulus package sending strong signal of solidarity. The deal was notable because for the first time European countries agreed to raise large sums by selling bonds collectively, rather than individually. The announcement of the package has considerably eased risk of a deep recession in Eurozone. This deal and the uncertainty regarding the extension of the Relief Package is adding to the pressure on the US Dollar. Dollar Index has declined by 7.7 percent since its recent peak in March-20.

July 24, 2020 / 15:37 IST

Market Close:

Benchmark indices recovered smartly and ended flat on July 24 on the back of buying seen in the Reliance Industries and also IT and energy stocks.

At close, the Sensexwas down 39.35 points or 0.10% at 38101.12, and the Nifty was down 21.30 points or 0.19% at 11194.20.About 1055 shares have advanced, 1557 shares declined, and 140 shares are unchanged.

Reliance Industries, HCL Tech, Tech Mahindra, Sun Pharma and Infosys were among major gainers on the Nifty, while losers included Zee Entertainment, Hindalco, Axis Bank, SBI and Gail India.

Except IT and Energy other sectoral indices ended in the red, while BSE Smallcap and Midcap indices ended lower.

July 24, 2020 / 15:25 IST

Earnings:

Asian Paints has posted 67 percent YoY fall in its Q1 net profit at Rs 219.6 crore versus Rs 672.1 crore and revenue was down by 42.7% at Rs 2,922.6 crore versus Rs 5,104 crore, reported CNBC-TV18.

July 24, 2020 / 15:11 IST

Credit Suisse on PNB Housing Finance:

Credit Suisse has remained neutral on PNB Housing Finance with a target at Rs 180 per share. The leverage of 8.3x is one of the highest in the sector, while visibility on capital raise will be key for the stock.

It will need to raise Rs 3,000 crore to get to comfortable leverage of 6x. Credits Suisse has tweaked its EPS estimates by +6% in FY21 & -2% for FY22, reported CNBC-TV18.

July 24, 2020 / 15:00 IST

SBI Funds Management to raise stake in CSB Bank post RBI approval

Reserve Bank of India has conveyed its approval to ‘SBI Funds Management Private Limited’ to acquire shares up to 10 % of the paid up capital of the CSB Bank through various schemes of ‘SBI Mutual Fund.’

SBI Funds Management Private Limited through various schemes of SBI Mutual Fund is currently holding 4.734% in the paid up capital of the bank.

July 24, 2020 / 14:56 IST

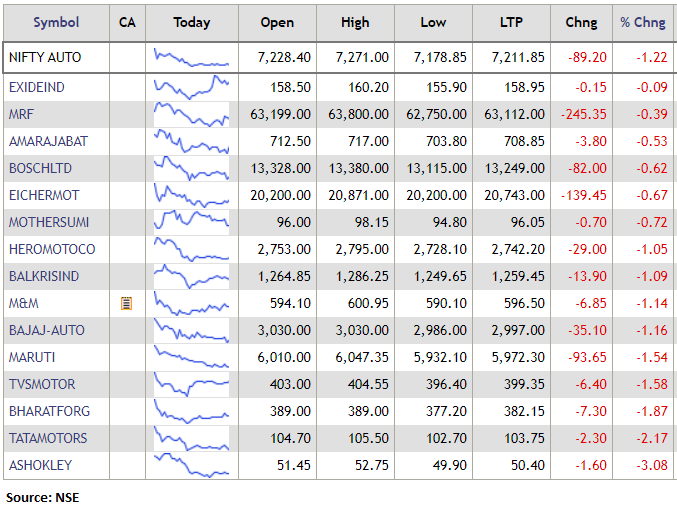

Nifty Auto Index shed over 1 percent dragged by the Ashok Leyland, Bharat Forge, Tata Motors:

July 24, 2020 / 14:48 IST

CCL Products Q1:

The company's consolidated net profit rose 11 percent YoY at Rs 38.5 crore versus Rs 34.7 crore and revenue was up 5.9% at Rs 289.2 crore versus Rs 273.2 crore, reported CNBC-TV18.

July 24, 2020 / 14:30 IST

Earnings:

Crompton Greaves Consumer Electrical has posted 38.9 percent YoY fall in its Q1FY21 consolidated net profit at Rs 74.8 crore versus Rs 122.4 crore and revenue was down 46.5 percent at Rs 720.1 crore versus Rs 1,346.8 crore, reported CNBC-TV18.