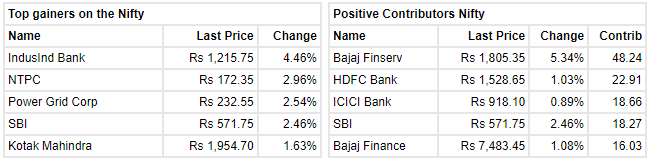

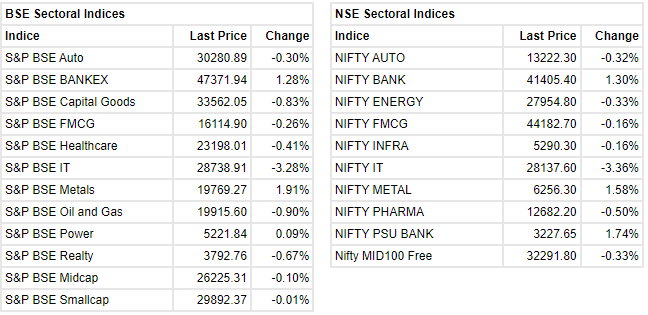

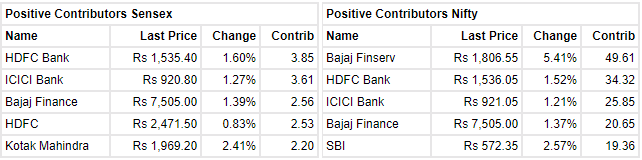

Indian markets fell the least in the Asian region. Among sectors, metals and banking indices rose the most, while IT and Oil & Gas indices fell the most. Broader market continued to be subdued as advance decline ratio was negative at 0.72:1.

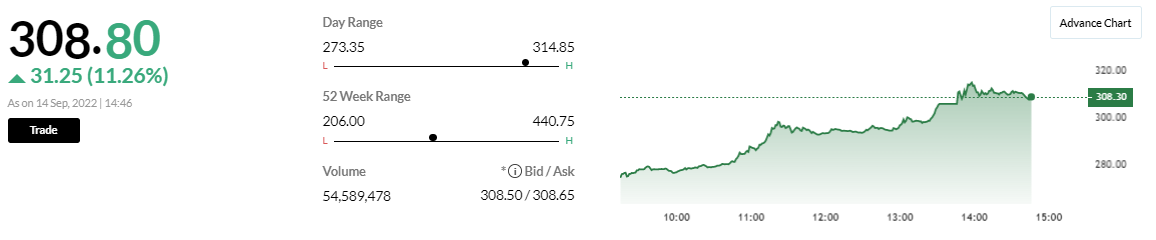

Nifty recovered very well from the morning lows but succumbed to afternoon selling. It faced resistance from the high of the previous day. Now 18,088-18,092 could be the resistance for the near term while 17,765 could be the support. Broader market is showing the first signs of distribution.